The electric-vehicle stocks have been mixed this year, but not Ford (F) and General Motors (GM).

While Tesla (TSLA) stock has been exploding — recently rallying more than 90% from the April 27 low to the recent high and up more than 150% from the 2023 low — Ford and GM have been playing catchup.

Ford stock recently enjoyed a 30% rally from last month’s low to the recent high, while GM shares jumped about 22%.

Don't Miss: Tesla Win Streak Might Snap; Here's 2 Buy-the-Dip Spots

The gains don't match Tesla's but they are much better than many other EV stocks at the moment.

A deal with Tesla’s supercharger network helped power these stocks higher. Now they're pulling back, and investors are wondering whether these two stocks can bounce back.

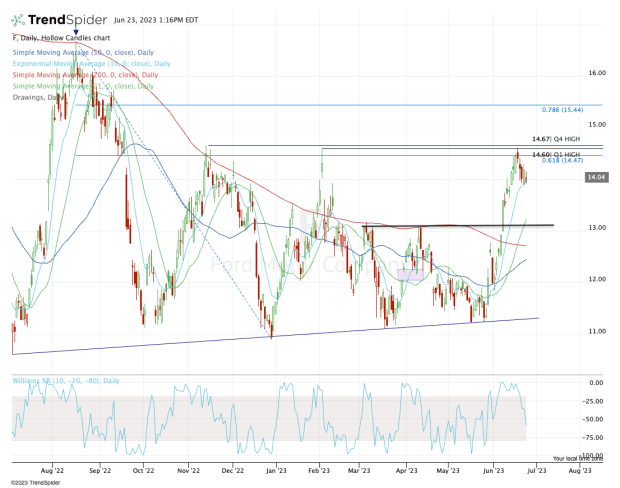

Trading Ford Stock

Chart courtesy of TrendSpider.com

The rally in Ford has been aggressive. At one point, the shares rose in 10 of 11 sessions and 13 of 15. But the stock found resistance at a familiar level: $14.65.

The fourth-quarter and first-quarter highs sit at $14.67 and $14.60, respectively. So far the high for this quarter, which ends next week? $14.61.

Clearly this area is resistance, and it doesn’t help that the 61.8% retracement comes into play near $14.50.

Don't Miss: Buy the Dip in Intel as Shares Try to Ride AMD, Nvidia Momentum?

Ford shares are pulling back into the rising 10-day moving average, which is often support for stocks in a strong uptrend. Active buyers will look for support to materialize from this zone.

If it does not, the next most meaningful area of support may come into play in the low-$13s, which was prior resistance this quarter. It’s also where the 21-day moving average comes into play.

If the shares can break out and clear the $14.60s, then $15 is the next stop, followed by the 78.6% retracement up near $15.50.

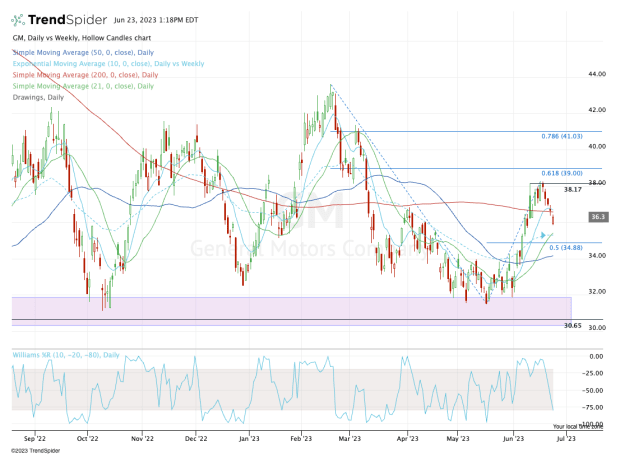

Trading GM Stock

Chart courtesy of TrendSpider.com

General Motors had a great setup going into today, as the stock closed right above the 10-day and 200-day moving averages after a quick four-day dip.

But the stock gapped lower on Monday morning, and even though it’s rallying off the lows, it remains vulnerable.

Don't Miss: Can AMD Stock Make New Highs? First, Here's Where Support Must Hold

The bulls need to see GM stock regain the $36.75 area, putting it back above the 10-day and 200-day moving averages. That could open the door back to the $38 area and ultimately put $40-plus in play.

On the downside, continued weakness could put the low-$35s in play, which is the 10-week and 21-day moving averages.

Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Get started now.