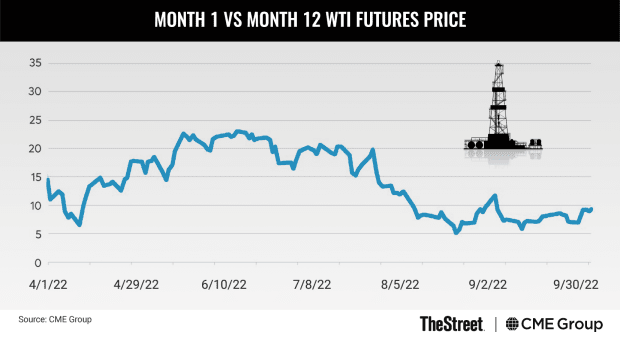

The third quarter of 2022 was soft for oil. The nearby futures price of WTI declined about 25%, and at $80 per barrel, was more than 10% lower than it was before the start of the Russian-Ukrainian war. The shape of the futures curve collapsed: The spread between the nearby futures contract and 12 months forward ended the quarter around $8 after averaging $17 in the second quarter.

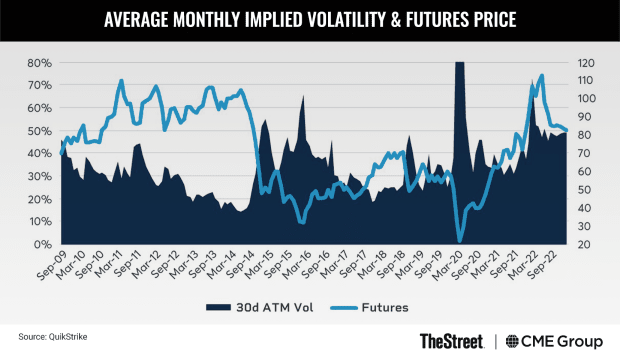

But volatility has shown little sign of softening. The 30-day at-the-money implied vol remains elevated at around 50%, where it has been since April. Compare this to the last time oil prices hovered near $100 for an extended period of time: 2013 through mid-2014. Despite similarly low global inventories, during that period, crude oil implied volatility reached historic lows with an average 30-day ATM implied vol of 19.2%, hitting an all-time low of 12.7% on June 6, 2014.

What’s different now? Uncertainty. Just ask the pundits. Oil market reports that historically have provided clear forecasts for oil supply-demand balances and prices now display multiple scenarios outlining the wide possibilities under varying scenarios.

Bloomberg’s word trend feature shows that the word “uncertainty” appears in headlines more than twice as frequently as it did in 2013 – and more than any other time outside of the initial months of the covid pandemic.

Two-Way Risk

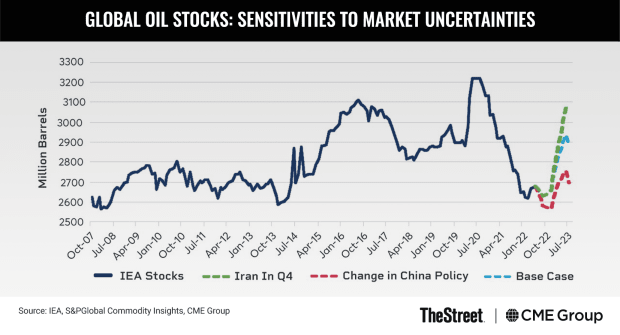

The uncertain evolution of geopolitical and economic conditions in 2022 and onward make oil balances difficult to pin down. There are too many large moving pieces, and too many possibilities.

A mild recession and an Iranian Nuclear Deal without further OPEC intervention could drive inventories from historic lows to the high end of the range; Russian production losses and a recovering China would keep balances well below average.

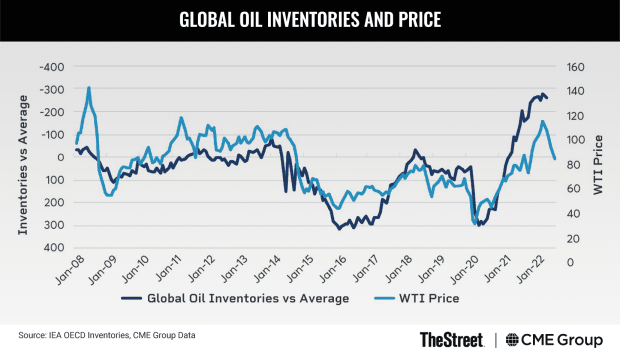

But oil supply and demand balances are key drivers of oil prices. When oil inventories are below average, prices tend to be high; when inventories are above average, prices tend to be lower. Frequent and large shifts in the probabilities that balances move toward highs or lows means volatility for prices.

