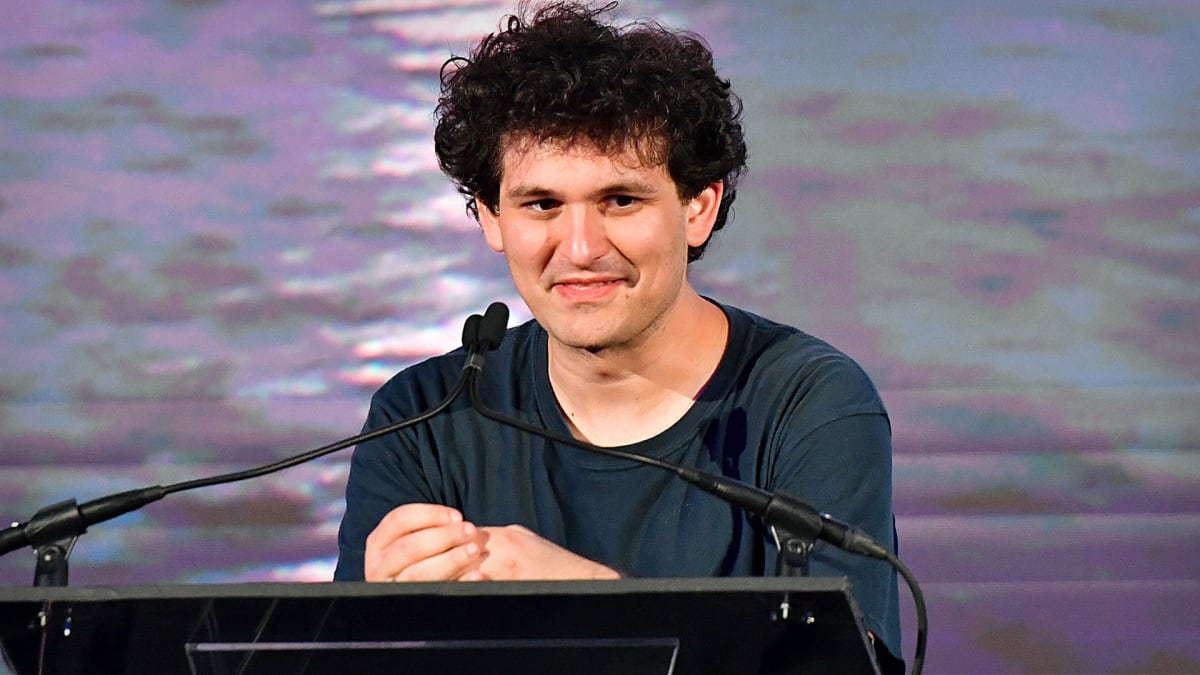

Sam Bankman-Fried, 30, the founder of cryptocurrency exchange FTX, has spoken out in an interview for the first time since the collapse of his crypto empire.

In this interview of more than an hour, intended to give his version of what happened, Bankman-Fried tried to convey the idea that he had no intention of defrauding the customers and investors of his companies FTX and Alameda Research, a hedge fund that also acts as a trading platform.

"I didn’t ever try to commit fraud on anyone,” Bankman-Fried said contritely to Andrew Ross Sorkin at the New York Times Dealbook Summit via Zoom on November 30. "I saw it as a thriving business and I was shocked by what happened this month.”

But when asked about the timeline, Bankman-Fried said he started worrying on November 6. It was on that day that he realized there was a serious problem.

"There was a potential, serious problem there," he said. "Alameda's position was big on FTX," and it had just taken a huge hit. There was suddenly a "run on the bank," with $4 billion in withdrawals every day.

'It Would Be a Bit Messy'

He added that FTX started calling potential financiers to shore up the business.

He went on to say he was nervous. Ross Sorkin then asked him if he was nervous because the company was going to collapse or because he was going to be caught. He replied that he was nervous because the situation would lead to substantial losses for Alameda.

"It would be a bit messy" for Alameda, but the impact was going to be minimal for FTX, Bankman-Fried said. But by late evening, he was beginning to consider contingency scenarios.

On November 6, Changpeng Zhao, the CEO of Binance, a rival of FTX, announced in a post on Twitter that his company had made the decision to sell $530 million worth of FTT coins, a cryptocurrency issued by FTX. Binance had received its coins when the firm sold its stake in FTX in 2021. In his announcement, Zhao added that the decision to liquidate FTT coins was due to recent revelations which appeared to be about Alameda's balance sheet.

In a November 2 article, Coindesk claimed that most of the balance sheet from Alameda Research, Bankman-Fried's trading platform, was comprised of the FTT token, the cryptocurrency issued by FTX. Clearly, if the token collapsed, Alameda would be left with nothing. This revelation surprised investors who thought the firm had other assets.

The leaked balance sheet showed that Alameda listed $3.66 billion in unlocked FTT and $2.16 billion of FTT collateral. It also showed a total of $14.6 billion in assets and some $8 billion in liabilities, which included $7.4 billion worth of loans.

However, although he was worried about all these developments and was considering emergency scenarios as he revealed in the November 30 interview, Bankman-Fried said on November 7 that his companies had no liquidity problems.

"A competitor is trying to go after us with false rumors. FTX is fine. Assets are fine," he posted on Twitter on November 7. "FTX has enough to cover all client holdings. We don't invest client assets (even in treasuries). We have been processing all withdrawals, and will continue to be."

The tweet has since been deleted.

What is certain is that his admission of November 30 will not help restore public confidence in the crypto industry.