The Federal Reserve has been front and center for investors lately.

Specifically, that’s been the case this week amid Chairman Jerome Powell’s two-day testimony with Congress.

Broadly speaking, that’s been the case for about a year now. The Fed first raised interest rates a year ago in an effort to combat inflation.

Don't Miss: WeightWatchers Rallied 79% in One Day. Now What?

And since that first rate hike in the current cycle, we've seen a series of hawkish commentary, fiscal tightening and ever-increasing interest rates.

The Fed most recently raised interest rates in February, by 25 basis points (0.25 percentage point). At the time, the bulls were hopeful that the Fed would raise rates one more time in March, again by 25 basis points, and then pause.

The federal funds futures market was even pricing in a rate cut by the end of the year.

That's no longer the case, particularly after the jobs report, CPI, PPI and PCE reports for January all came in hotter-than-expected last month.

So where does all of this leave the stock market? Let’s look at it from a technical perspective.

Trading the S&P 500 Amid Rising Rates

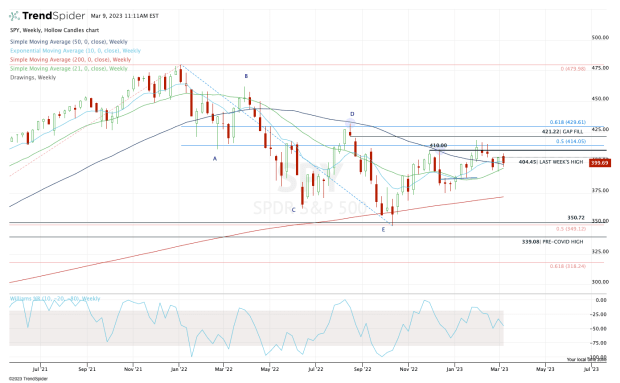

Chart courtesy of TrendSpider.com

Since bottoming near 3,500 in mid-October, the S&P 500 has actually done pretty well. Despite somewhat lackluster earnings and the reality of higher interest rates for a longer period, the index has held up.

If we zoom out and look at the weekly chart for the SPDR S&P 500 ETF (SPY), traders will notice a few positive developments. Mainly, that the SPY ETF has closed above all its major weekly moving averages.

Further, it also put in a higher high after taking out $410 and a lower low by finding support near $375 during its December pullback.

After a more recent three-week pullback, the SPY was consolidating nicely between $393 and $404.50. Early this week, it tried to clear the top of this range but was rejected.

From here, the bulls desperately want to see the low-$390 area hold as support and for the SPY to clear $404.50, then the 2023 high near $418 (and the 50% retracement).

If it can do that, it not only creates another higher high, it opens the door to the gap-fill near $421, then the 61.8% retracement near $430.

On the flip side, what happens if the SPY takes out support at the $393 level?

If that were to occur, the door could open back down to $375, putting a serious stress test on the market and threatening to break the lower-low development. The one bright side to all this is that the 200-week moving average also comes into play near this area and was support near the October lows.

Should both of these measures break, then the $350s are technically back in play.

Trading the Nasdaq

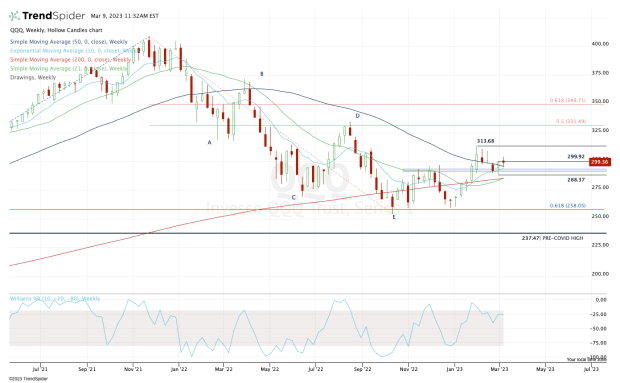

Chart courtesy of TrendSpider.com

Historically, tech stocks tend to struggle amid rising rates. That’s clear as the Invesco QQQ Trust Series (QQQ) has underperformed the S&P 500 in this bear market.

Keep in mind that Apple (AAPL) and Microsoft (MSFT) make up roughly 24% of the QQQ ETF. That figure swells to almost 35% when including Amazon (AMZN) and Nvidia (NVDA).

Don't Miss: Amazon Stock: Back Up to $100 or Down Toward New Lows?

Overall, the top 10 holdings of the ETF make up more than half the fund. So as goes its top holdings, so goes the QQQ ETF.

On the upside, the bulls want to see the QQQ clear and hold above $300. Not only does that clear two weeks worth of highs, but it also keeps it above all its major weekly moving averages.

That leaves $313.70 in play and if the QQQ can take out that level, we could see a move toward $330 develop. That level marks the 50% retracement and the third-quarter high — and perhaps more important, it would keep the bullish trend intact with another higher high.

On the downside, a break of $288 puts the 21-week and 200-week moving averages in play, along with the 50% retracement of the current rally from the October lows.

A break of these levels puts $280 in play and if it fails to hold, it’s possible we see a deeper correction back down into the upper-$250s, which was support in October and December.

The Bottom Line for the Stock Market

Stocks have traded pretty well despite the rising-rate rhetoric from the Fed and the somewhat uninspiring earnings reports. That said, a lot of positivity is likely being driven by the fact that the economy hasn’t fallen apart.

If inflation can cool and the economy remains resilient, then higher stock prices are on the horizon. But if we get higher rates, worse-than-expected earnings and a breakdown in the economy, then stocks are likely heading lower again.

Keep in mind this could be a volatile range-bound year, to frustrate both bulls and bears alike.