Traders report that the market today is headline-driven, and this fits with the uncertainty around oil balances. Here are five key drivers to keep an eye on:

1. Economic Indicators and Fed Policy

Oil demand is highly correlated with economic activity. The more goods we make, the more energy we consume producing them and the more fuel we use moving them via truck, ship, and rail. As we move into the end of 2022, some believe a mild global recession is imminent, or already underway. But the severity of the economic malaise and the duration remains in question, leading to greater focus on economic data releases like the weekly jobs report, monthly ISM, and PMI data. The action and commentary of the Federal Reserve that can exacerbate or assuage conditions are also key.

In the 2008-09 Great Financial Crisis, global oil demand fell short of trendline growth by an average of 4 million barrels per day across a 12-month period. In the milder Dot-Com collapse in 2000-01, the loss was closer to only 1 million barrels per day.

2. Chinese Covid Policy

Chinese growth has slowed sharply this year as leaders pursue a Zero-covid policy. Before 2020, Chinese oil demand was growing at just under 5% a year – or an average of 600,000 barrels per day, according to IEA data. But in the second quarter of 2022, demand fell 1% year on year, a loss of 1 million barrels per day. Expectations that continued lockdowns with little stimulus recently caused S&P Global Commodity Insights to lower their forecast for the next 12 months by over 500,000 barrels per day – amounting to an additional 187 million barrels of inventory.

3. The Iran Nuclear Deal

Iran has been exporting approximately 800,000 barrels per day of oil and condensate in 2022, down from over 2 million barrels per day before sanctions were reinstated. Prospects of reviving the 2015 nuclear deal have varied wildly over the last 18 months, with high expectations in March fading by July. According to commodities analysts, a resolution could quickly bring on an extra 500,000 barrels per day of exports, and at least another million over the following 12-18 months. Talks amongst delegates and deadlines for performance continue to be closely tracked by traders and analysts. As of early October, behind-the-scenes talks continue, with Iran holding out for the International Atomic Energy Agency to cease investigations into undisclosed nuclear activity.

4. OPEC Meetings and Minister Commentary

OPEC+ meetings – and the commentary of key OPEC+ ministers in between them – have a long-standing tradition of influencing market prices because they can significantly change oil balances. The October 5, 2022 meeting implemented a headline cut of 2 million barrels per day from November 2022 until the end of 2023. While the underperformance of OPEC+ production implies the real supply impact will be closer to 800,000 barrels per day, this amounts to over 300 million barrels – equivalent to the swing in OECD oil inventories from average to minimums. CME’s OPEC Watch Tool can help traders track upcoming meetings and outcomes priced into the crude oil options markets; CVOL offers real-time insight into volatility response leading up to and following key meetings.

Follow crude oil volatility with CVOL

5. Strategic Petroleum Reserve Discussion

In 2022, the United States released over 200 million barrels of crude oil from the Strategic Petroleum Reserve. Some market watchers correlate the release with the decline in gasoline prices over the summer period. As the price of crude oil has declined, questions remain on when and how much the U.S. will seek to purchase. If prices rise, the rhetoric may shift toward additional releases. SPR policy will be essential to continue to watch.

Beyond these factors, there remain even more wildcards for oil balances. The impact of European sanctions on Russian production is unknown. Most expect sanctions to cut 1 – 2 million barrels per day of supply, but output thus far has been resilient. The severity of winter weather and the impact of oil demand from high natural gas prices is too early to know with certainty. U.S. production continues to disappoint, with the slope of the increase still unknown.

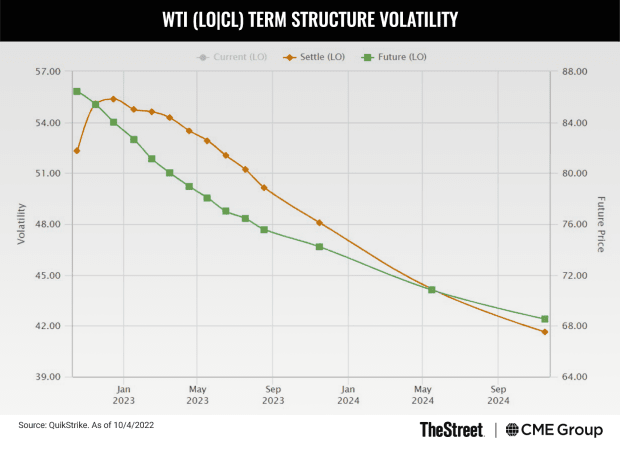

With large uncertainties, it’s no wonder the options market continues to price high volatility. In fact, as of early October 2022, the term structure of WTI is in slight contango with even higher volatility prices through mid-2023. While the 10-year average at-the-money volatility is 34%; the forward curve is still above 40% in 2025. Meetings, public comments, and geopolitical events impacting probabilities will continue to generate headlines and give market participants plenty of price risks to manage in the oil markets.