From as much as $96 billion to around $3 billion: Credit Suisse Group AG is poised to join the historic ranks of finance giants sold at fire-sale prices in the grip of a market crisis.

As UBS Group AG looks all set to snap up the once-storied Swiss institution, the emergency government-brokered deal over the weekend bears soft echoes of the 2008 banking crash as Wall Street preps for fresh volatility on Monday.

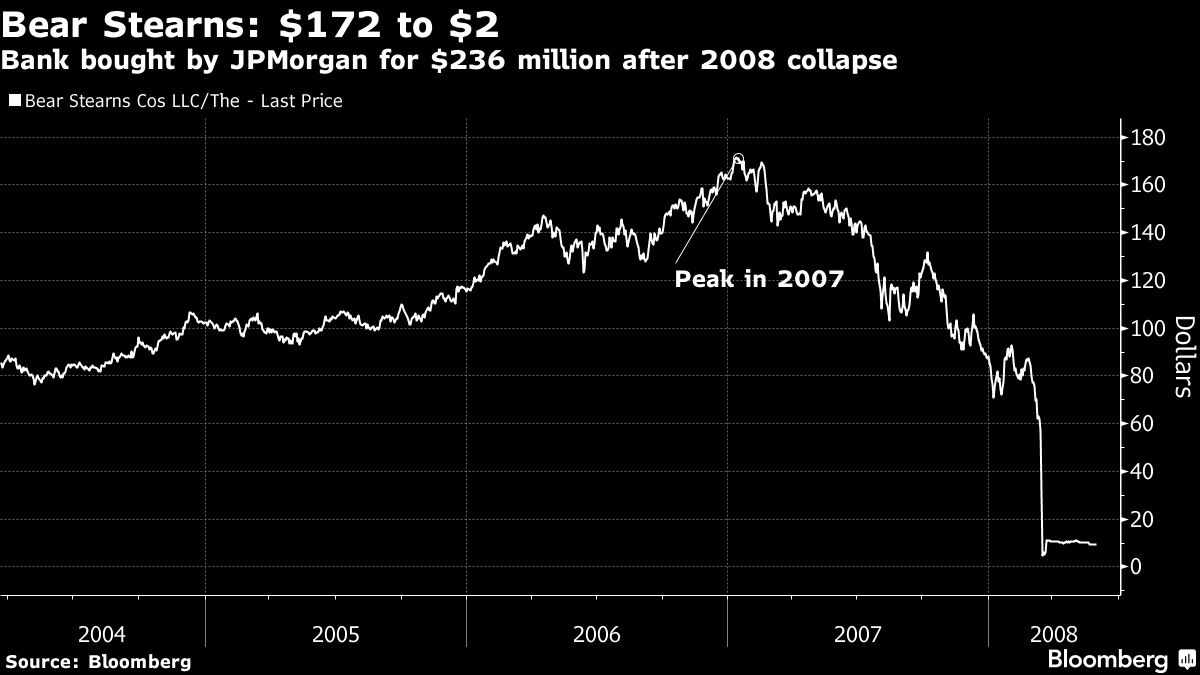

A reminder: During the Global Financial Crisis, JPMorgan Chase & Co. paid about $240 million for Bear Stearns — an investment bank that once commanded a stock market value of $140 billion. More takeovers and bailouts followed as the credit downturn grew increasingly dire.

Now in the US, regulators are seeking to sell off parts of Silicon Valley Bank, whose failure sent the market values of other regional banks plunging. In Europe on Sunday, UBS agreed to take over Credit Suisse in an all-stock deal that’s a steep discount to the 7.4 billion francs ($8 billion) it was worth at the close of business Friday.

With the fallout from rising interest rates threatening fresh turmoil, here’s a reminder of past bailouts and distressed mergers and acquisitions in the financial world.

The $2 Deal

- Bear Stearns: Just as the US housing-market crash was beginning to upend financial markets in early 2008, JPMorgan Chase & Co. bailed it out the New York investment firm by paying just $2 a share to take it over. In 2007, it was trading for as high as $170 a share. Jamie Dimon, JPMorgan’s chairman and chief executive officer, orchestrated the deal after the struggles of Bear Stearns’ hedge funds undermined confidence in the investment bank.

