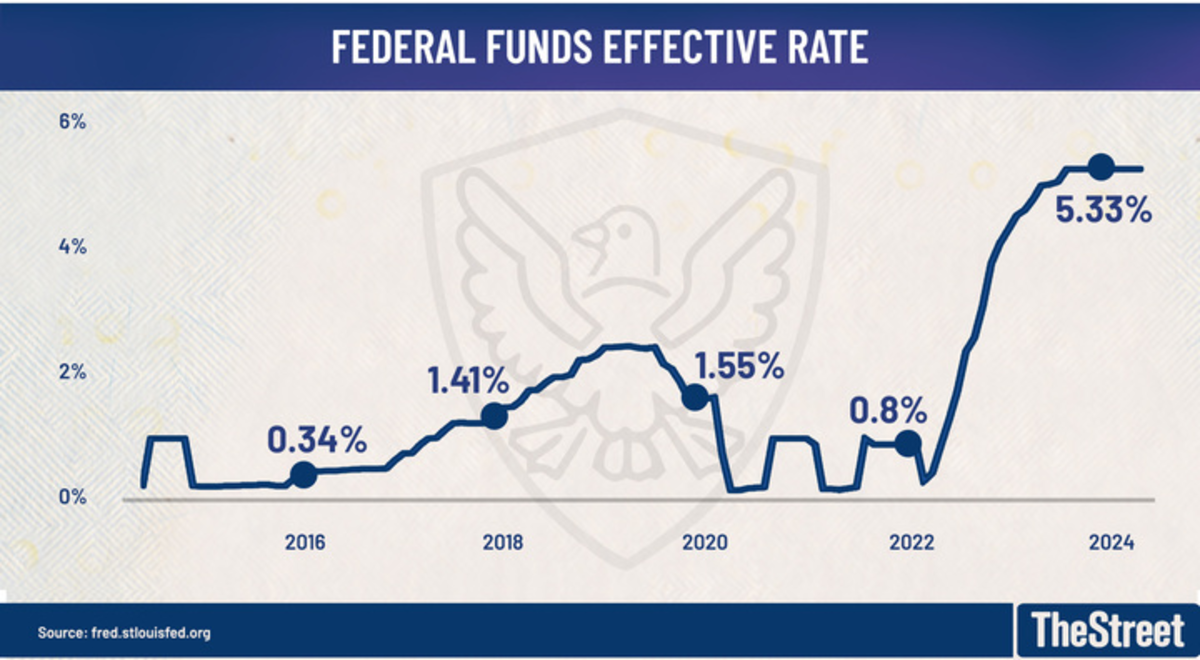

The Federal Reserve held its benchmark lending rate unchanged Wednesday, repeating its view that further confidence is needed to confirm that inflation is returning to its preferred 2% target, but disappointing the markets, which were looking for signals of an autumn interest-rate cut.

The policy-making Federal Open Market Committee held its key rate at between 5.25% and 5.5%, the highest in 22 years. The unanimous and widely expected move followed the central bank's two-day policy meeting in Washington.

The Fed also issued fresh growth and inflation projections alongside its rate decision. It lifted its end-of year forecast for core PCE inflation, the central bank's preferred gauge, to 2.8% from the 2.6% estimate in March.

The Summary of Economic Projections, also known as the dot plots, now suggests just one 0.25-percentage-point rate cut can be expected this year, down from a March forecast of as many as three.

Related: CPI inflation report resets timing of Fed interest rate cuts

"The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2%," the Fed said in a prepared statement.

"In addition, the [policy-making Federal Open Market Committee] will continue reducing its holdings of Treasury securities and agency debt and agency mortgage‑backed securities," the statement added. "The committee is strongly committed to returning inflation" to its 2% target.

