Being financially responsible is a good skill to have. It helps people save for emergencies, stay out of debt, achieve set goals, and make them more satisfied and secure overall. However, some cross the line from being frugal to cheap, often leading to missed experiences and relationship issues.

This woman recently shared how her thrifty husband didn’t allow her to fix her engagement ring, even though she planned to do it with her hard-earned money. The whole situation left her heartbroken, which pushed her to seek unbiased opinions from people online.

Being financially savvy is a good skill to have. However, it can become an issue when it crosses the line from frugal to cheap

For this married couple, it even shook the previously solid relationship

While being frugal is all about the value you get from spending your money, being cheap is all about seeing numbers and how to reduce them

Image credits: Mikhail Nilov / Pexels (not the actual photo)

“There’s cheap, and there’s frugal,” says Keith Klein, a certified financial planner. It’s important to distinguish the two before becoming too dissatisfied with a spouse’s spending habits, experts say. The latter individual often searches for the best deals—something that shouldn’t be frowned upon. Partners who try to make the most of the household income don’t deserve the cheap label unless they start putting off crucial purchases for the indefinite future.

While being frugal is all about the value you get from spending your money, being cheap is all about seeing numbers and how to reduce them. If the two would need to buy, for example, a phone, the frugal person would buy a good quality one that will last them longer, saving them money in the long run. A cheap person would find a device with the lowest price tag possible that might break in the first few months, costing them more in the future.

“If you really think your spouse is being cheap, don’t present them with a demand,” Klein says. “Ask them why they want to go the cheap route.” Their insights may help the couple find the solution to their economic attitude.

People tend to hold on to their old habits about money even when their financial situation has changed. A spouse who grew up in a low-income household may be accustomed to putting money aside because they don’t want to go back to that point. Others might hope to build a savings account for a rainy day or save money just for the sake of it.

Different spending habits don’t mean that the relationship can’t work

Image credits: Porapak Apichodilok / Pexels (not the actual photo)

Different spending habits in couples don’t mean that the relationship can’t work. Sonya Britt, an associate professor of personal financial planning at Kansas State University, says, “I think opposite spending personalities can still have a successful relationship. It will just take more work for them.”

When one likes to pinch their pennies while the other enjoys spending their hard-earned money, it might be a good idea to break out the budgeting spreadsheet. An important aspect that it has to include is some ‘fun money,’ as the person who likes to treat themselves can start to feel deprived and hide their spending.

The more frugal spouse should remember that it’s okay to buy some more exciting, nonessential items as long as they’ve paid their bills and put some of their income into retirement and savings. Ken Moraif, senior advisor with Money Matters in Dallas, jokes, “To a great degree, I find my job as a financial advisor is to give [clients] permission to spend money.”

For some partners, it might be even more convenient to keep their bank accounts separate. This prevents the thrifty spouse from knowing whether the new shoes cost $40 or $140, and agreeing on a limited budget gives the frugal partner peace of mind that the other isn’t dipping into funds necessary for crucial expenses.

“Having a cheap spouse may not be much fun, but consider that they may not be thrilled to be living with a spendthrift either. With open communication and a bit of compromise, there’s no reason financial opposites can’t eventually live in harmony,” concluded financial expert Maryalene Laponsie.

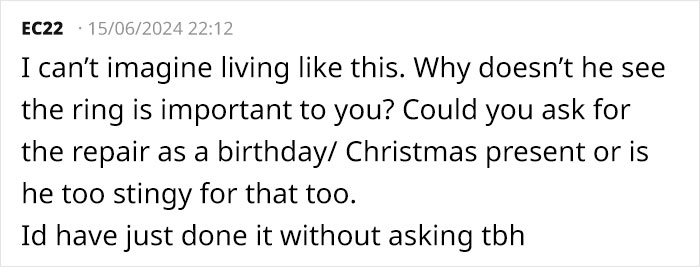

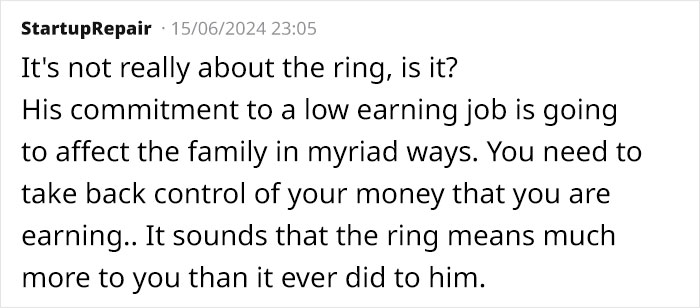

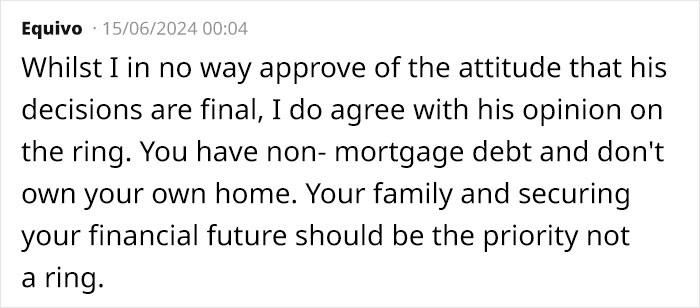

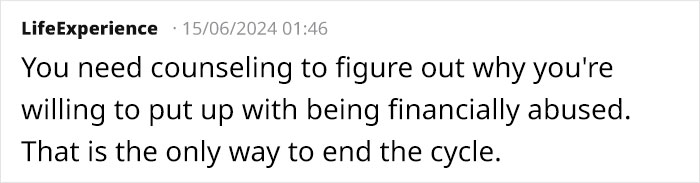

The author received various reactions in response to her post