Who you going to call? There's no ministerial price-buster in the transition between two governments

Fuel companies have pocketed bigger margins this month, with none of the usual government oversight in the heat of the election battle.

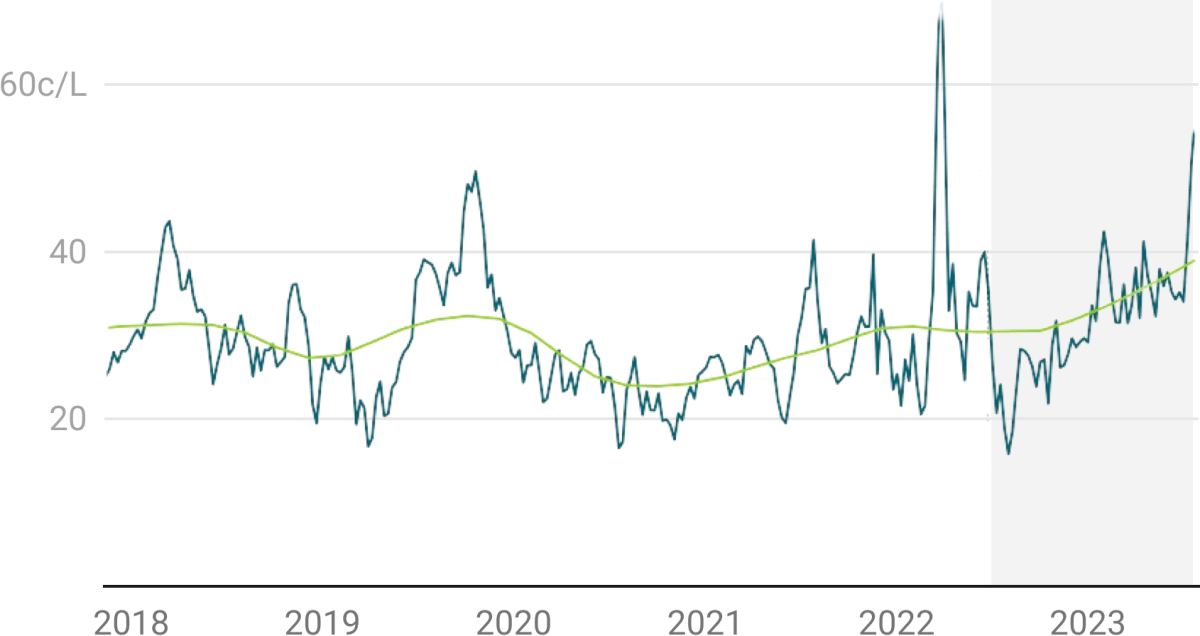

MBIE weekly monitoring data shows the margin retained on a litre of regular 91 petrol by the big importers – Z Energy, BP and Mobil – has soared from 33c to 52.4c a litre, in the past three weeks. Margins on diesel have risen from 32.7c to 47.7c over the same period.

It's because lower crude oil prices have not immediately been passed on at the petrol pump; instead fuel companies have pocketed the change.

That's a slight simplification, because the big companies hedge by buying their fuel from overseas when prices are low and exchange rates are favourable, so the price paid by motorists doesn't necessarily reflect that day's crude oil price on international markets.

But competitive pressures between the big three companies should force retail prices to follow the prices of imported refined fuel down. That's not happening this month.

READ MORE: * What a Labour Opposition and leadership will look like * Greens relinquish prized ministerial portfolios to uncertain fates * The first things new ministers need to learn (but won’t be told) * Free market free-for-all: Buying NZ’s school curriculum off the app store

National has promised to act on fuel prices in its first 100 days, by abolishing the Auckland Regional Fuel Fax and cancelling a scheduled increased to fuel excise. But it's not yet formed a government, which leaves the market in limbo.

In July 2022, when margins spiked above 60c/L, the energy minister sent the big fuel companies a 'please explain' that nudged them into pushing their margins back down. Megan Woods acknowledged fuel companies were not always able to immediately adjust prices to match shifts in costs, but said the historically high margins concerned her.

She bluntly told them she expected to see the recent decrease in importer costs passed through to consumers at the pump "in the coming weeks".

