The Federal Reserve, wrapping up its two-day meeting in Washington on Wednesday, is likely to maintain its view that interest rates need to remain elevated, possibly until the start of next year, to tame stubborn inflation pressures tied to an outperforming domestic economy.

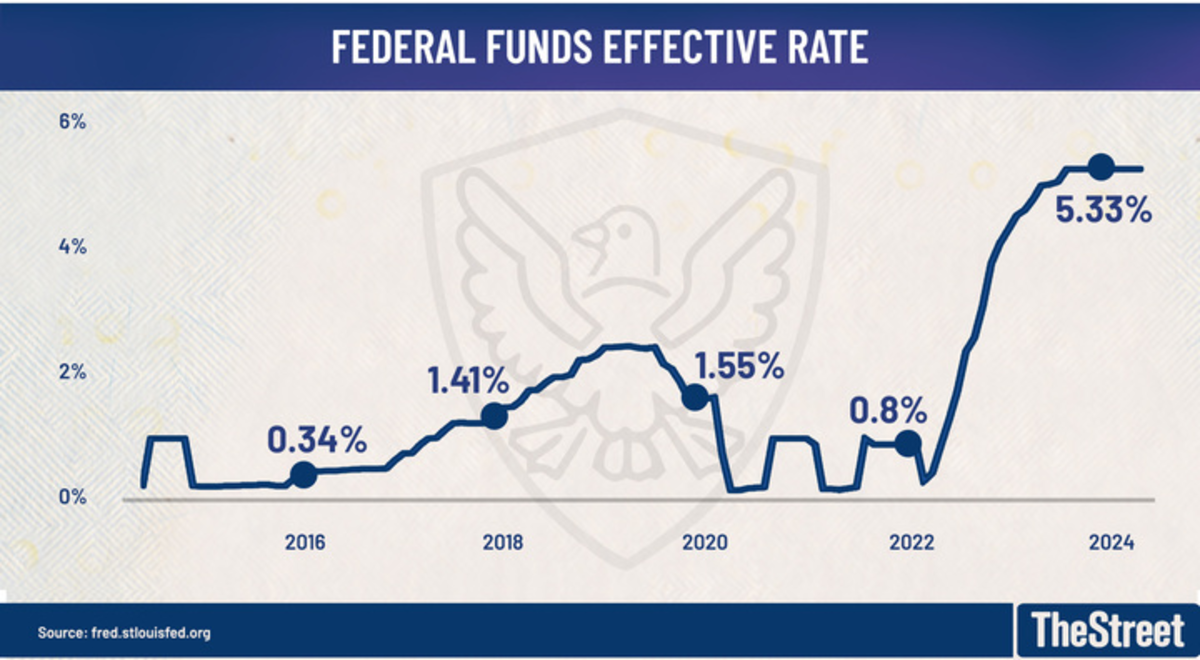

The central bank is not expected to change its benchmark lending rate, which sits at a two-decade high of between 5.25% and 5.5%. And it's expected to reiterate its view that inflation remains too high for, and presents too much of a growth risk to, the world's biggest economy.

That position, expected to be sketched out in detail through fresh growth and inflation projections from Fed officials on Wednesday, is likely to find further support from inflation data and market expectations even before Chairman Jerome Powell speaks to the media at 2:30 pm Eastern Time.

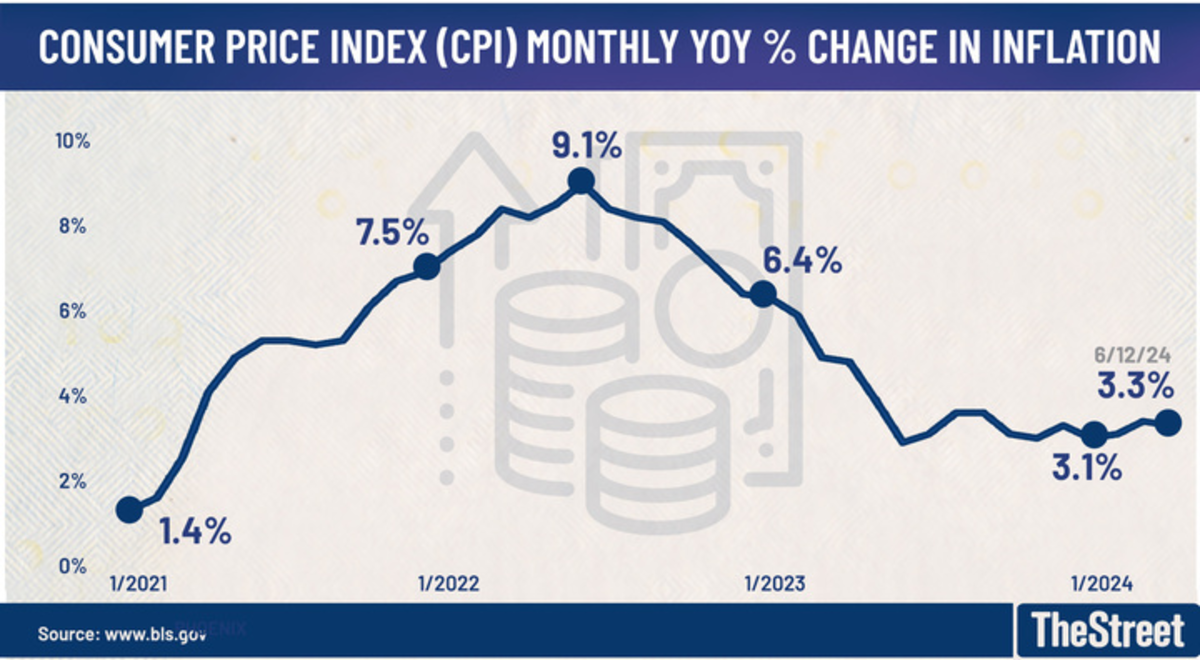

Bureau of Labor Statistics/TheStreet

The Commerce Department will publish its first estimate of May consumer price inflation prior to the market open on Wednesday, and some economists suggest it could indicate moderating core and headline pressures that are likely to extend into the summer months.

