Providing a diverse range of perspectives from bullish to bearish, 12 analysts have published ratings on Academy Sports (NASDAQ:ASO) in the last three months.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 4 | 5 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 1 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 3 | 3 | 4 | 0 | 0 |

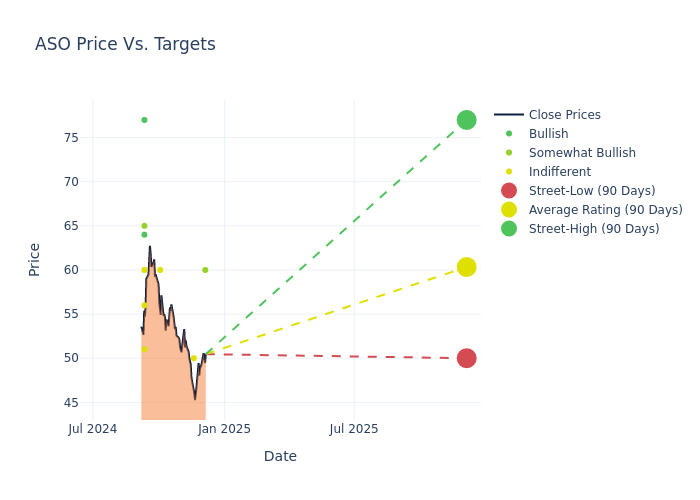

Analysts have recently evaluated Academy Sports and provided 12-month price targets. The average target is $61.33, accompanied by a high estimate of $77.00 and a low estimate of $50.00. Experiencing a 1.6% decline, the current average is now lower than the previous average price target of $62.33.

Exploring Analyst Ratings: An In-Depth Overview

The standing of Academy Sports among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Cristina Fernandez | Telsey Advisory Group | Lowers | Outperform | $60.00 | $65.00 |

| Joseph Civello | Truist Securities | Lowers | Hold | $50.00 | $63.00 |

| Greg Melich | Evercore ISI Group | Lowers | In-Line | $60.00 | $65.00 |

| Jonathan Matuszewski | Jefferies | Lowers | Buy | $64.00 | $68.00 |

| Simeon Gutman | Morgan Stanley | Maintains | Equal-Weight | $60.00 | $60.00 |

| Will Gaertner | Wells Fargo | Raises | Equal-Weight | $51.00 | $46.00 |

| John Kernan | TD Cowen | Raises | Hold | $56.00 | $54.00 |

| Anthony Chukumba | Loop Capital | Maintains | Buy | $77.00 | $77.00 |

| Greg Melich | Evercore ISI Group | Raises | Outperform | $65.00 | $60.00 |

| Seth Basham | Wedbush | Maintains | Outperform | $65.00 | $65.00 |

| Joseph Civello | Truist Securities | Raises | Buy | $63.00 | $60.00 |

| Joseph Feldman | Telsey Advisory Group | Maintains | Outperform | $65.00 | $65.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Academy Sports. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Academy Sports compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Academy Sports's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Academy Sports's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Academy Sports analyst ratings.

Get to Know Academy Sports Better

Academy Sports and Outdoors Inc is engaged in the retail business of sporting goods and outdoor recreation products. The product categories of the company are outdoors, apparel, sports & recreation, and footwear.

A Deep Dive into Academy Sports's Financials

Market Capitalization Analysis: The company's market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Decline in Revenue: Over the 3 months period, Academy Sports faced challenges, resulting in a decline of approximately -2.15% in revenue growth as of 31 July, 2024. This signifies a reduction in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Consumer Discretionary sector.

Net Margin: Academy Sports's net margin excels beyond industry benchmarks, reaching 9.21%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Academy Sports's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 7.39%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Academy Sports's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 2.93% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Academy Sports's debt-to-equity ratio is below the industry average. With a ratio of 0.87, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

The Core of Analyst Ratings: What Every Investor Should Know

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.