FOUR people linked to a Scottish restaurant empire are accused of a £1.1 million VAT fraud.

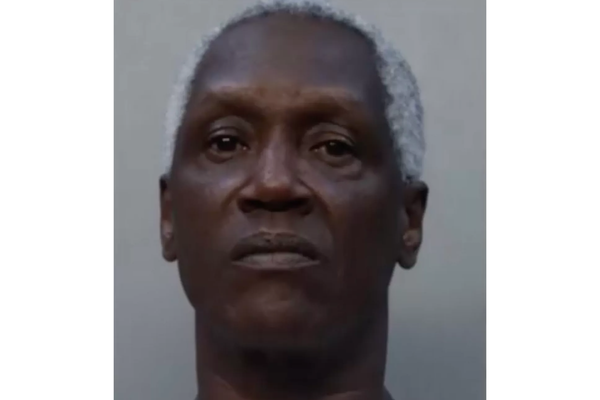

Antonio Carbajosa, 40, Mary Carbajosa, 68, Kevin Campbell, 43, and Khalid Javid, 66, denied the allegations during a hearing at the High Court in Glasgow on Wednesday.

The group are said to have been "knowingly concerned in the fraudulent evasion of VAT" totalling £1,149,470 between November 2011 and October 2016.

No venues are named on the indictment, but addresses for a number of restaurants in Glasgow city centre and in the West End are listed, including in Tunnel Street, Argyle Street, and St Vincent Street.

It is first claimed that the Carbajosas and Campbell failed to register three named limited companies for the purposes of VAT or submit returns to HMRC.

Prosecutors claim the same trio did "suppress the true value of sales" for four other limited companies – including Rotunda Leisure Limited – said to be involved in restaurant and takeaway businesses.

This is said to have involved their accountant Javid, which includes a claim he did "under-declare" on VAT returns the correct level of income brought in.

The indictment alleges Javid did help "systematically reduce" sales figures and "falsely declare" to HMRC that VAT owed by the limited companies was "less than the true value".

All four are said to have registered three further firms, which the Carbajosas and Campbell allegedly controlled and managed.

It is stated that the required VAT was not paid from what was generated by these companies.

They are said to have been involved in registering company directors "who did not exist" or had no links to the firms in "an attempt to divert attention" that the Carbajosas and Campbell were in charge.

Antonio Carbajosa and Campbell are then accused of diverting "sales revenue" from Just Eat, Deliveroo and Hungry House food order apps into their personal bank accounts.

This was said to be in a bid to hide the "revenue stream" from their companies and restaurants, resulting in the wrong VAT being paid.

The two men and Javid face a separate charge under the Value Added Tax Act spanning between April 2013 and May 2017.

A fifth accused – 27-year-old Georgia McArthur – also features on the indictment.

She is not accused of VAT fraud, but is instead alleged to have attempted to pervert the course of justice on April 14, 2023.

It is claimed she hid a phone belonging to her partner, Antonio Carbajosa, from HMRC officers during a search of his property in Hyndland, Glasgow.

He faces a separate charge of the same offence in that he allegedly said a mobile found during the raid was his, but prosecutors state it was instead McArthur's.

Antonio Carbajosa, Campbell, of the city's Kelvinbridge, Mary Carbajosa, also of Hyndland, Javid, of Stepps, Lanarkshire, and McArthur, of Clarkston, East Renfrewshire, had their attendance excused for the virtual hearing today.

Legal teams for each instead pleaded not guilty on their behalf.

Lord Young – the allocated judge in the case – set a trial which is scheduled to begin in April 2026.

The case would last up to 10 weeks.