Ratings for CarMax (NYSE:KMX) were provided by 17 analysts in the past three months, showcasing a mix of bullish and bearish perspectives.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 5 | 8 | 1 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 1 | 0 | 0 |

| 2M Ago | 1 | 2 | 2 | 0 | 0 |

| 3M Ago | 2 | 3 | 4 | 1 | 0 |

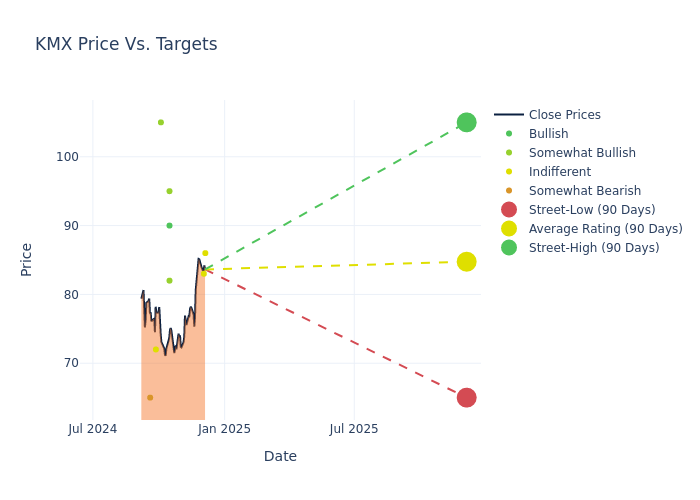

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $83.53, a high estimate of $105.00, and a low estimate of $65.00. Surpassing the previous average price target of $81.69, the current average has increased by 2.25%.

Exploring Analyst Ratings: An In-Depth Overview

An in-depth analysis of recent analyst actions unveils how financial experts perceive CarMax. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Jeff Lick | Stephens & Co. | Announces | Equal-Weight | $86.00 | - |

| Michael Montani | Evercore ISI Group | Raises | In-Line | $83.00 | $81.00 |

| Michael Montani | Evercore ISI Group | Lowers | In-Line | $76.00 | $79.00 |

| Michael Montani | Evercore ISI Group | Raises | In-Line | $79.00 | $76.00 |

| Steven Shemesh | RBC Capital | Maintains | Outperform | $82.00 | $82.00 |

| Seth Basham | Wedbush | Maintains | Outperform | $95.00 | $95.00 |

| Chris Pierce | Needham | Maintains | Buy | $90.00 | $90.00 |

| Brian Nagel | Oppenheimer | Maintains | Outperform | $105.00 | $105.00 |

| Michael Montani | Evercore ISI Group | Lowers | In-Line | $76.00 | $79.00 |

| Chris Pierce | Needham | Raises | Buy | $90.00 | $87.00 |

| Scot Ciccarelli | Truist Securities | Lowers | Hold | $72.00 | $75.00 |

| Steven Shemesh | RBC Capital | Raises | Outperform | $82.00 | $75.00 |

| Michael Montani | Evercore ISI Group | Raises | In-Line | $79.00 | $76.00 |

| Chris Pierce | Needham | Raises | Buy | $90.00 | $87.00 |

| Scot Ciccarelli | Truist Securities | Raises | Hold | $75.00 | $70.00 |

| Rajat Gupta | JP Morgan | Raises | Underweight | $65.00 | $55.00 |

| Seth Basham | Wedbush | Maintains | Outperform | $95.00 | $95.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to CarMax. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of CarMax compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for CarMax's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

For valuable insights into CarMax's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on CarMax analyst ratings.

Discovering CarMax: A Closer Look

CarMax sells, finances, and services used and new cars through a chain of around 250 used retail stores. It was formed in 1993 as a unit of Circuit City and spun off into an independent company in late 2002. Used-vehicle sales typically account for about 83% of revenue (79% in fiscal 2024 due to the chip shortage) and wholesale about 13% (19% in fiscal 2024), with the remaining portion composed of extended service plans and repair. In fiscal 2024, the company retailed and wholesaled 765,572, and 546,331 used vehicles, respectively. CarMax is the largest used-vehicle retailer in the US but still estimates that it had only about 3.7% US market share of vehicles 0-10 years old in 2023. It seeks over 5% share a few years from now. CarMax is based in Richmond, Virginia.

CarMax's Financial Performance

Market Capitalization Analysis: With an elevated market capitalization, the company stands out above industry averages, showcasing substantial size and market acknowledgment.

Revenue Growth: CarMax's revenue growth over a period of 3 months has faced challenges. As of 31 August, 2024, the company experienced a revenue decline of approximately -0.85%. This indicates a decrease in the company's top-line earnings. When compared to others in the Consumer Discretionary sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: CarMax's net margin excels beyond industry benchmarks, reaching 1.89%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): CarMax's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of 2.15%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 0.49%, the company showcases effective utilization of assets.

Debt Management: With a below-average debt-to-equity ratio of 3.11, CarMax adopts a prudent financial strategy, indicating a balanced approach to debt management.

Analyst Ratings: Simplified

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.