Terry Collins, the AA's principal policy advisor, confirms that his subscriber-only data from Envisory (formerly Hale & Twomey) also shows the margins have been creeping up.

"If they were sustained at this level than a please explain from the Minister may have occurred," he says. "But as you are aware, everybody has been distracted in the past few weeks electioneering and we don’t know when we will have a new energy minister."

Petrol profit margins

Collins believes there has been a slight easing in the past week, but if there's not further easing this week then there will be tough questions to be asked of the fuel companies.

The Commerce Commission has new powers to monitor the fuel companies' margins and profits. The Labour Government gave the commission those powers after it conducted a competition inquiry that found an active wholesale market does not exist in New Zealand, and this is weakening price competition in the retail market.

Simon Thomson, the acting general manager for market regulation, says the commission analyses information, disclosed by the fuel companies, to monitor the competitive performance of fuel markets.

It looks at indicators of competition in both the wholesale and retail market, including importer margins. Its quarterly monitoring reports have highlighted wide differences between pump prices in different parts of the country, and even different parts of the same towns.

But the last report was before the government restored the full excise tax on petrol, and crude oil prices on the world market resumed their rise.

"We are continuing to monitor what is happening with importer margins over the long-term to ensure that competition in fuel markets works well and benefits consumers," Thomson said.

"The weekly margins monitoring is susceptible to volatility in the global market and we prefer to look at margins and other indicators over a longer time period – you will have noticed, MBIE’s reporting includes a trend line which demonstrates that consistent trends are more telling than week by week variations."

BP spokesperson Gordon Gillan will not answer Newsroom questions about increased margins, or about the likelihood BP will profit from National's policy to cut the Auckland fuel tax and freeze excise rises. "Taxes are set by the government," is all he will say.

Instead, he reissues his standard pro forma statement: "There are a number of factors that influence prices," he says. "We continue to review BP Connect prices every day to ensure competitiveness in the market. The BP website has more information on the facts about fuel pricing. There are also a number of independent BP operators all around the country who set their own prices and manage their own operations."

Mobil did not respond to repeated emails, and its phone rang unanswered. (See update)

It was only Z Energy, whose parent company Ampol is listed on the NZX and ASX, that addressed the question about importer margins.

Z is the biggest fuel importer in New Zealand, and operates both the Z and Caltex service stations, as well as supplying jet fuel to airlines.

Chief executive Lindis Jones tells Newsroom MBIE's importer margin measure is a "poor indicator" of the bigger measures of profitability.

“Z is committed to giving both our consumers and regulators assurance on fair and reasonable pricing in a volatile operating environment," he insisted. "Strong demand for oil, constrained supply combined with ongoing geopolitical events have led to sustained high and volatile prices on international markets.

"We acknowledge MBIE’s importer margins are a metric used to monitor the collective gross margins of fuel importers. However Z has consistently expressed concern to MBIE with how these are measured and that they are a poor indicator of competitiveness and profitability.”

Jones acknowledges the Auckland Regional Fuel Tax and Fuel Excise Levies have an impact on the overall pump price. "Z is committed to working with the incoming government on any changes related to these."

Newsroom's inquiry to caretaker Commerce Minister Duncan Webb was referred to the incoming National-led administration.

MBIE's manager of manager of resources, gas and fuel supply policy, Dominic Kebbell, comfirms New Zealand fuel importer margins have climbed over the past three weeks following sharp falls in international cost. Preliminary information shows that importer margins and retail prices began to fall last week.

"However, margins are not yet back to normal levels," he says. "Diesel margins in particular did not fall much last week, due to further falls in the international cost of diesel."

Mobil Oil NZ chair Wayne Ellary replied with a statement two days later. "Mobil strives to offer competitive prices, which is a balancing act between the immediate effects and influences of the market, weighed against the longer term outlook for business and the industry," he said.

"In the current volatile cost and price environment, it is challenging when specific periods of high margins are judged in isolation without also considering the impact of low-margin periods.

"Our margins are impacted by a number of factors outside of our direct control including increased product cost and increased operating costs.

Ellary added: "We look forward to working with the new Government when it is formed."