The Federal Reserve held its benchmark lending rate unchanged Wednesday, noting a "lack of further progress" in its inflation fight, and suggested that it would hold off on rate cuts until at least later in the year.

The policy-making Federal Open Market Committee held its key rate at between 5.25% and 5.5%, the highest in 22 years, a unanimous move that Wall Street widely expected following the central bank's two-day policy meeting in Washington.

The Fed's last rate move, a quarter-point increase, came in July 2023 when headline inflation was pegged at an annual rate of 3.2% and the economy was growing at a 3.4% clip.

Since then, the economy has remained strong, running firmly ahead of forecasts on the back of resilient consumer spending powered in part by a robust labor market. The Atlanta Fed's GDPNow forecasting tool, meanwhile, pegs current-quarter growth at around 3.9%.

That, however, has kept inflation rate elevated, with the Fed's preferred gauge, the core PCE price index, holding at around 2.8% over March and April, as employment and energy costs jumped and consumers continued to run down their pandemic-era savings.

It's also hammered market bets that the Fed, which as recently as March was forecasting three interest-rate cuts for this year, will start lowering borrowing costs anytime before the late autumn.

"The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2%," the Fed said in the statement that followed its rate decision.

"The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals," the statement added.

"The Committee's assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments."

U.S. stocks pared earlier declines immediately following the Fed decision, with the S&P 500 marked 4 points, or 0.07%, lower on the session and the Nasdaq marked 10 points, or 0.05%, in the red.

The Fed also said it would slow the pace of bond sales from its $7.4 trillion balance sheet from $60 billion per month to $25 billion per month, starting in June.

Related: Fed faces fine-line walk between inflation hawk and slow-growth realist

"The Committee will maintain the monthly redemption cap on agency debt and agency mortgage‑backed securities at $35 billion and will reinvest any principal payments in excess of this cap into Treasury securities," the Fed said. "The Committee is strongly committed to returning inflation to its 2% objective."

Benchmark 10-year Treasury-note yields slipped 2 basis points to 4.632% following the interest rate decision while 2-year notes fell 2 basis points to 4.985%.

“The fact that inflation remains elevated means we’re not going to see rate cuts very soon," said Sonu Varghese, global macro strategist at Carson Group in Omaha. "At the same time, they are going to slow the pace at which they shrink their balance sheet, which will likely put less upward pressure on bond yields”

More Economic Analysis:

- Watch out for 8% mortgage rates

- Hot inflation report batters stocks; here's what happens next

- Inflation report will disappoint markets (and the Fed)

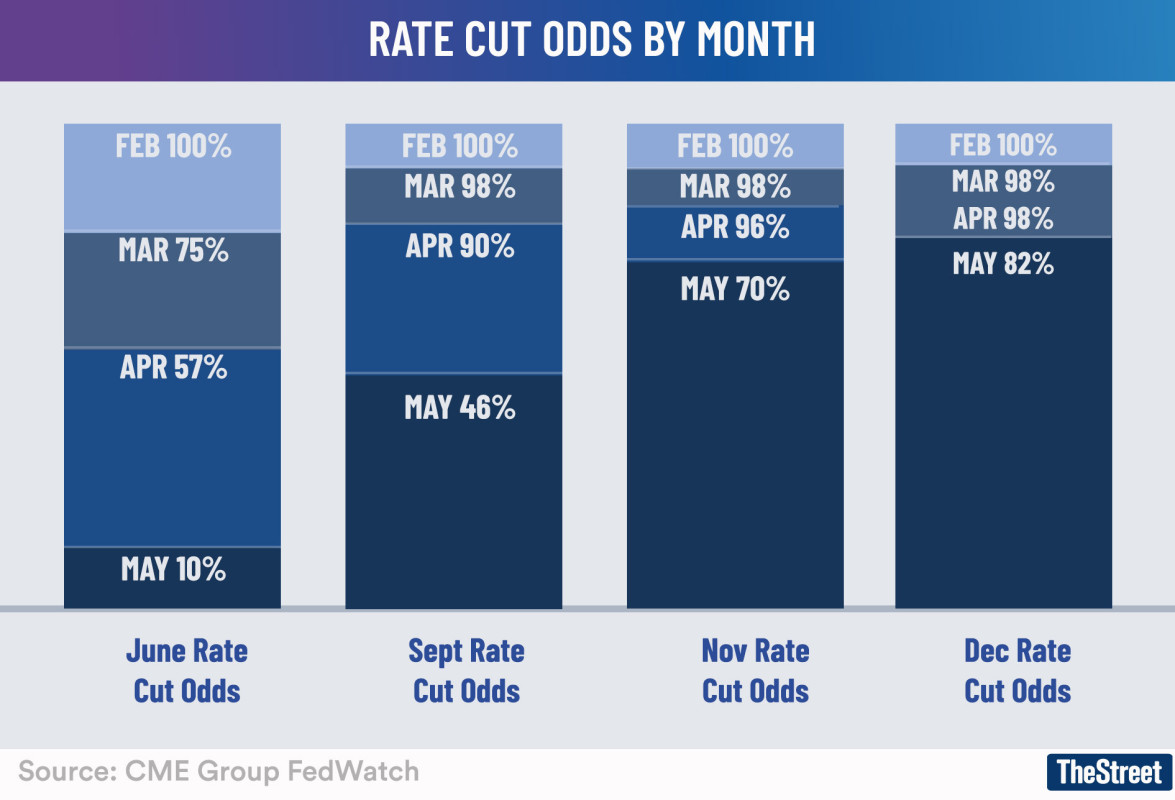

The CME Group's FedWatch now puts the odds of a June rate cut at just 6.3% with the chances of a July reduction pegged at 20.7%.

The most optimistic reading for 2024 rate cuts puts the year-end federal funds rate at between 4.5% and 4.75%, but the main odds suggest only one rate cut this year, which would leave it at between 5% and 5.25%.

Related: Veteran fund manager picks favorite stocks for 2024

.jpg?w=600)