- Market cap journey: $140 billion to around $240 million deal

Fannie Mae and Freddie Mac

- Two weeks before the collapse of Lehman Brothers in September 2008, authorities agreed to bail out Fannie Mae and Freddie Mac, government-sponsored enterprises that played a crucial role in financing US home loans. The US Treasury Department offered each of them up to $200 billion of capital support in exchange for warrants over 79.9% of common stock together with some preferred stock.

- Fannie Mae and Freddie Mac: From $138 billion in combined value to under $4 billion now

Merrill Lynch

- Bank of America Corp. agreed to acquire Merrill Lynch & Co. for about $50 billion as the credit crisis claimed one of America’s oldest financial companies. Merrill Lynch was battered by several billion dollars in losses and write-downs from subprime-mortgage-contaminated securities. BofA’s offer was 70% below 2007 peak share price.

Lehman Brothers

- Battered by the fallout of the housing bust, Lehman Brothers famously failed to secure a bailout or a takeover. Instead, it filed for bankruptcy in September 2008, wiping out shareholders and sending shock waves across the world.

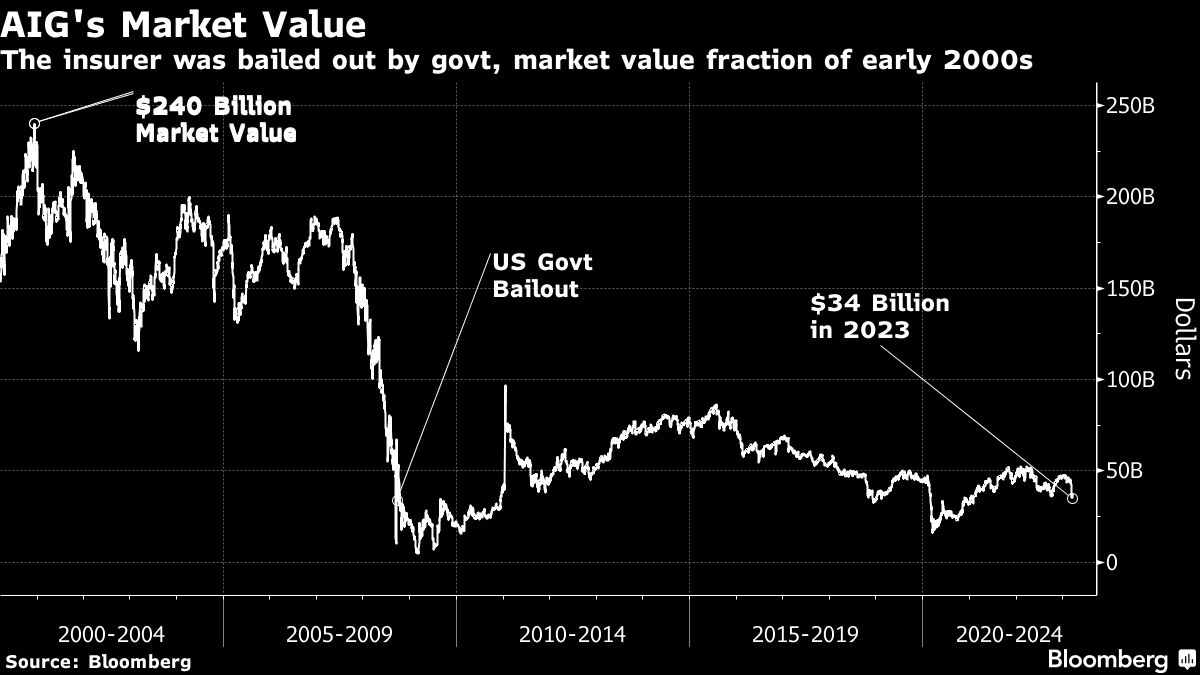

AIG

- That same month, the US government took control of American International Group Inc. in an $85 billion bailout to prevent the bankruptcy of the nation’s biggest insurer. AIG unraveled after guaranteeing fixed-income securities that were battered by the housing collapse.

Long-Term Capital Management

- Hedge fund Long-Term Capital Management nearly collapsed before the Federal Reserve orchestrated a rescue by banks back in 1998. The hedge fund was undone by bets that turned disastrous after markets were roiled by Russia’s financial crisis that year. LTCM was a private firm managing more than $100 billion in assets, before eventually shuttering in 2000.

©2023 Bloomberg L.P.