Cryptocurrency brokerages Gemini and Genesis are reassuring people that their operations are still solvent after the massive collapse of exchange FTX.

The insolvency of FTX could result in more companies in the industry facing severe liquidity issues, including crypto exchanges and lenders.

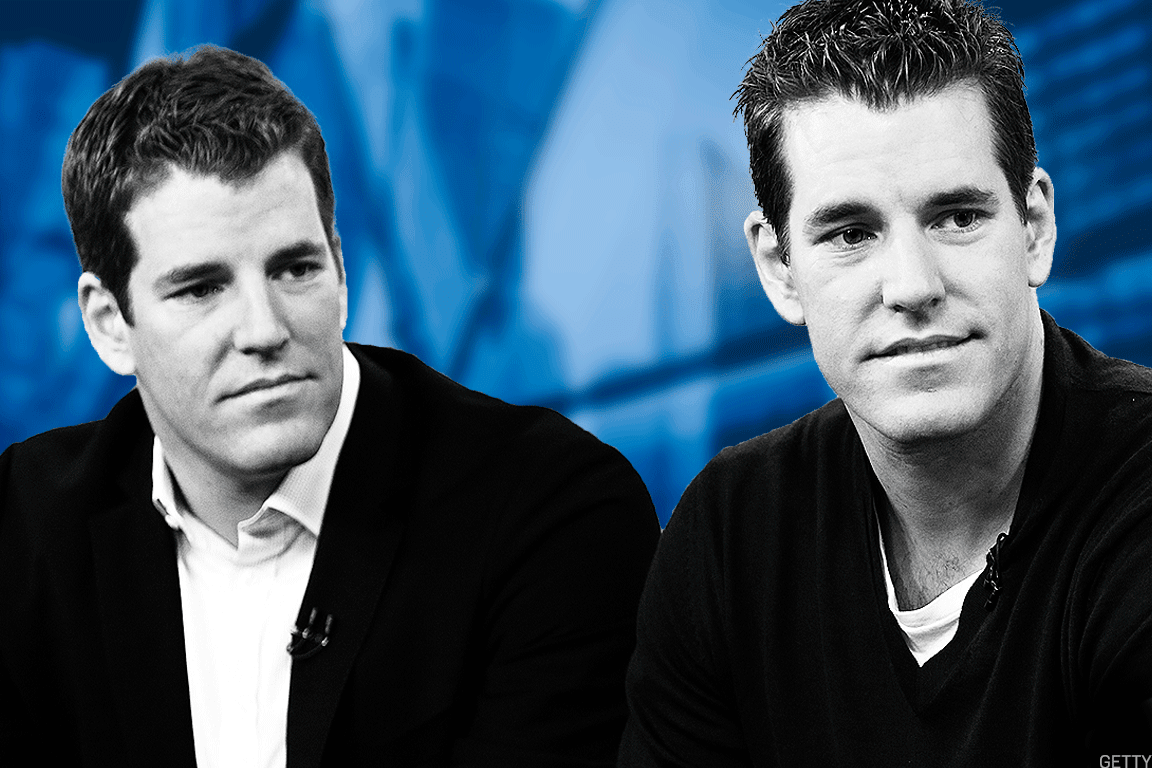

Gemini, the exchange founded by the Winklevoss twins, is attempting to calm crypto investors. The exchange said on Wednesday that it would halt withdrawals on its Earn accounts that provide interest. The lending partner for the Earn accounts is Genesis.

“We are aware that Genesis Global Capital, LLC (Genesis) — the lending partner of the Earn program — has paused withdrawals and will not be able to meet customer redemptions within the service-level agreement (SLA) of 5 business days.,” Gemini said.

Gemini said it hopes to have more information in a few days.

"We are working with the Genesis team to help customers redeem their funds from the Earn program as quickly as possible," Gemini said in a tweet. "We will provide more information in the coming days."

'Disappointed'

The company also said, "We are disappointed that the Earn program SLA will not be met, but we are encouraged by Genesis’ and Digital Currency Group’s commitment to doing everything in their power to fulfill their obligations to customers under the Earn program," in a tweet.