"We look for a relatively firm increase in core CPI inflation that keeps year-ago inflation unchanged," JP Morgan analysts led by Michael Feroli wrote earlier this week.

"While we continue to expect further cooling in inflation this year—and notably the Fed is focused on PCE inflation, which is running below CPI — the current pace may leave various participants still concerned about lack of further progress."

Easing headline figure; sticky core

Wall Street expects to see the headline reading hold at an annual rate of 3.4%, but ease notably to 0.1% when compared with April levels.

So-called core inflation, which strips out volatile food and energy prices, is likely to ease to 3.5% on the year and hold at 0.3% on the month.

Those levels are still a long way from the Fed's 2% target, and although Powell and his colleagues have said they could start cutting rates prior to reaching that threshold, they would still prefer to see "several months" of data that confirm a slowing inflation trend.

Related: Surprise jobs report pummels Fed rate-cut bets

That could be difficult in an economy that added 272,000 new jobs last month, a bigger-than-expected tally that included robust wage gains of 0.4%, and a current-quarter estimate from the Atlanta Fed's GDPNow tool that suggests growth rate of 3.1%.

Small-business hiring plans, meanwhile, jumped to the highest level of the year last month, according to the National Federation of Independent Business's benchmark survey. Its broader optimism index recorded its second-consecutive monthly gain.

Strong services sector

The Institute for Supply Management's benchmark index for activity in the services sector, the biggest component of U.S. growth, also impressed in May, rising to a nine-month high of 53.8 points as inflation pressure eased.

That could give the Fed deeper confidence that its long run of rate hikes, is having the desired, if prolonged, impact on inflation while allowing the economy to continue to grow.

"Last Friday’s jobs report showed a domestic labor market that continues to follow the soft-landing blueprint by the book so far," said Jason Pride, chief of investment strategy and research at Glenmede.

"Once investors gain firmer confidence in a return to price stability, markets may begin to adjust interest rates lower to account for an incrementally less restrictive Fed," he added.

Related: The Fed doesn't want to talk about stagflation. It might not have a choice.

Powell would, of course, welcome such a soft-landing scenario into the second half, particularly if it means the Fed can avoid the political maelstrom of the autumn presidential race and pass on any rate decision during their September and November meetings.

"The Fed views monetary policy as restrictive and will keep rates higher for longer at these levels until they have confidence that inflation can sustainably get back to their target," said John Madziyire, head of U.S. Treasurys and TIPS and senior portfolio manager at Vanguard.

"The market is currently pricing in the first cut in December, but we are not forecasting any in 2024," he added.

CME Group's FedWatch pegs the odds of a September cut at just 48%, with the chance of a follow-on move in December trading at similar levels.

Central bank wiggle room

That said, recent rate cuts from both the Bank of Canada and the European Central Bank, as well as likely easing this week from the Bank of England, could provide cover for the Fed to deliver one rate reduction.

That would be an effort to ensure that consumers don't bear the brunt of its inflation-fighting policies while Wall Street celebrates record-high stock prices.

St. Louis Federal Reserve/TheStreet

"We might need to wait until Fed governors get an earful over Thanksgiving dinner before we see rates cut," said Bryce Doty, senior portfolio manager at Sit Investment Associates. "People will be pretty sick of 22% credit card rates and 7.5% mortgage rates by then, given the loss of any kind of savings safety net."

"The Fed has a dentist’s mentality, believing that pain now will save you suffering down the road," he added. "They are oblivious to how high interest rates are driving up costs for businesses that are being passed onto the consumer."

Related: Goldman Sachs forecasts what’s next for the Fed’s rate outlook

Consumers are indeed pushing back on relentless price hikes from major brands such as McDonald's (MCD) , Starbucks (SBUX) and Kraft Heinz (KHC) , with some evidence that they're also running-down their pandemic-era savings.

"The top 20% are in great shape with their high incomes meaning inflation is more of an irritation rather than a severe constraint," said ING's chief international economist, James Knightley.

"It is a very different situation for those lower-income households where high inflation has been a much greater burden and financial strains are emerging with credit-card and auto-loan delinquencies rising sharply."

That said, they're also expecting softer inflation pressures over the coming year.

The New York Fed's monthly survey of year-ahead inflation expectations eased to 3.2% last month, while the three-year projection held at 2.8%, a rate similar to that seen prior to the 2020 pandemic.

More Economic Analysis:

- Surprise jobs report pummels Fed rate-cut bets

- Jobs report to highlight shift from hot inflation to cooling labor market

- Fed doesn't want to talk about stagflation. It might not have a choice.

"The economic tug-of-war is between a relatively strong consumer and higher than comfortable inflation," said Jeff Klingelhofer, co-head of investments at Thornburg Investment Management in Santa Fe, N.M.

"While indicators show signs the battle is coming to a conclusion, it’s not clear which side will be victorious," he noted. "I would like to hear Chair Powell reiterate that rates are in restrictive territory and emphasize patience."

Related: Veteran fund manager picks favorite stocks for 2024