The Federal Reserve signaled that it's considering cutting its key interest rate but isn't yet confident inflation is licked. The S&P 500 extended losses after release of the Fed policy statement and chair Jerome Powell's comment that a March rate cut was "not the base case."

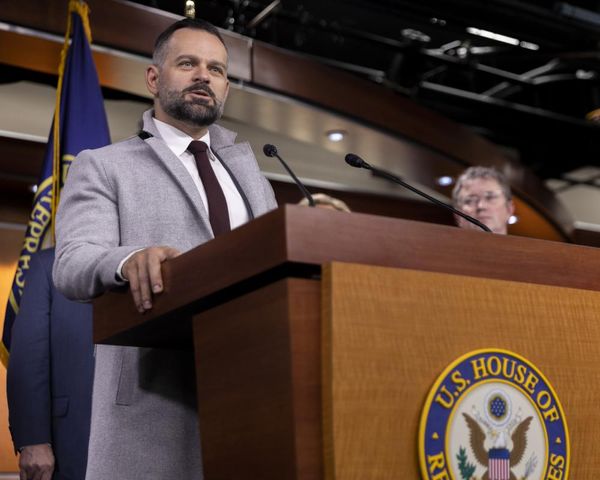

Fed Chair Powell

Powell indicated that the good economic news, including strong growth, low unemployment and falling inflation, gives the Fed flexibility to wait until policymakers are comfortable with starting the process of cutting rates.

Still, Powell's overall message was pretty dovish. "We don't look at stronger growth as a problem," Powell said. "We have six months of good inflation data."

The Fed, he said, will gain the confidence to cut interest rates with further benign inflation data, even if economic growth remains robust.

We want to "finish the job" while keeping the labor market strong,

Powell's comments briefly seemed to spark the S&P 500 because the economy enjoyed a burst of strong growth in the second half of 2023. accompanied by rapid disinflation. GDP grew 4.9% in Q3, followed by 3.3% in Q4.

That suggests Powell isn't worried about the big picture — including the strong stock market rally.

Powell seemed to imply that a couple of more tame inflation readings could put a rate cut on the table. Given that there are two more monthly inflation readings before March 20, that timeline suggests a rate cut then is still possible.

He said the Fed was prepared to maintain the current federal funds target range for longer — "if appropriate."

Powell reiterated his wariness about keeping policy too tight for too long.

He also noted that the Fed will begin an in-depth discussion in March to settle on a plan for slowing or ending its balance-sheet tightening.

Fed Rate Cut Odds

After Powell's downplaying of the possibility of a March 20 rate cut, markets were pricing in 35.5% odds of a rate cut that day, down from above 50% before the Fed meeting statement.

Rate cut odds had jumped earlier in the day after the ADP employment report revealed a sharper-than-expected slowdown in private-sector hiring this month, with 107,000 new jobs. Also, the Fed's favorite measure of wage growth, the Employment Cost Index, rose 0.9% in Q4, down from 1.1% in Q3.

S&P 500

The S&P 500 fell 1.6% in Wednesday stock market action, as moderate losses deepened after the 2 p.m. ET Fed policy statement and chair Powell's news conference. The S&P 500 dipped 0.1% on Tuesday after hitting a record closing high on Monday.

Be sure to read IBD's The Big Picture column after each trading day to get the latest on the prevailing stock market trend and what it means for your trading decisions.