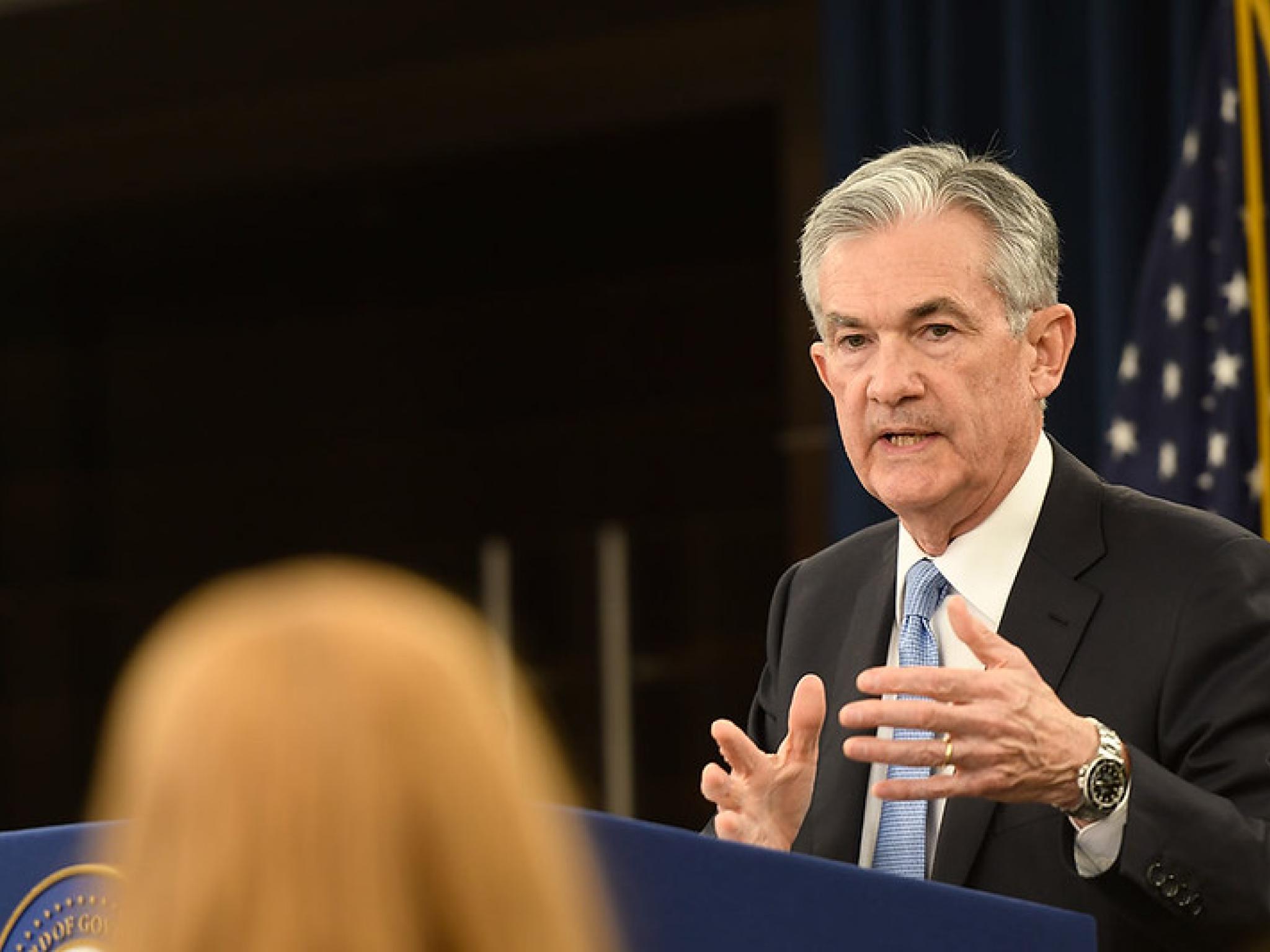

- Federal Reserve Chair Jay Powell has emphasized on tighter and more aggressive monetary policy to tackle excessive inflation, the Financial Times reports.

- Powell expressed confidence in the Fed's ability to tighten policy via a series of interest rate hikes to shrink the central bank's $9 trillion balance sheet amid the challenging labor market and inflation without sparking a recession.

- Powell looks to return the monetary policy stance to a neutral level followed by more restrictive levels to restore price stability. The "neutral" rate neither aids nor hampers growth, and most policymakers believe that figure to be around 2.4%.

- After Powell affirmed the Fed's commitment to suppress inflation, the U.S. stocks sold off, including possibly raising rates by half a percentage point rather than the standard quarter-point increase.

- The Fed chair's challenge will be to forge consensus among committee members about how swiftly monetary policy needs to tighten inflation according to the Fed's 2% target.

- The S&P 500 dived 0.8% before recouping some losses. The benchmark 10-year yield was up 0.15 percentage points on the day at 2.3%.