GameStop (GME) -) shares moved higher in early Thursday trading after the money-losing video game retailer said it named billionaire chairman Ryan Cohen as group CEO.

Cohen, who will not take a salary from the role, follows the ousting earlier this summer of Matt Furlong, the fifth CEO to depart the Grapevine, Texas based group over the past five years. GameStop has also weathered a notable exodus of top executive talent, with CFO Diana Saadeh-Jajeh resigning last month.

Mark Robinson, who had serving as interim CEO following Furlong's departure, will remain with the group as general counsel.

Earlier this month, GameStop said group revenues rose 2.5% from last year to $1.164 billion, topping Street forecasts, as its shift to online sales from a reliance on brick-and-mortar traffic continues to support its topline.

Profits, however, remain elusive and the Grapevine, Texas-based retailer posted a loss of 3 cents per share, down from a loss of 35 cents per share last year and inside the Street's 14 cent loss forecast. GameStop has only registered only two profitable quarters in the past three years.

GameStop shares were marked 3.7% higher in early trading Thursday to change hands at $17.79 each.

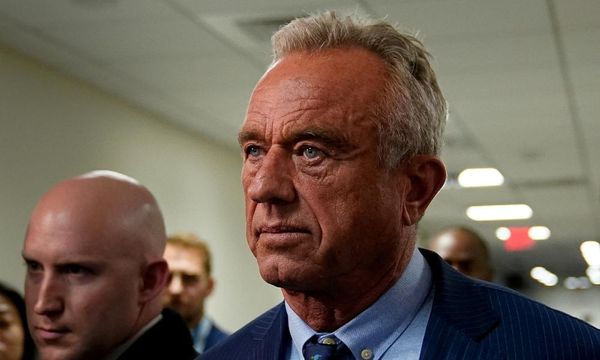

Cohen, meanwhile, a billionaire investor famous for a host of meme-stock investments, is reportedly facing a Securities and Exchange Commission probe into some of his trades

The Wall Street Journal reported on September 8 that Cohen, who is also the founder of pet-supplies company Chewy.com (CHWY) -), was asked by the SEC to provide information about both his trades and communications with senior executives at Bed Bath & Beyond.

Cohen took a 10% stake in the struggling home retailer in March 2022 through his RC Ventures investment company, only months after pushing the group to put three of his allies on the company's board.

He also advocated for the retailer to look at several strategic alternatives, including sale of its lucrative BuyBuy Baby division, and the ouster of Chief Executive Mark Tritton, who left the group in June of the same year.

Cohen's RC Ventures sold all of its 9.45 million shares of Bed Bath & Beyond in mid-August, netting around $60 million in the process.

The timing of the sale raised questions among some investors, and speculation it could draw interest from the SEC, given Cohen's proximity to management talks with what the company had described as "external financial advisors and lenders on strengthening our balance sheet."

Bed Bath & Beyond ultimately filed for Chapter 11 bankruptcy protection in April this year. The company was bought out of bankruptcy by Overstock.com, OSTK which relaunched itself under Bed Bath's name.

- Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Get started now.