YouTube TV, the fast-growing virtual multichannel video programming distributor, is expected to post a profit for the first time in 2024, according to analyst Michael Nathanson of MoffettNathanson.

Nathanson sees YouTube TV having operating income of $200 million in 2024, following a loss of $300 million in 2023. He sees net income continuing to rise, hitting $600 million in 2026.

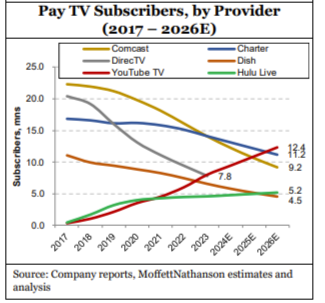

In February, parent company Alphabet reported that YouTube TV grew to 8 million subscribers, making it the third-biggest pay-TV distributor, following cable giants Charter Communications and Comcast.

“Going forward, we expect YouTube TV to grow subscribers at a similar pace of roughly 1.5 million per year, reaching 12 million subscribers in 2026 and generating nearly $11 billion in revenues,” Nathanson said Thursday in a research report.

“Given the rapid growth of YouTube TV – especially in the context of the accelerating decline of traditional Pay TV providers – it is quickly becoming a crucial player in the linear TV ecosystem,” Nathanson said. "At the current levels of decline [of cable and satellite subs], YouTube TV is on a clear path to becoming the largest pay-TV provider in the United States. “

Nathanson expects YouTube TV core revenues to increase to $7.5 billion in 2024 from $5.8 billion in 2023. Core revenue are forecast to hit $10.1 billion in 2026.

Virtual MVPDs have faced a profit squeeze as they try to price their services lower than cable, but still have pay carriage feels at least as high as cable’s.

Nathanson estimates YouTube TV’s costs for its vMVPD iat $6.3 billion in 2024 and increasing to $8.6 billion by 2026.

YouTube also has revenue from the NFL’s Sunday Ticket package. Nathanson estimates Sunday Ticket revenues doubling to $400 million in 2024, rising to $700 million by 2026. Sunday Ticket costs YouTube a pricey $1 billion annually.

Nathanson notes that while YouTube TV was originally offered at a bargain price, subscribing to YouTube TV has become more costly over time.

“With traditional MVPD packages now fetching prices in excess of $100, we would argue the ease of YouTube TV (mobile viewing, no cable boxes or satellites, etc.) still presents a great value to those still watching linear television and a great entry point for younger consumers not conditioned for the traditional distribution models,” Nathanson said.