At one point on Friday, shares of Foot Locker (FL) were up 18% after the company reported earnings. However, those gains faded leaving shares up 8.6% for the day.

Investors initially cheered the results, as the company delivered a top- and bottom-line earnings beat.

Management also raised the company’s full-year earnings outlook, as CEO Mary Dillon continues to focus on improving the retailer. Investors may remember her from her time at Ulta Beauty (ULTA).

It’s been a mixed but generally favorable earnings season for retail stocks, as companies like Walmart (WMT), TJX Companies (TJX), Macy’s (M) and others trade higher on their results.

There’s a key support level for Foot Locker that investors should keep an eye on.

Buy or Sell Foot Locker Stock?

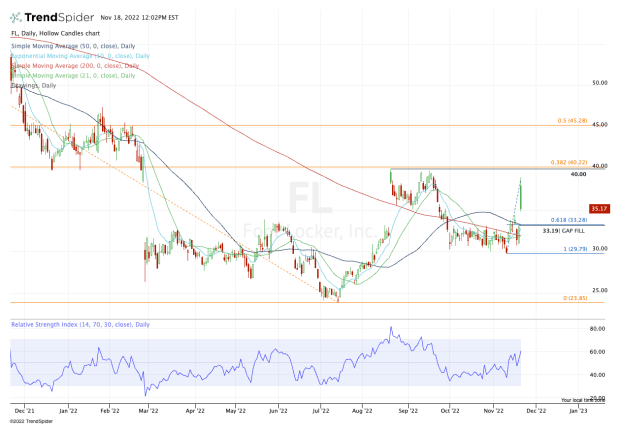

Chart courtesy of TrendSpider.com

Trading at roughly 8 times this year’s earnings expectations, Foot Locker is far from expensive. However, the up-and-down nature of its business — and worries of a looming recession — have kept investors out of the name.

When I look at the daily chart above, my eyes are instantly drawn to the $33 to $33.50 area.

There we have the 61.8% retracement, the 50-day and 10-day moving averages, and the gap-fill level at $33.19.

Currently trading in the $35 range and it’s not clear whether Foot Locker stock will test the $33 area. However, if it does there is a plethora of potential support and if traders want to stay long (or get long) this stock, they will need Foot Locker to hold this area.

Should it fail, it opens the door down to the $30 area, which has been support for the last two months.

On the upside, I want to see if Foot Locker can reclaim the $36.75 to $37.50 zone. Above that puts Friday’s high in play at $38.92.

If Foot Locker stock can clear that level, then it opens the door up to key resistance near $40. Both of Foot Locker's rallies over the last few months have stalled near this mark.

This area is also the 38.2% retracement of the total range comes into play. It's also a prior support level, which is now clearly acting as resistance.

Let's not get ahead of our skis, though. From here, see how Foot Locker stock handles ~$33. That will determine who’s in control of the stock.