Driven by overwhelming demand for AI servers, high bandwidth memory (HBM) is experiencing rapid growth. Micron and SK Hynix officially said that their HBM supply is sold out for 2024 and most of 2025. As a result, prices of HBM memory are expected to increase by 5% to 10% next year, according to analysts from TrendForce. Furthermore, prices of other types of DRAM will likely increase as well, with DDR5 predicted to increase by 15% to 20% due to memory manufacturers shifting priorities to HBM production.

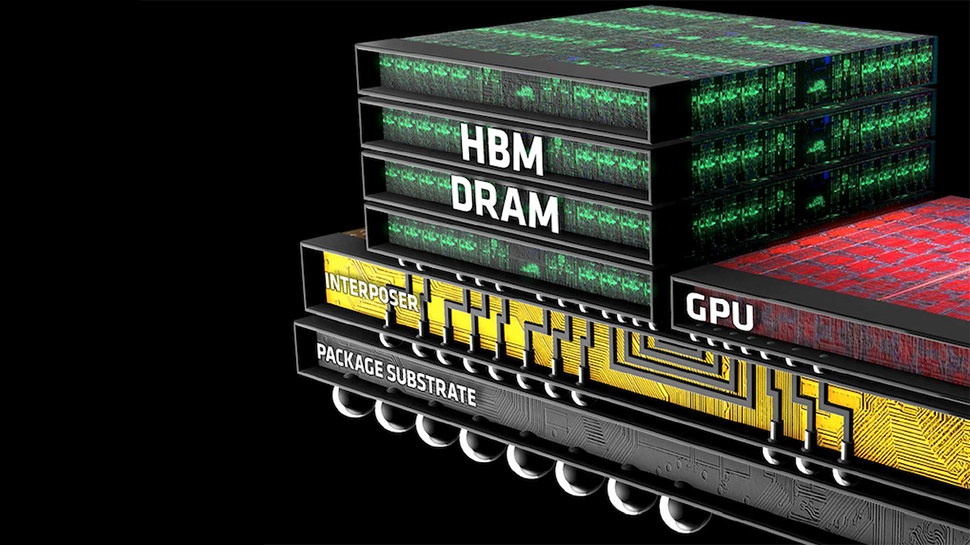

HBM is much more expensive than standard DRAM types, costing about five times more than DDR5. This higher cost is justified by the substantial performance and capacity advantages that HBM has compared to commodity DRAMs. It's also considerably harder to build HBM memory devices and stacks than traditional DDR ICs and modules. Memory makers have to devote more production capacity to HBM, reducing the capacity available for other types of memory, which naturally drives DRAM prices up.

TrendForce recently adjusted its forecast for the second-quarter server DRAM contract prices. The market research firm initially expected DRAM prices to increase by 3% to 8%, but it now projects a rise of 15% to 20%. This update represents the third successive quarter of double-digit percentage growth of DRAM prices, starting from Q4 2023. In April alone, the prices of server DRAM in all categories rose by 9% to 19%.

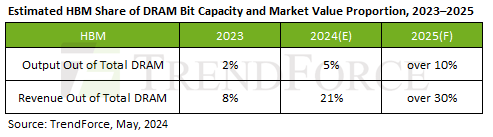

From a market share perspective, HBM's portion of total DRAM bit capacity is set for a rapid increase. It's anticipated to grow from a mere 2% in 2023 to 5% in 2024, eventually exceeding 10% by the end of 2025. This expansion reflects escalating demands placed on memory subsystems by cutting-edge AI applications. As a result, HBM’s contribution to the total DRAM market is predicted to grow considerably, potentially dominating more than 30% of the market's value by 2025.

Discussions about HBM pricing for 2025 started in the second quarter of 2024, prompted by limited overall DRAM capacity. This limitation has led to an initial price hike of between 5% and 10%. These adjustments reflect the market's expectation of continued robust demand for AI despite the current production yields for HBM3e's TSVs, which only range between 40% and 60%.

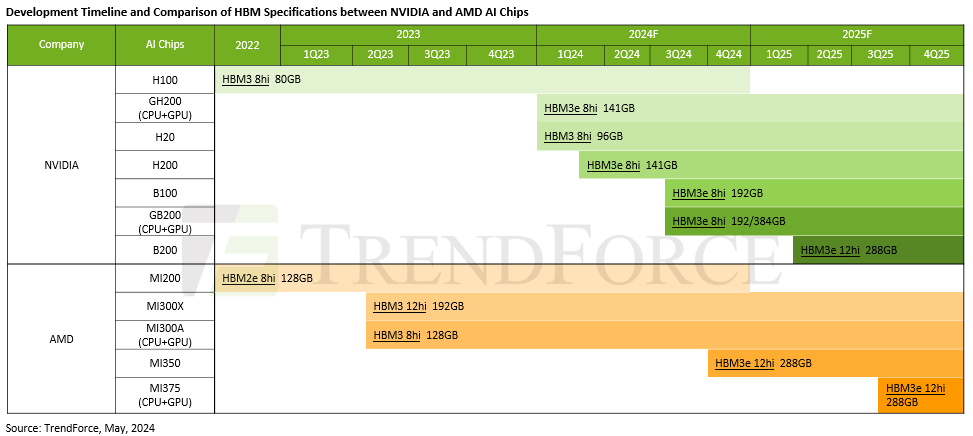

Looking ahead, major AI solution providers will focus on enhancing HBM performance and capacity, particularly the adoption of HBM3E and increased use of 12-Hi stack products. TrendForce forecasts suggest that demand for HBM will nearly reach a 200% growth rate in 2024 and is anticipated to double by 2025.