Gemini's other products and services are not impacted since the company is a "full-reserve exchange and custodian," according to a tweet. "All customer funds held on the Gemini exchange are held 1:1 and available for withdrawal at any time."

Gemini faced another setback around 12:00 PM ET when it experienced an outage from AWS, the cloud platform of Amazon. The outage was restored within a few hours

"We experienced an Amazon Web Services EBS outage with one of our primary databases," the company tweeted. "We have restored the database and are bringing the exchange back up."

On Nov. 9, two days before FTX filed for bankruptcy, Cameron Winklevoss, who founded cryptocurrency exchange Gemini with his twin brother Tyler, fired a thinly veiled criticism at FTX.

"We do not do anything with your funds unless explicitly authorized and directed to do so by you," he posted on Twitter. "Regulatory oversight is important as it ensures that companies like Gemini do what they say they do."

Genesis Stops Customer Withdrawals

Crypto exchange Genesis confirmed on Wednesday that it has stopped customers from making withdrawals and issuing new loans, the latest company to be severely impacted from the collapse of FTX.

The brokerage told TheStreet in an email that it's "number one priority is to serve our clients and preserve their assets," a spokesperson said.

"Therefore, we have taken the difficult decision to temporarily suspend redemptions and new loan originations in the lending business," Genesis said. "We are working diligently to shore up the necessary liquidity to meet our lending client obligations."

The division that has halted the withdrawals is Genesis Global Capital, which works with institutional clients and had $2.8 billion in total active loans as of the end of the third quarter of 2022.

Genesis said it has three primary business lines: spot and derivatives trading, lending and borrowing, and custody.

"Our spot and derivatives trading and custody businesses remain fully operational," the company spokesperson added.

Genesis said via Twitter it is working on a plan for its lending business such as injecting new capital that will be announced next week.

"We have hired the best advisors in the industry to explore all possible options," the company tweeted. "Next week, we will deliver a plan for the lending business. We’re working tirelessly to identify the best solutions for the lending business, including among other things, sourcing new liquidity."

The company reinforced that Genesis Global Trading, its broker/dealer that holds its BitLicense, is "independently capitalized and operated – and separate from all other Genesis entities," in a tweet.

Genesis faces major losses when Three Arrow Capital, which is also known as 3AC, became insolvent in May.

The crypto company filed a $1.2 billion claim in bankruptcy court.

Genesis does not have any outstanding liabilities linked to Three Arrows Capital.

"3AC negatively impacted the liquidity and duration profiles of our lending entity Genesis Global Capital," the company tweeted. "Since then, we have been de-risking the book and shoring up our liquidity profile and the quality of our collateral."

FTX Practices

FTX was once a major brokerage for trading crypto and the bankrupt company said it could have as many as one million investors who are seeking to recoup their losses.

The Bahamian-based brokerage filed for bankruptcy after facing massive liquidity issues when its acquirer, Binance, backed out of a merger.

Several other crypto firms, including Celsius and Voyager Digital, also filed for bankruptcy in 2022 as they also faced liquidity issues and falling prices in bitcoin and other digital asset prices.

FTX was an exchange used by crypto investors that included retail and institutional traders such as several hedge funds. It was backed by numerous high profile venture capitalists such as SoftBank, Ontario Teachers' Pension Plan, Sequoia Capital, Temasek, Sea Capital, IVP, ICONIQ Growth, Tiger Global, Ribbit Capital, Lightspeed Venture Partners, and funds and accounts managed by BlackRock.

The insolvency of FTX, which filed for Chapter 11 bankruptcy on November 11, was the result of a liquidity shortfall when clients attempted to withdraw funds from the platform a few days ago. The liquidity shortfall appears to have been the result of FTX’s founder reportedly transferring $10 billion of customer funds from FTX to his cryptocurrency trading platform Alameda Research, according to Reuters, citing two sources that "held senior FTX positions until this week”.