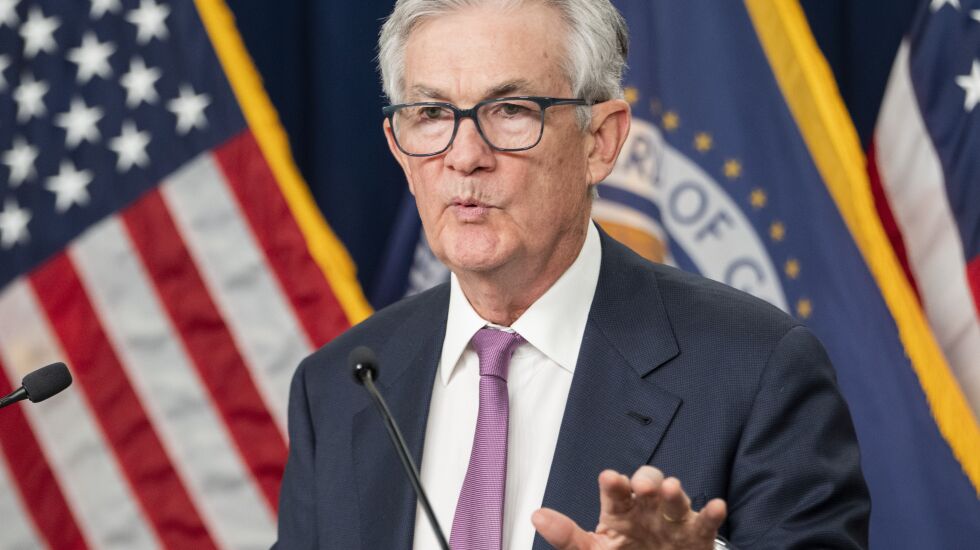

WASHINGTON — Federal Reserve Chair Jerome Powell said Tuesday that last week’s blockbuster U.S. jobs report showed it would likely take time to curb high inflation but that he expects a “significant decline” in inflation this year.

At the same time, Powell said the job market’s strength and the persistence of inflation pressures mean that the Fed will need to keep raising its benchmark interest rate this year. He did not specify how many additional rate hikes he envisioned. But at a news conference last week, Powell had suggested that he envisioned “a couple” more hikes in 2023.

While inflation pressures are easing, the Fed chair cautioned that “these are the very early stages of disinflation. It has a long way to go.”

Powell’s remarks Tuesday followed the moderately optimistic note he struck at a news conference last week. Speaking to reporters then, Powell noted that high inflation had begun to ease and said he believed the Fed could tame spiking prices without causing a deep recession involving waves of layoffs.

But the Fed chair warned that the job market was still out of balance, with robust demand for labor and too-few workers in many industries leading employers to sharply raise wages, a trend that could help keep inflation high.

On Friday, the government issued a surprising blowout jobs report that suggested that the economy and hiring were even healthier than Fed officials thought. Employers added 517,000 jobs in January, the report said, nearly double December’s gain, and the unemployment rate reached 3.4%, the lowest level in 53 years.