The United Auto Workers strike took a turn for the worse when the union announced stalled progress in its negotiations with Ford Motor (F) -), resulting in more workers heading for the picket lines.

The news didn't sit well with Ford, particularly given the UAW workers' latest target for its "stand-up" strike, which will impact the production of highly profitable trucks and SUVs.

The potential hit to Ford's sales due to production headwinds drew a stern rebuke from the Detroit automaker that's unlikely to win over workers.

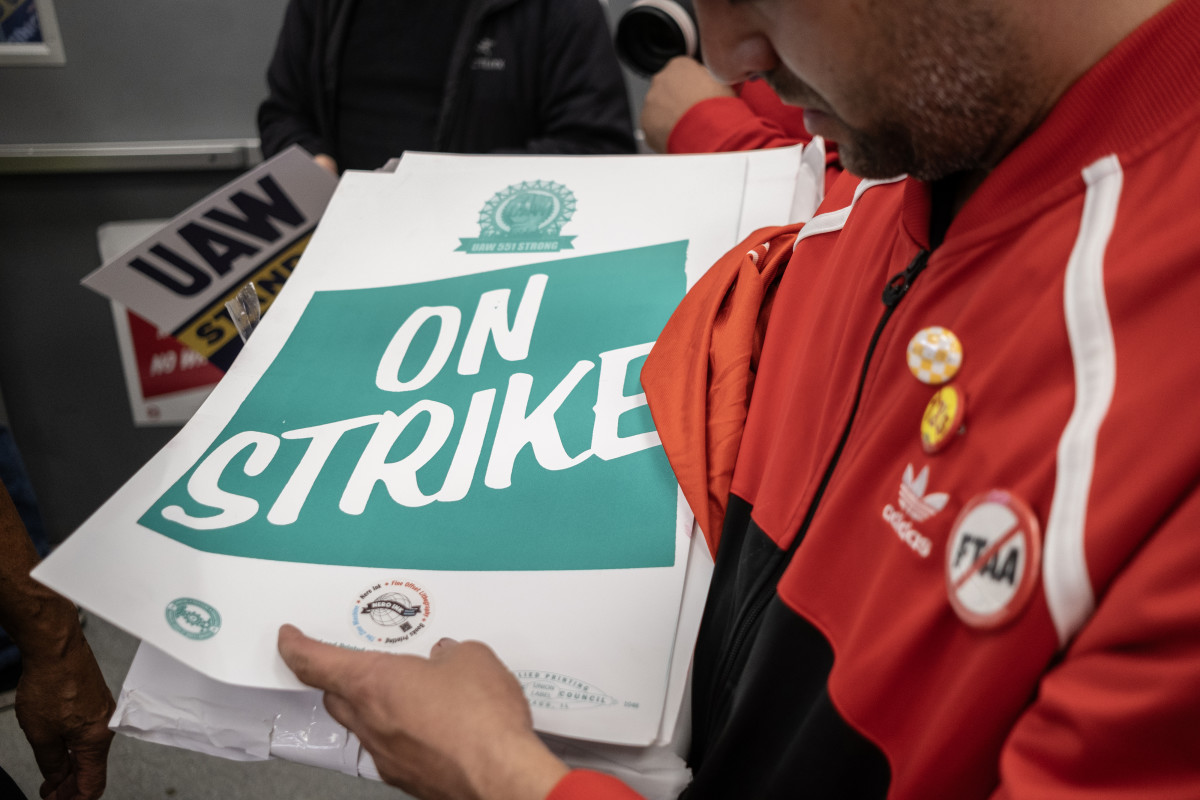

Striking UAW workers demand a record contract

The big three U.S. automakers, Ford, General Motors (GM) -), and Stellantis' (STLA,) -) have enjoyed record profits since the Covid pandemic.

A surge in worker wages, government stimulus payments, and low-interest rates catapulted auto sales as inventories shrank because of pandemic-era lockdowns.

Related: General Motors gets 'cold shoulder' from UAW workers

Increasing demand provided automakers with newfound pricing power, and even though interest rates have risen and stimulus payments are over, a strong jobs market has kept sales humming along, boosting revenue by billions of dollars.

UAW workers argue that it's time for Detroit's big three to share the wealth. They're demanding a 40% wage increase, 32-hour workweeks, a return to pre-Great Recession pensions, and a faster path to the top tier of hourly earnings.

Ford has previously said that meeting those demands would put it on a path to bankruptcy, an argument the UAW has dismissed.

For instance, the UAW recently pointed out that General Motors spent more on share buybacks than it did on labor over the past decade. It's also said that automakers like Ford would still have pocketed billions of dollars in profits if they had previously agreed to its terms.

The back-and-forth between the two sides suggests that the strike could worsen if a negotiation breakthrough doesn't happen.

Ford issues stern rebuke over UAW decision

The impasse on Oct. 12 caused the UAW to call on more local members to go on strike.

Workers at Ford's Kentucky Truck plant responsible for producing Super Duty pickup trucks, the Expedition, and Lincoln's Navigator SUV hit the picket line, bringing the total number of striking workers to about 34,000.

“It’s time for a fair contract at Ford and the rest of the Big Three. If they can’t understand that after four weeks, the 8,700 workers shutting down this extremely profitable plant will help them understand it,” said UAW President Shawn Fain.

More UAW strike

- Here's what striking UAW auto workers want

- General Motors delivers hard-nosed message to UAW workers

- Ford delivers tough-luck news for UAW workers

The UAW's decision followed a terse 10-minute meeting between union representatives and Ford management.

Ford wasn't impressed. A statement responding to the new strike called the decision "grossly irresponsible" and "wrongheaded."

The Kentucky Truck plant is Ford’s most significant plant. It's also one of the world's largest auto factories, accounting for $25 billion annually in revenue. Analysts at Wells Fargo estimate that shutting down the plant could cost Ford $150 million weekly in profit.

The decision to strike there will likely have ripple effects throughout Ford's supply chain. Over 5,000 workers at Ford, GM, and Stellantis have already been laid off because of production disruptions caused by striking workers. That number is likely to increase.

Ford says, "approximately a dozen additional Ford operations and many more supplier operations that together employ well over 100,000 people" could be impacted.

One area of contention leading to the expansion of the UAW strike may be Ford's hesitancy toward including future electric vehicle battery workers in any new contract.

Electric vehicles are quickly displacing internal combustion engine (ICE) vehicles, prompting significant investments in EV infrastructure, including batteries necessary to operate them. General Motors agreed on Oct. 6 to include battery workers in negotiations. However, Ford and Stellantis haven't made that decision yet.

Automakers likely worry that expanding contracts to EV-related plants could disadvantage them when competing with Tesla (TSLA) -), Toyota Motor (TM) -), Honda (HMC) -), and others less exposed to the higher labor costs associated with union workers.

Tesla's 120,000 non-union employees receive average wages and benefits totaling about $55 per hour, over $10 per hour less than GM, Ford, and Stellantis union workers.

Higher costs that could widen that gap could make competing for market share more difficult. According to Cox Automotive, EV sales rose 49.8% year-over-year in the third quarter to 313,000 vehicles. Tesla's market share was 50%, selling over 156,000 EVs in the quarter. Ford was the second largest EV maker, selling 21,000 vehicles.

Sign up to find out what stocks we're buying now (Ford isn't one of them!)