A federal judge rejected Boeing Co.‘s (NYSE:BA) plea agreement on Thursday in the criminal fraud case stemming from two fatal 737 Max crashes, citing concerns over diversity, equity and inclusion policies in the selection of a government-appointed monitor.

What Happened: U.S. District Judge Reed O’Connor in Texas ruled that the court was not convinced the government would select a monitor “without race-based considerations,” reported CNBC.

The decision gives Boeing and the Justice Department 30 days to determine next steps in the case related to the crashes that killed 346 people in 2018 and 2019.

The ruling comes as Boeing faces intensifying pressure on multiple fronts. Emirates Airlines recently expressed frustration over five-year delays in the delivery of a $52 billion aircraft order. At the same time, a DHL cargo plane crash in Lithuania last week involving a Boeing 737 added to scrutiny of the manufacturer’s safety record.

See Also: Santa Rally: 10 S&P 500 Stocks That Outperform In December’s Second Half

Why It Matters: The rejected plea deal would have allowed Boeing to avoid trial and pay a reduced fine of $243.6 million, half of the original $487.2 million penalty. The agreement emerged after Boeing violated a previous plea deal that was set to expire shortly after a door panel blew out during an Alaska Airlines 737 Max 9 flight in January.

Victims’ family members opposed the agreement, with attorney Erin Applebaum calling for “real accountability” rather than what they termed a “sweetheart deal.” The families sought greater input in the monitor selection process.

Boeing’s challenges extend beyond legal issues. Under new CEO Kelly Ortberg, the company faces production delays exacerbated by a recent seven-week worker strike. The manufacturer plans to cut 17,000 jobs globally, including 2,500 U.S. positions, as it grapples with negative shareholder equity and over $57 billion in debt.

Price Action: Boeing’s stock closed at $156.67 on Thursday, down 1.02% for the day. In after-hours trading, the stock dipped 0.05%. Year to date, Boeing has declined 37.77%.

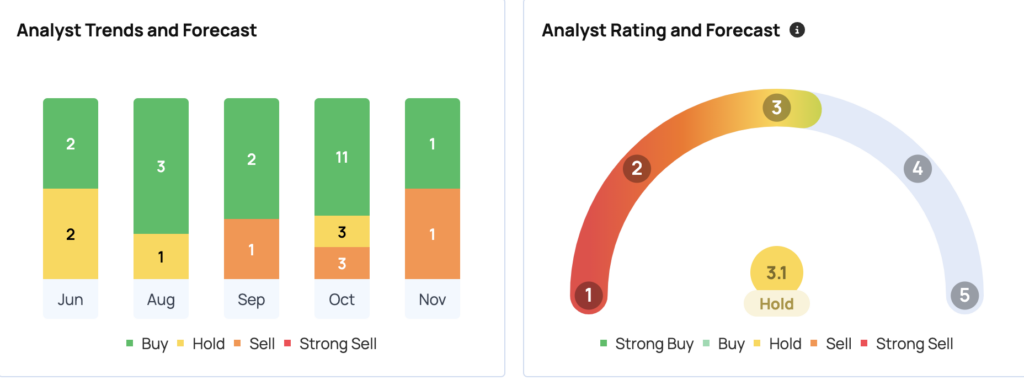

According to data from Benzinga Pro, Boeing’s consensus price target is $197.85 from 23 analysts, with a high of $260 and a low of $85. Recent ratings from JP Morgan, Wells Fargo, and RBC Capital average $158.33, implying a 1.11% upside.

Read Next:

Image via Flickr

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.