In the preceding three months, 8 analysts have released ratings for BILL Holdings (NYSE:BILL), presenting a wide array of perspectives from bullish to bearish.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 3 | 5 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 2 | 2 | 0 | 0 |

| 2M Ago | 0 | 0 | 2 | 0 | 0 |

| 3M Ago | 0 | 1 | 0 | 0 | 0 |

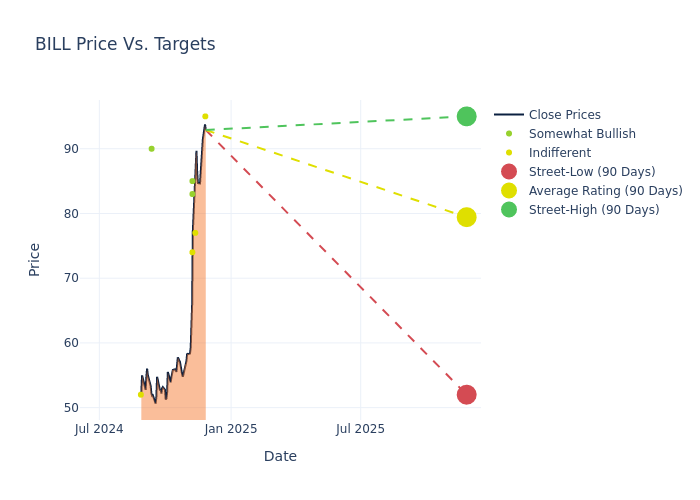

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $78.25, along with a high estimate of $95.00 and a low estimate of $60.00. This upward trend is evident, with the current average reflecting a 29.19% increase from the previous average price target of $60.57.

Analyzing Analyst Ratings: A Detailed Breakdown

The analysis of recent analyst actions sheds light on the perception of BILL Holdings by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Keith Weiss | Morgan Stanley | Raises | Equal-Weight | $95.00 | $58.00 |

| Will Nance | Goldman Sachs | Raises | Neutral | $77.00 | $60.00 |

| Ken Wong | Oppenheimer | Raises | Outperform | $83.00 | $70.00 |

| Clarke Jeffries | Piper Sandler | Raises | Overweight | $85.00 | $60.00 |

| David Koning | Baird | Raises | Neutral | $74.00 | $62.00 |

| David Koning | Baird | Raises | Neutral | $62.00 | $60.00 |

| Will Nance | Goldman Sachs | Raises | Neutral | $60.00 | $54.00 |

| Thomas Poutrieux | Exane BNP Paribas | Announces | Outperform | $90.00 | - |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to BILL Holdings. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of BILL Holdings compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of BILL Holdings's stock. This comparison reveals trends in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of BILL Holdings's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on BILL Holdings analyst ratings.

Get to Know BILL Holdings Better

BILL Holdings Inc is a provider of software-as-a-service, cloud-based payments and spend and expense management products, which allow users to automate accounts payable and accounts receivable transactions, enable businesses to easily connect with their suppliers or customers to do business, eliminate expense reports, manage cash flows and improve back office efficiency. Initial Public Offering and Follow-on Offering.

A Deep Dive into BILL Holdings's Financials

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Revenue Growth: BILL Holdings's remarkable performance in 3 months is evident. As of 30 September, 2024, the company achieved an impressive revenue growth rate of 17.53%. This signifies a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Information Technology sector.

Net Margin: BILL Holdings's net margin excels beyond industry benchmarks, reaching 2.49%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): BILL Holdings's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of 0.22%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): BILL Holdings's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of 0.1%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: BILL Holdings's debt-to-equity ratio is below the industry average at 0.24, reflecting a lower dependency on debt financing and a more conservative financial approach.

Analyst Ratings: What Are They?

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.