Earlier this year in May, Elon Musk contended that the idea that people weren't having children because it was bad for the environment was pure nonsense, and hoped that civilization doesn’t end with everyone in adult diapers.

"Some people think that having fewer kids is better for the environment. It's total nonsense. The environment is going to be fine," the Tesla CEO said. “We don't necessarily need to grow dramatically, but let's not gradually dwindle away until civilization ends with all of us in adult diapers, in a whimper."

Bitcoin maximalist Anthony “Pomp” Pompliano argues an adjacent subject, saying that investing is a game of demographics, and calls for investors to select markets that have a strong potential for growth.

“You want to select markets that are ascending, not descending. Data points like population growth, percent of young people, and life expectancy are key indicators of where the world is going,” Pomp wrote in his blog. “Pick the right market and you can make the trend your friend.”

While that may sound confusing, the theory isn’t new, here’s what Pomp is talking about.

According to the Survey of Consumer Finances, demographic shifts in the United States and worldwide have a significant impact on investment risks and returns.

Fifty years ago, the median age of the U.S. population was 28, today it is 38, and by 2050 it will be 41, and the average life expectancy in the U.S. is 78.7 years, according to Pew Research.

In 2001, the median working age was 39; it is now 41; and by 2031, it will be 42. This conceals significant changes in the age distribution, even though it appears trivial.

Declining birth rates, rising median working age, and a rising retiree population might have severe effects on capital accumulation and future retirement preparations.

Older people, who often invest the most, control a larger percentage of the stock market, Fed data shows from the end of last year. 74.5% of shares of mutual funds and corporate equity were held by investors 55 and older.

According to some experts, the rising number of older adults will result in a type of asset collapse as more retirees convert their investments to cash, so they may spend more.

The demand for all types of investments will also likely fall due to the declining population of young people.

“The United States is in a league of its own. There is no other wealthy country in the world that has a life expectancy below 80 years old,” Pomp noted.

china passes united states in life expectancy

— ian bremmer (@ianbremmer) September 7, 2022

should be a headline in every us newspaper pic.twitter.com/SSo2IBL0vQ

Investors who are nearing retirement are less ready to accept investment risk, since they won't have enough time to rebuild investments in the event of a market downturn.

The financial markets and the value of U.S. stocks would suffer as older investors sell off their stocks.

“There are few countries that have been able to thrive for decades in the face of deteriorating demographics, so this is worth continuing to watch in the coming years,” Pompliano said.

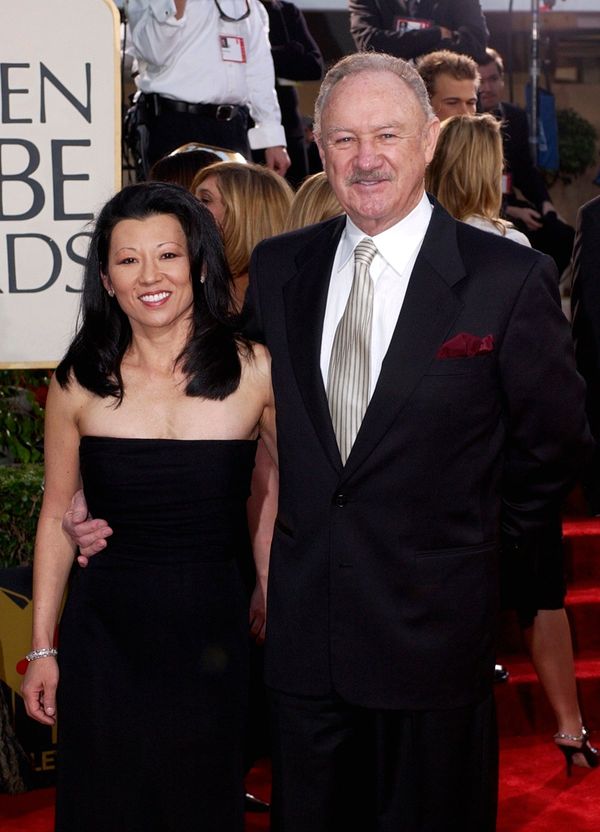

Photo: Courtesy of MoneyConf and Daniel Oberhaus on flickr