I don’t want to say Rivian (RIVN) stock got what it deserved because at the end of the day, it was only taking advantage of favorable market conditions.

Further, even pointing out that Rivian investors got what they deserved does no good — it just adds salt to the wound now that the stock is down 87% from the highs.

That said, at one point this stock was more valuable than Ford (F) and General Motors (GM) as its market cap swelled beyond $100 billion.

For a company with little to no revenue, such an egregious valuation was ridiculous. It doesn’t matter that Amazon (AMZN) was an investor and a customer or that Ford had a stake in it as well.

The reality is that Rivian didn’t have a strong enough business to justify its stock price.

Not only is Ford is a competitor to Rivian given its suite of electric vehicles, but now the former is looking to reduce its stake in the latter.

Ford has decided to pare down its stake in Rivian as concerns for high-growth stocks mount. Keep in mind, Amazon’s stake is almost double that of Ford’s current position, which still stands at roughly 94 million shares.

Here’s the interesting part, though.

Goldman Sachs moved Ford’s sale of 8 million shares at $26.90. JPMorgan moved another block in the 13 to 15 million share range as the lockup period ended on Sunday, but the seller is not known.

Obviously, all this selling has not helped the charts.

Trading Rivian Stock

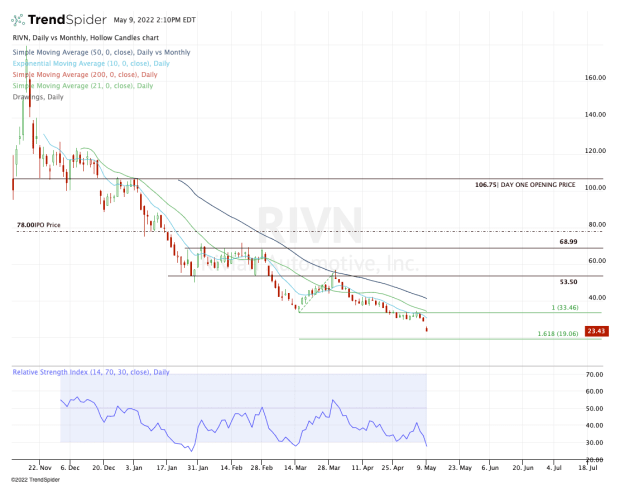

Chart courtesy of TrendSpider.com

Once this one started to break down, there was nothing there to support it.

First $106.75 was support, then turned into resistance. $78 was support, then failed. Then $53.50 was support, then turned into resistance. The $33.50 area did the same.

At each turn, we’ve seen various support levels fail and in many instances, we’ve seen them turn into resistance.

Gapping down on the news, I’d love to report that there is some bullish divergence on the chart — but there is none. Simply put, Rivian stock has been in a free-fall and its stock has been a falling knife.

Anyone that has tried to catch it has only gotten hurt. At this stage of the game, there are better growth stocks to buy that have strong fundamentals and/or better valuations.

On a rally, I want to see how this name handles the 10-day and 21-day moving averages, as well as the $33.50 area. My guess is it acts as resistance. If it’s not, perhaps we have a potential uptrend forming.

On the downside, see how Rivian stock handles the $19 to $20 area. That’s the 161.8% downside extension.