Ford (F) and General Motors (GM) are down hard on the day as analysts at UBS downgrade the stocks.

Ford stock is down almost 7% on Monday, while GM shares are down 5.25% on the day and were down as much as 7.5% at the session low. Both stocks are riding multi-day losing streaks and are down more than 10% from last week’s high.

UBS analyst Patrick Hummel downgraded Ford from a neutral rating to a sell rating and lowered his price target 23% down to $10.

He also cut General Motors from neutral to sell, but lowered his price target a whopping 32% down to $38 a share.

Of course, it doesn’t help that stocks like Tesla (TSLA) have been getting smoked, down 30% in just a few weeks.

On the plus side though, neither Ford nor GM has made new 52-week lows amid the current pullback.

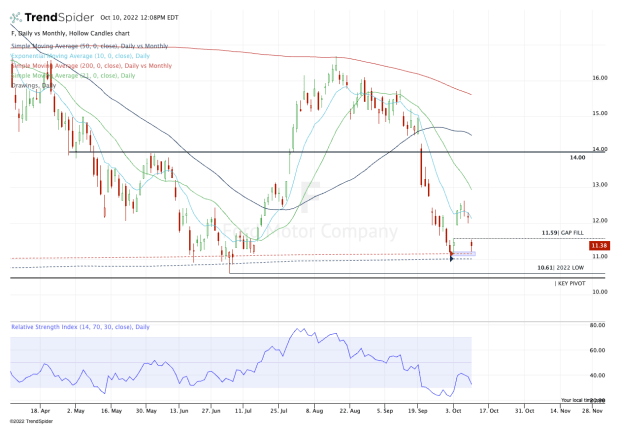

Trading Ford Stock

Chart courtesy of TrendSpider.com

Ford shares exploded higher on Tuesday, up almost 8%. The move left a notable gap at $11.59, which the stock filled with Monday’s gap-down.

Now finding its footing just above $11, Ford stock sits in a key area. Not only is that last month’s low, but it’s also where the 50-month, 200-month and 200-week moving averages come into play. These are some long-term, notable moving averages.

If Ford stock rallies from here, let’s see if it can fill the gap up near $12 and clear the 10-day moving average. If it does, $12.50 and the 21-day moving average could be next.

Below $11 may usher in a test of the $10.50 to $10.61 area, which is a key pivot on the long-term chart and the current 2022 low, respectively.

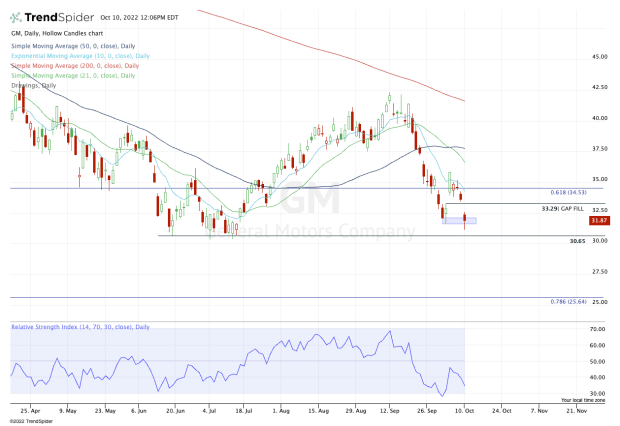

Trading General Motors Stock

Chart courtesy of TrendSpider.com

As for General Motors, the stock broke below the September low in early trading, but has since recovered this level.

Like Ford, it filled the gap it left behind last Tuesday down at $33.29. Unfortunately though, it now has an upside gap to fill at $33.40.

If the stock can get to this level, let’s see how it handles this mark and the declining 10-day moving average. Back above it could put $35 to $36 in play.

On the downside, GM stock is vulnerable to more selling pressure if it remains below the September low of $31.61.

In June and July, the stock did a great job carving out a low near $30.50. Bulls will want to see this area hold as support if GM shares continue to sink.

A close below $30 could bring in more selling pressure and -- in a panic or simply over time -- GM may see a test of the $25 to $26 area, which is the 78.6% retracement from the all-time high down to the covid low.