GameStop (GME) had been in focus on Wednesday: The stock was putting together a massive rally after the videogame retailer reported earnings.

At one point, the shares were up about 53% on the session. As TheStreet's Martin Baccardax reported, that’s as the company “posted its first profit in more than two years amid a cost-cutting drive and its move to online sales."

While the stock got off to an unexpectedly hot start, it has struggled to maintain its post-earnings gains.

Don't Miss: Realty Income Pays a 5.1% Dividend Yield; Here's When to Buy the Dip

Of course, it didn’t help that the Federal Reserve raised interest rates yesterday, while headlines from Treasury Secretary Janet Yellen and Chairman Jerome Powell continued to flow in from two separate events yesterday.

Ultimately, shares of GameStop closed 35% higher yesterday. But while the stock rallied almost 10% from today’s open, at last check it was down about 6.5% or down 17.5% from its post-earnings high.

Let’s take another look at this prominent retailer.

Trading GameStop Stock

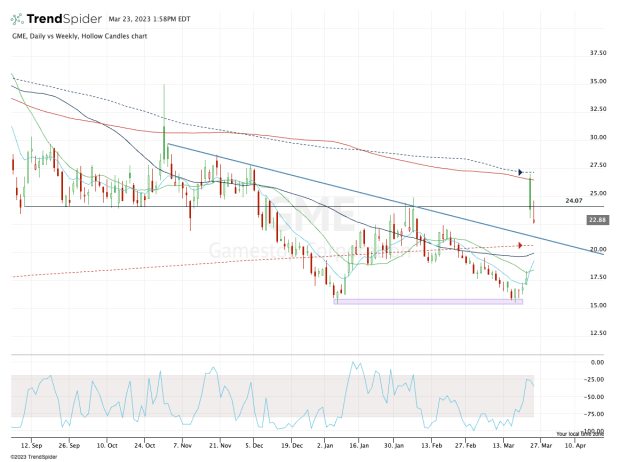

Chart courtesy of TrendSpider.com

One of the leaders of the so-called meme stocks, GameStop has made some truly breathtaking moves. Yesterday’s 50% rip highlighted that reality.

Yesterday was a tricky session, not just for broad-market investors but for investors in GameStop as well.

That’s as the stock opened near the 200-day moving average and faded throughout the day. While it bounced nicely from the lows — unlike the S&P 500, which closed near session lows — GameStop closed right near the key $24 zone.

Don't Miss: Amazon Stock Is Teetering on a Breakout. Here's the Setup.

That level was notable support until a larger breakdown in December. In early February $24 was stiff resistance. When a level turns from support to resistance, it's a bearish observation.

Now that the stock is being rejected from that level, it adds another layer of concern. Despite the big gap-up on Wednesday, the stock has been rejected from two key measures: the 200-day moving average and the $24 level.

Don't Miss: Let's Pump the Brakes on GameStop's Profitable Quarter

If it can regain $24 and start closing above this level, perhaps the bulls will get another run at the 200-day and the post-earnings high up at $27.

On the downside, GameStop shares could be vulnerable to testing the topside of prior downtrend resistance, currently near $21.

That comes into play just above the 10-day, 50-day and 200-week moving averages, which would technically be in play should GameStop correct down toward $21.

Keep these levels in mind if you’re looking to trade this name.

Action Alerts PLUS offers expert portfolio guidance to help you make informed investing decisions. Sign up now.

.png?w=600)