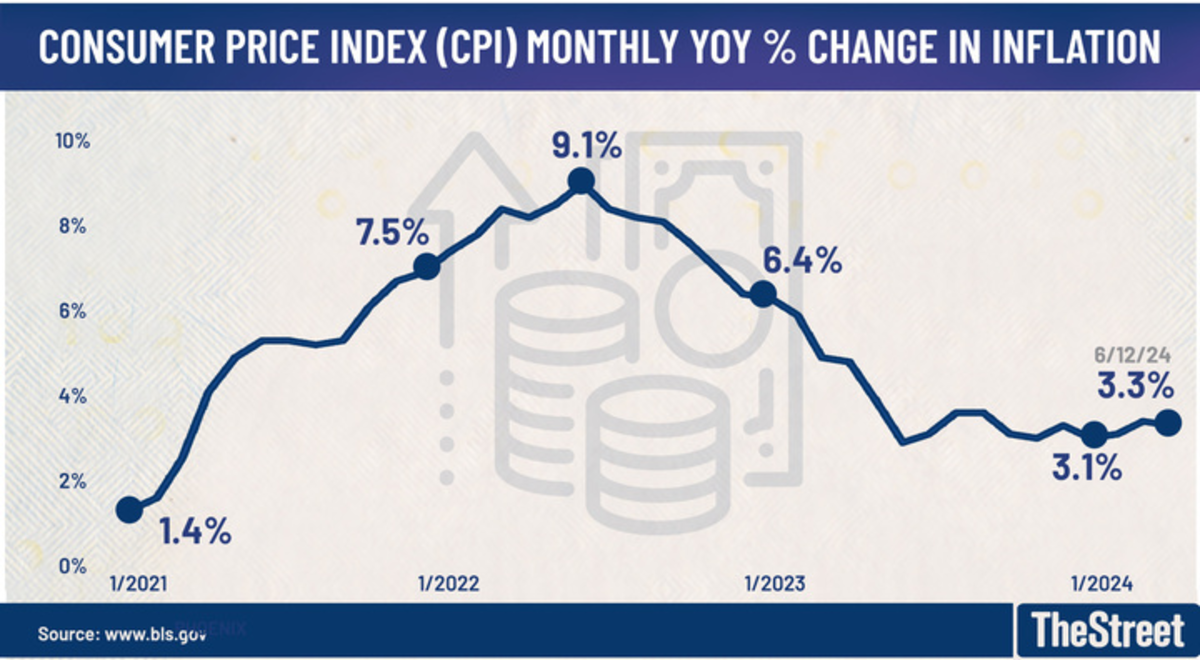

Bureau of Labor Statistics/TheStreet

The Fed's last rate move, a quarter-point increase, came in July 2023 when headline inflation was pegged at an annual rate of 3.2% and the economy was growing at a 3.4% clip.

Data published by the Commerce Department Wednesday showed headline inflation eased to 3.3% last month, the lowest in more than three years, while the Atlanta Fed's GDPNow forecasting tool indicates a current-quarter growth rate of 3.1%.

Fed Chairman Jerome Powell confirmed that he and his colleagues were aware of today's May inflation reading, which showed the slowest levels of monthly price gains in four years, but added that "most" officials chose not to update their rate forecasts with the new data.

U.S. stocks pared gains immediately following the Fed decision, with the S&P 500 marked 50 points, or 10.95%, higher on the session and the Nasdaq marked 308 points, or 1.78%, in the green. The Dow slipped 30 points.

Related: Fed rate cut bets face another CPI test as Powell seeks patience

Benchmark 10-year Treasury-note yields rose 1 basis point to 4.277% following the interest rate decision while 2-year notes fell 2 basis points to 4.712%.

The U.S. dollar index, which tracks the greenback against a basket of six global currency peers, was marked 0.7% lower at 104.467, close to the levels it traded prior to the Fed rate decision.

St. Louis Federal Reserve/TheStreet

"The first and second paragraphs of the Fed statement tell a clear story: inflation is stable, but the economy is strong," said Giuseppe Sette, president of AI market research firm Toggle AI.

"We're on the fence but in no way committed to cutting rates too soon," he added. "The 2024 cut priced in the market remains a coin flip, which will be likely decided by inflation in Q3."

More Economic Analysis:

- Surprise jobs report pummels Fed rate-cut bets

- Jobs report to highlight shift from hot inflation to cooling labor market

- Fed doesn't want to talk about stagflation. It might not have a choice.

The CME Group's FedWatch now puts the odds of a July rate cut at just 11% but pegs the odds of a September reduction at around 63%, down from around 72% prior to the Fed decision.

Related: Veteran fund manager picks favorite stocks for 2024

.jpg?w=600)