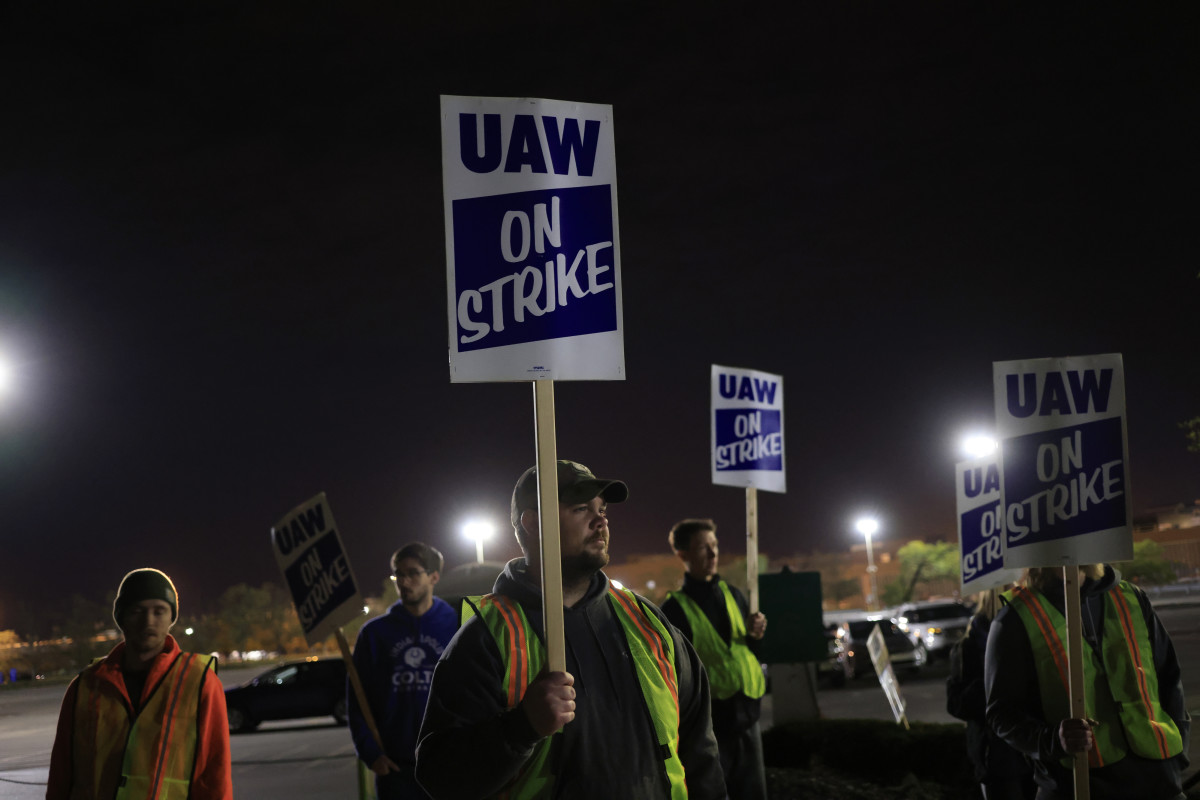

The past 24 hours saw a massive escalation in the United Auto Workers' battle with the Detroit Three for better wages, job security and benefits. The UAW called on 6,800 Stellantis (STLA) -) workers to stand up and strike the company's Sterling Heights Assembly Plant on Monday; the plant is responsible for assembling Stellantis' Ram 1500 pickup trucks.

Tuesday morning, hours after General Motors (GM) -) posted an earnings beat, the UAW announced a strike expansion of 5,000 workers against GM's Arlington Assembly plant. Some analysts have called this plant the most profitable auto plant in the world.

Roughly 45,000 UAW members are now on strike, a little more than 30% of the union's nearly 150,000 total membership.

With Stellantis "outraged" by the escalation and GM preparing to hemorrhage another $200 million weekly, in addition to the $800 million bite the strikes have already taken out of the company's earnings, former Ford CEO Mark Fields thinks the stage is set for the strikes to draw to a close.

His reasoning for this impression is twofold: one, the UAW has now struck the most profitable plants at each of the Detroit Three, and two, by striking these specific plants, UAW leadership can plausibly come back to their members with confidence that the deals they have on the table are the best they are going to get.

"We're probably closer to the end of the negotiations than the end of the beginning," Fields told CNBC.

This latest escalation, to Fields, is more indicative of closing strategies than it is of more strikes to come.

"I think (UAW President Shawn Fain) was waiting for the earnings to come out," Fields said. "I think he's looking for that one last cudgel to be able to use against the automakers to say: 'Look, they're profitable.'"

"At the same time," Fields said, "it's about time to cut a deal."

Still, a key gap that exists between the union and the automakers involves electric vehicle production plants. Fields said that, despite the union's demands to organize future EV plants, such a move is a "non-starter for the automakers." The Detroit Three, he said, are all too aware of what kind of investments they need to make in order to be competitive in the EV space with non-union imports and EV startups, such as Tesla (TSLA) -).

"Strikes don't get better with age," Fields said, noting that they hurt the workers in addition to the companies. "With this unprecedented level of transparency of the proposals on the table," he said, workers might be keen to just take a deal and end the strike.

Related: Former Ford CEO has harsh words of advice for UAW union strikers

The Tesla factor

With EV plans disrupted due to the strikes, Fields said that the longer-term view held by the automakers likely has not changed: the industry is in the midst of a transition from combustion engines to electric vehicles. That transition will happen.

The real impact the strikes will have on the EV efforts of the traditional automakers is in pushing back their EV production timelines, an additional profitability challenge in a sector that has been slowing down.

"Now you get to the hard part of EV adoption, which is convincing the mass market to buy these vehicles," Fields said, explaining that Tesla CEO Elon Musk's ongoing price cuts are being done in an effort to "cement the position of Tesla in the marketplace before the established OEMs really ramp up for their vehicles."

"Getting profitability in EVs for the entire industry is harder now given what's happened with pricing led by Tesla."

Shares of GM hit a new 52-week low Tuesday, following the company's decision to pull its full-year guidance pending the conclusion of the auto strikes.

Get investment guidance from trusted portfolio managers without the management fees. Sign up for Action Alerts PLUS now.