Across the recent three months, 10 analysts have shared their insights on CNX Resources (NYSE:CNX), expressing a variety of opinions spanning from bullish to bearish.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 0 | 8 | 1 | 0 |

| Last 30D | 0 | 0 | 0 | 1 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 5 | 0 | 0 |

| 3M Ago | 1 | 0 | 3 | 0 | 0 |

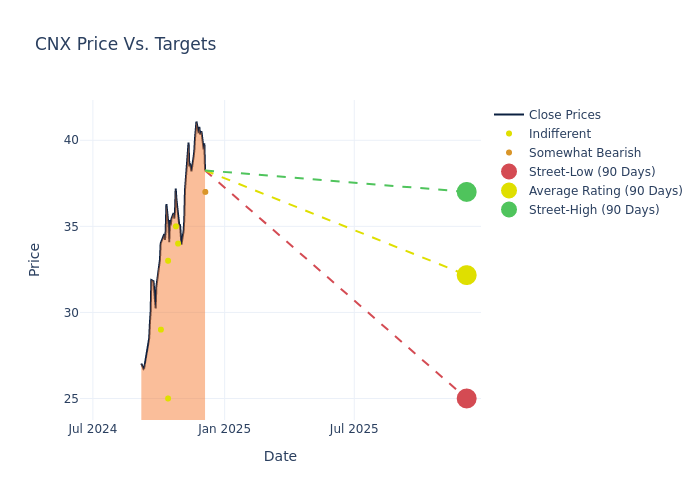

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $32.1, a high estimate of $38.00, and a low estimate of $25.00. This current average reflects an increase of 6.22% from the previous average price target of $30.22.

Breaking Down Analyst Ratings: A Detailed Examination

An in-depth analysis of recent analyst actions unveils how financial experts perceive CNX Resources. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Zach Parham | JP Morgan | Raises | Underweight | $37.00 | $31.00 |

| Zach Parham | JP Morgan | Lowers | Neutral | $31.00 | $32.00 |

| Neal Dingmann | Truist Securities | Lowers | Hold | $34.00 | $38.00 |

| Mike Scialla | Stephens & Co. | Raises | Equal-Weight | $35.00 | $26.00 |

| Brian Velie | Capital One | Announces | Equal-Weight | $25.00 | - |

| Nitin Kumar | Mizuho | Raises | Neutral | $33.00 | $32.00 |

| Phillip Jungwirth | BMO Capital | Raises | Market Perform | $29.00 | $26.00 |

| Neal Dingmann | Truist Securities | Raises | Buy | $38.00 | $31.00 |

| Nitin Kumar | Mizuho | Raises | Neutral | $32.00 | $30.00 |

| Zach Parham | JP Morgan | Raises | Neutral | $27.00 | $26.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to CNX Resources. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of CNX Resources compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for CNX Resources's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

Capture valuable insights into CNX Resources's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on CNX Resources analyst ratings.

Get to Know CNX Resources Better

CNX Resources Corp is an independent low carbon intensity natural gas and midstream company engaged in the exploration, development, production and acquisition of natural gas properties in the Appalachian Basin. The company's operating segment include Shale and Coalbed Methane. It generates maximum revenue from the Shale segment. It also has other segment that includes nominal shallow oil and gas production.

CNX Resources: A Financial Overview

Market Capitalization Perspectives: The company's market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Revenue Growth: CNX Resources's remarkable performance in 3 months is evident. As of 30 September, 2024, the company achieved an impressive revenue growth rate of 10.75%. This signifies a substantial increase in the company's top-line earnings. When compared to others in the Energy sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: CNX Resources's net margin is impressive, surpassing industry averages. With a net margin of 19.55%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): CNX Resources's ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of 1.54%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): The company's ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of 0.76%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 0.56, caution is advised due to increased financial risk.

Analyst Ratings: Simplified

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.