The abrupt and rapid collapse of the FTX cryptocurrency exchange has caused a shock in the crypto space.

The fall of a company valued at $32 billion in February, which occurred in just a few days, ended up casting suspicion on the entire young industry of financial services, based on the Blockchain technology.

Confidence in the industry is at an all-time low. Retail investors have fled, while institutional investors, linked to FTX and its sister company Alameda Research, are still determining their losses from their exposure to Sam Bankman-Fried's empire.

While there are lessons to be learned from this disaster which threatens the entire sector, it is an understatement to say that it will take a long time to regain the lost confidence.

'A Lot of Mistakes'

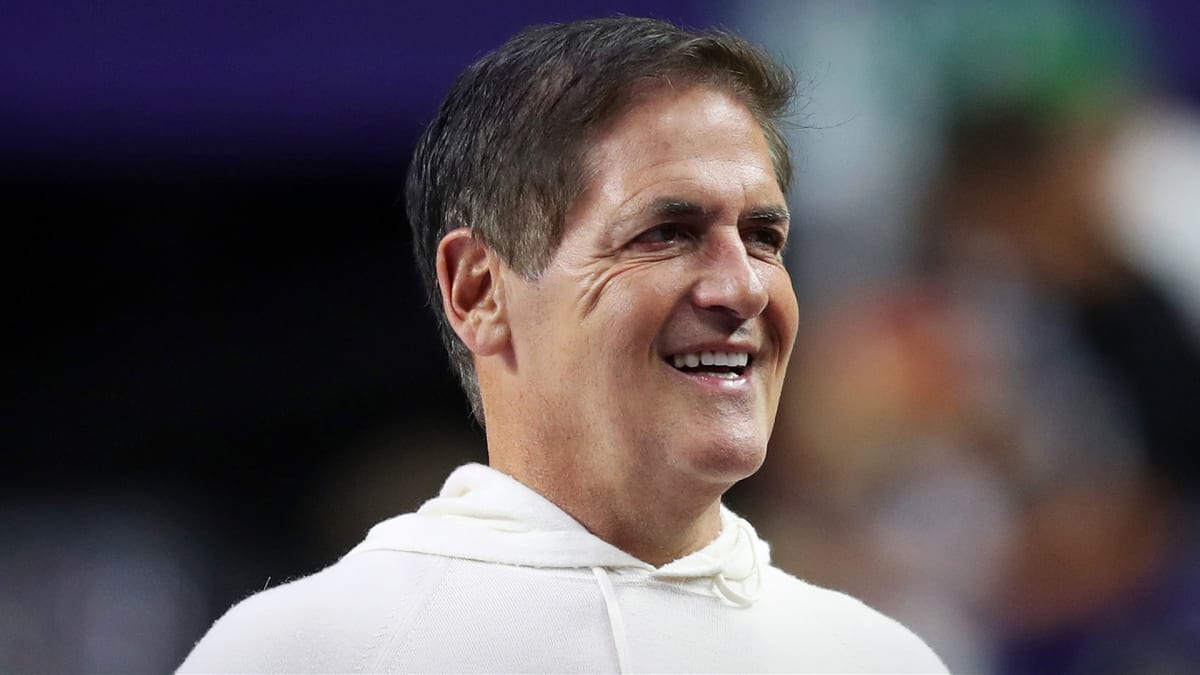

Billionaire Mark Cuban has not lost faith, though. He continues to believe in the industry and assures that there is still a lot of value in the sector, despite the fall of FTX. He believes that crypto has its place and that you just have to look at the big picture.

"Separate the signal from the noise," Cuban told TMZ. "There's been a lot of people making a lot of mistakes, but it doesn't change the underlying value."

Cuban said that, as long as consumers have viable options in the crypto world, he doesn't foresee the currency going in the tank.

The Dallas Mavericks owner is currently the subject of a class action lawsuit related to the bankruptcy of crypto lender Voyager Digital, which he had promoted in a partnership signed in October 2021. This partnership between Voyager Digital and the Dallas Mavericks had one mission: to promote cryptocurrencies by making coins more accessible through educational and digital programs.

"Cuban and Ehrlich, as will be explained, went to great lengths to use their experience as investors to dupe millions of Americans into investing — in many cases, their life savings — into the deceptive Voyager platform and purchasing Voyager earn program accounts (“EPAs”), which are unregistered securities," the class action lawsuits said, also referring to Stephen Ehrlich, who was CEO of Voyager.

"As a result, over 3.5 million Americans have now all but lost over $5 billion in cryptocurrency assets."

Voyager filed for bankruptcy as collateral damage of a credit crunch caused by the sudden collapse of sister cryptocurrencies Luna and UST on May 9. Millions of customers have lost their savings. Assets of Voyager Digital had been purchased by FTX, as part of the mortgage lender's liquidation process.

"A basic question. Why have I invested in crypto?" Cuban wrote on Twitter on Nov. 13. "Because I believe smart contracts will have a significant impact in creating valuable applications. I have said from day 1, the value of a token is derived from the applications that run on its platform and the utility they create."

Smart Contract

A smart contract is a piece of computer code that determines the terms of a transaction (loans, trading, etc.) and doesn't rely on any third party.

"What has not been created is an application that is ubiquitous. One that is obviously needed by everyone and they are willing to go through the learning curve to use. Maybe it never comes. I hope and think it will," Cuban continued.

The billionaire then compared the crypto industry to the streaming industry, implying that bad ideas are likely to perish while good ones will prevail.

"The best analogy I can use is the early days of streaming. The sh-- people had to do to listen to a 16k stream of music was insane. An internet subscription for your dial up modem. Download the provider client. Download a tcp/ip client. Download the streaming client," he argued. "Click on a batch file on a website. Make sure it all worked together. All while being laughed at for just not turning on your radio or tv."

He concluded on a note of optimism.

"But for in office or out of market it was worth it. It started as niche in 1995. Now realize that Smart Contracts are about 5 years old."

Cuban is involved in several crypto projects, including the very select Bored Ape Yacht Club, which represents a collection of over 10,000 online images of monkeys striking funny poses. Bored Apes are the most expensive non-fungible tokens (NFTs).

He is what many called in the crypto space an Ethereum maximalist, which means that he strongly believes in the potential of the second largest crypto ecosystem after Bitcoin. Ethereum is considered the internet of the crypto industry which aims to disrupt traditional financial services.