Shares of General Electric (GE) are up almost 1% at last check and have started the year on the right foot for the longs.

If it finishes higher today, GE stock will have rallied in each of the first three days of the year. With the S&P 500 and Nasdaq currently lower so far in 2023, GE’s performance is impressive.

The company has been in the news this week, as it completed the spinoff of its General Electric Healthcare unit, which now trades under the ticker symbol GEHC.

Sticking with the outperformance theme, though, GE stock has actually been doing pretty well lately.

The shares are up 19% from last month's low and are working on their third straight weekly gain. Further, the stock is down just 8.5% over the past year, outpacing the S&P 500’s decline of roughly 20%.

Now that the stock is hitting multiquarter highs, let’s revisit the charts.

Trading GE Stock

Chart courtesy of TrendSpider.com

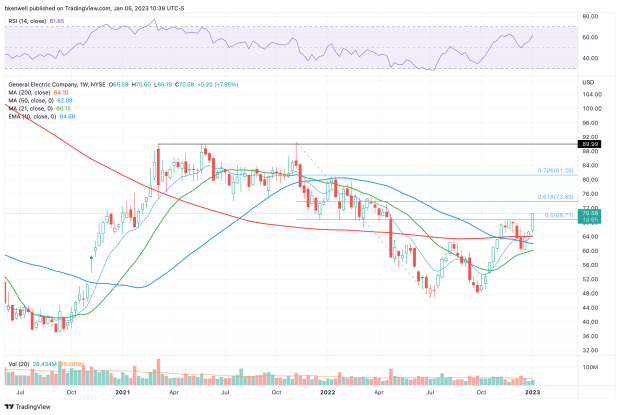

For more than a year now, the $68.50 level has proved pivotal for GE stock.

In the fourth quarter of 2021 and the first quarter of 2022, this level was very strong support. Once the shares broke below this level, they took time to retest it.

When they finally did so, in Q4 2022, GE shares were rejected by this area — which also happens to be the 50% retracement of the two-year range.

General Electric stock is now breaking out over that area, as well as clearing the fourth-quarter high. It’s an impressive upside rotation given the market's overall price action.

From here, it will be key for the $68.50 area to turn into support. That will solidify the bulls’ control of the stock and enable investors to buy the stock on dips.

On the upside, look for a potential rally up to the 61.8% retracement near $73 to $74. If GE can clear this area, that opens the door to $81 and the 78.6% retracement.

Now that the stock is above all its daily and weekly moving averages, the short- and intermediate-term trends are working in the bulls' favor. It’s one of just a few stocks that can make that claim.

On the downside, use $68 to $68.50 as the pivot. A sharp drop below this level could put the mid- to low-$60s in play, and specifically puts the 10-week and 200-week moving averages back in play.