After the stock market's brutal June 13 session and a mixed session so far on June 14, FedEx (FDX) stock is a clear standout.

The stock fell just 2.8% yesterday — outperforming the nearly 4% decline in the S&P 500 — and is roaring higher on Tuesday. At its high, the Memphis package-delivery giant's shares were up more than 14%.

They're still up by more than 12% so far in Tuesday’s session. The rally comes on the heels of the company granting three board seats to activist investor D.E. Shaw Group and boosting its dividend by more than 50%.

That brings the dividend yield for FedEx stock up from 1.3% to 2%.

Despite today’s solid rally, though, shares of FedEx are running into a key area on the chart.

Trading FedEx Stock

Chart courtesy of TrendSpider.com

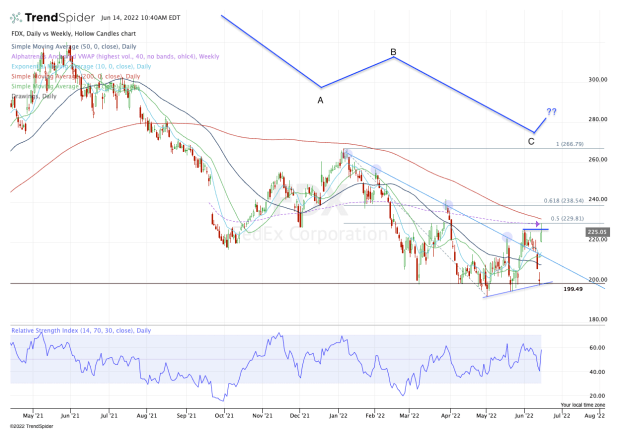

Like the S&P 500, FedEx stock hit its highs for the year during the first few trading sessions of 2022. From there FedEx fell into a brutal downtrend, with investors selling into each rally.

This month, the stock has faced a fair bit of volatility. The shares initially broke out over downtrend resistance and looked primed for more potential upside.

But a two-day 7.5% skid sent the stock back into key support near $200, a zone that’s held as support for several months now.

Right now, FedEx stock faces an enormous hurdle. It’s trading into the 50% retracement of the current range, trying to clear last month’s high at $226.33, the declining 200-day moving average and the weekly VWAP measure.

That’s a significant retracement mark, a significant rotation point, a significant moving average and a significant volume-based measure!

If the stock can power through this zone, it is very meaningful and opens the door to higher prices: $238 to $240 would be the next zone to watch, followed by $250, then possibly $265 to $270.

I always look at both the upside and the downside and the latter is particularly important in an environment like this.

Keep an eye on today’s low, near $220. Below that and FedEx stock could retest the 10-day and 21-day moving averages, along with the backside of prior downtrend resistance.

It would be quite constructive if this area could hold. If it doesn’t, then the $200 area is vulnerable to another test.