Tech stocks have always been a playground for dreamers and believers, but the recent breakout of the Chinese artificial intelligence company DeepSeek just shook up Nasdaq.

DeepSeek claims that its flagship AI model, R1, can perform as well as costly models like OpenAI more cheaply and requiring fewer resources.

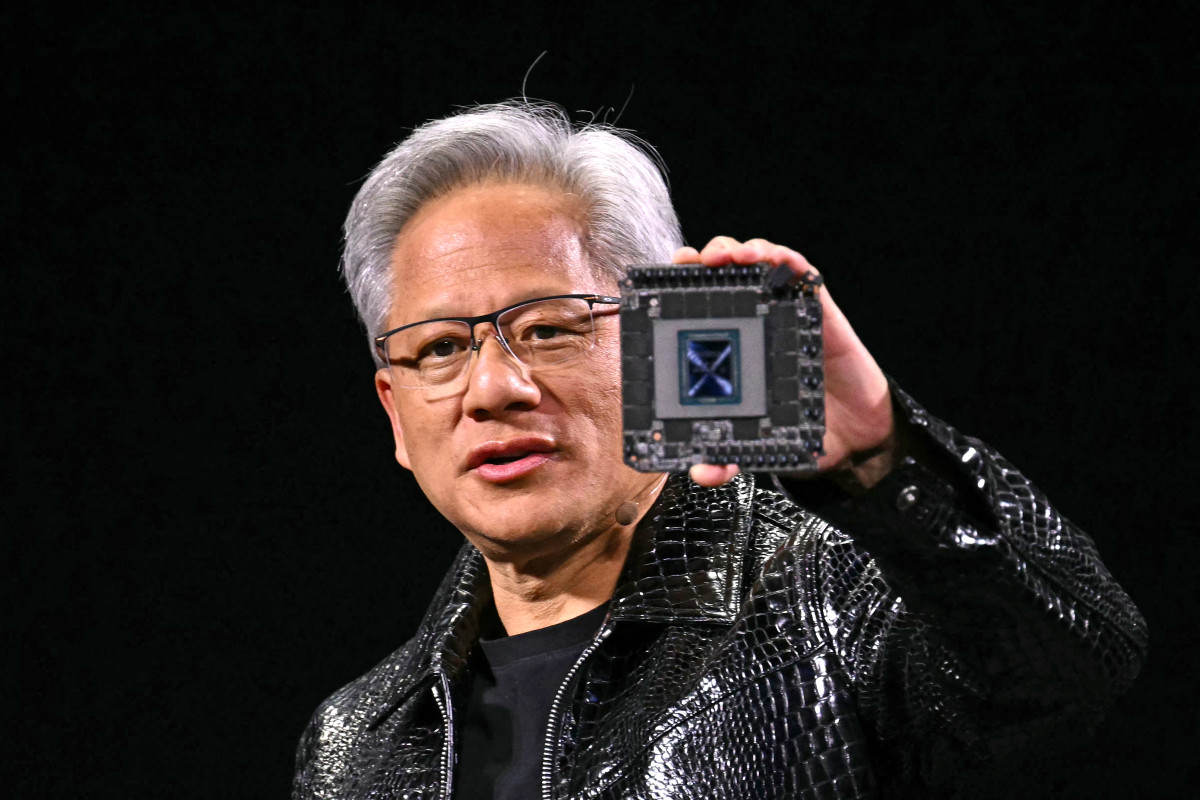

This has hurt major AI players, led by chip maker Nvidia, as it threatens the demand for the wide-margin high-end graphics-processing units, which have been a key driver of chipmakers' AI-focused revenue growth.

Last year, the S&P 500 gained 23% on the back of a tech-fueled rally driven by lower interest rates and strong earnings.

But risks such as rising oil prices, potential tariffs from the Trump administration, and global instability threaten to challenge the market’s momentum in 2025, Fidelity warns.

Now, as uncertainties on AI’s growth path rise, investors are exploring opportunities across sectors.

Fidelity has released a stock screen highlighting top growth, value and income stocks that could win in 2025.

Growth stocks keep the momentum

Growth stocks led by tech have outperformed value stocks for more than a decade and by a relatively wide margin, except for the pandemic period, Fidelity said.

Fidelity’s top picks for the growth sector sorted by market cap include Nvidia (NVDA) , Amazon (AMZN) , Meta Platforms (META) , Alphabet (GOOGL) , Broadcom (AVGO) , Mastercard (MA) , Netflix (NFLX) , T-Mobile US (TMUS) , and ServiceNow (NOW) .

