Exxon Mobil (XOM) has helped lead the charge higher, as energy has been the best-performing sector so far this year.

In fact, it’s been the best-performing sector over the last three, six and 12 months.

Given how oil prices have continued to march higher, it’s no surprise that energy stocks have continued to as well.

In that light, it’s not surprising that Exxon stock has too, given that it’s the largest company by market cap in the U.S. energy space. That’s also reflected in the Energy Select Sector SPDR ETF (XLE), as the stock has a weighing of more than 22%.

On Tuesday morning, the company delivered a bottom-line earnings beat, fueling the day's gains. It was more than that, though.

Exxon also announced a $10 billion share buyback, which is perhaps investors’ interpretation of the “all clear” sign from management.

Now Exxon Mobil stock is hitting its highest price since April 2019. I wonder though, could significantly more upside be in store?

Trading Exxon Mobil

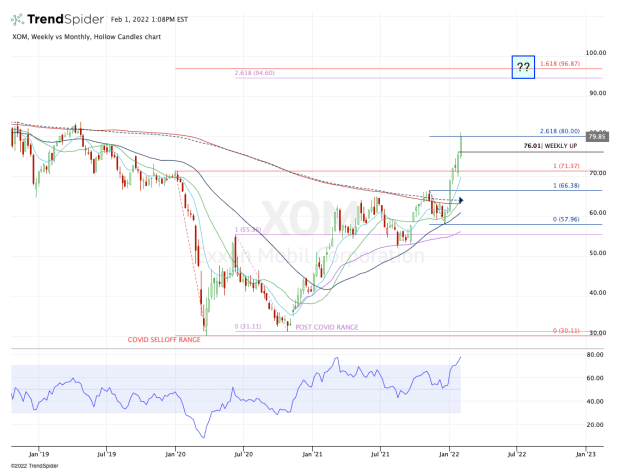

Chart courtesy of TrendSpider.com

Wondering how far Exxon Mobil stock can rally depends on your timeframe. In the short term, I’m not surprised to see the stock running into some resistance here at the 261.8% extension of the current range.

The stock has been an incredible performer, as it works on its seventh straight weekly gain.

It continues to gain momentum and churn higher, but if it rests here, investors can look to buy the dips to the short-term moving averages on the daily chart.

I don’t know if we’ll see it, but a dip down to the $71.50 area would be quite attractive in the short term, where Exxon has the pre-Covid 2020 high and the rising 10-week moving average.

Longer term though, what does it look like if the trend remains the friend of oil prices, the energy sector and Exxon Mobil stock?

I could see a scenario unfold where the stock continues to get bought on the dips and ride the larger trend higher — particularly if energy prices continue to rise.

On multiple ranges, we have key extensions that reach up to the $94.60 to $96.90 range. Let’s split the hairs and call it $95.

If that zone does come into play, $100 will certainly be in the cards.

Is it a guarantee we get there? Of course not! But the way energy stocks have been trading and given their solid growth and generally low valuations, I wouldn’t put it out of the realm of possibility should the trend remain strong.