These stocks have an expected earnings-per-share growth rate of at least 15.7% over three to five years and a cash-flow growth rate of at least 12.1% over five years.

Nvidia was one of last year’s biggest winners, surging 170%. The company’s growth has been driven by the demand for its GPUs, which power AI model training.

Related: Top analyst revisits Nvidia stock price target amid DeepSeek threat

The launch of DeepSeek models could hurt Nvidia, as margins on GPUs could be pressured. Still, several analysts have defended AI stocks. Investment firm Wedbush views the selloff as a "golden buying opportunity."

"There is only one chip company in the world launching autonomous, robotics, and broader AI use cases, and that is Nvidia," said Wedbush analyst Daniel Ives.

Bernstein has reiterated its outperform ratings on Nvidia, with a $175 price target, and Broadcom, with a $220 target, saying it continues to like those names within the U.S. semiconductor sector.

Amazon climbed 44% in 2024, driven largely by the growth of Amazon Web Services, its cloud-computing division. The company is building chips to give itself a cheaper alternative to Nvidia's equipment.

Meta Platforms also had a standout year, with its stock up 65%. The company is ramping up its AI investments to improve its generative AI advertising tools. Advertising accounted for 98.3% of Meta’s total revenue in the third quarter.

Meta is set to post its Q4 earnings on Jan. 29 after the market close, while Amazon will release financials next week.

Affordable opportunities among value stocks

Value stocks also feature prominently in Fidelity’s screen as they appeal to those looking for relatively stable and reasonably priced options.

The stock picks, featuring traditional automakers, banks and energy-focused companies, include Shell SHEL, Total Energies TTE, Banco Santander SAN, General Motors (GM) , Petroleo Brasileiro (PBR) , Honda Motor (HMC) , Ford Motor (F) , Deutsche Bank (DB) , Vale (VALE) , and Bayer (BAYRY) .

These picks all have low price-to-earnings multiples, ranging from 0 to 9.3 based on next year’s earnings estimates.

Last year, General Motors saw its stock rise nearly 50%, significantly outpacing the broader market. The company just posted its Q4 results, beating Wall Street’s expectations for the quarter.

Related: General Motors’ robotaxi exit is a massive hit for tech leader

The company sold 2.7 million cars in the U.S. in 2024, up 4% from 2023. It's the highest sales volume since 2019.

GM also maintained a positive outlook on electric vehicles. The company expects to build 300,000 EVs in 2025, a nearly 60% increase from last year.

But there are still uncertainties ahead under the Trump administration, such as potential tariffs that could drive up costs for automakers. (GM shares fell almost 9% on Jan. 28.)

Looking for dividends? Look to income stocks

Income is another strategy for investors seeking stable returns. This strategy features stocks with strong dividend yields and consistent dividend growth.

Since early 2022 (when interest rates were much lower) stock yields have struggled to compete with higher-yielding investments. "But rates came down in 2024 and more cuts are expected in 2025," Fidelity said. That could "further even out the field when comparing stock yields with other investments that generate income," the mutual-fund giant said.

Here are 10 stocks from Fidelity’s screen for income seekers. They offer dividend yields of 3.5% or higher and a five-year average dividend growth rate of at least 5.9%:

AbbVie (ABBV) , Chevron (CVX) , Nestle SA (NSRGY) , PepsiCo (PEP) , Bristol-Myers Squibb (BMY) , United Parcel Service (UPS) , Toronto-Dominion Bank (TD) , Bank of Montreal (BMO) , Equinor (EQNR) , Canadian Natural Resources (CNQ) .

Among the 10 stocks mentioned above, only AbbVie and Bristol-Myers Squibb saw their stocks rise in 2024.

More 2025 stock market forecasts

- Veteran trader who correctly picked Palantir as top stock in ‘24 reveals best stock for ‘25

- 5 quantum computing stocks investors are targeting in 2025

- Goldman Sachs picks top sectors to own in 2025

- Every major Wall Street analyst's S&P 500 forecast for 2025

In 2024 PepsiCo's stock declined more than 10%. The company has faced some headwinds, including product recalls in its Quaker Foods North America division and an overall pressured economy.

Despite these challenges, PepsiCo remains a dividend king, boasting more than 50 consecutive years of dividend increases.

Related: Veteran fund manager issues dire S&P 500 warning for 2025