Providing a diverse range of perspectives from bullish to bearish, 4 analysts have published ratings on Boston Beer Co (NYSE:SAM) in the last three months.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 1 | 2 | 0 | 0 |

| Last 30D | 0 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 1 | 1 | 2 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

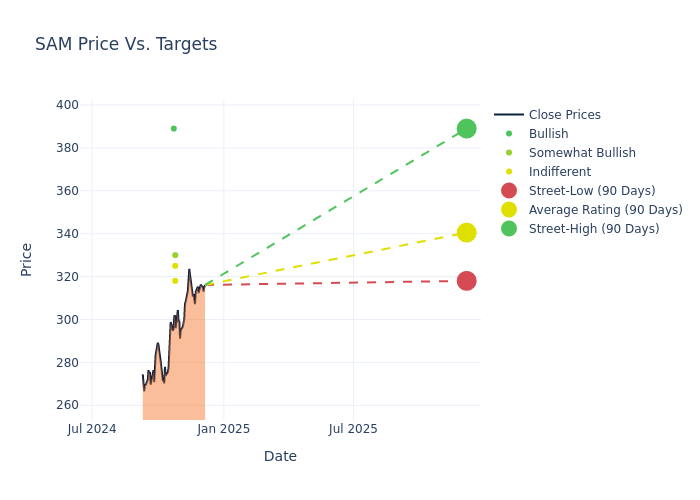

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $340.5, a high estimate of $389.00, and a low estimate of $318.00. Experiencing a 1.8% decline, the current average is now lower than the previous average price target of $346.75.

Deciphering Analyst Ratings: An In-Depth Analysis

The analysis of recent analyst actions sheds light on the perception of Boston Beer Co by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Nik Modi | RBC Capital | Maintains | Sector Perform | $318.00 | $318.00 |

| Michael Lavery | Piper Sandler | Raises | Overweight | $330.00 | $325.00 |

| Kaumil Gajrawala | Jefferies | Lowers | Hold | $325.00 | $355.00 |

| Bill Kirk | Roth MKM | Maintains | Buy | $389.00 | $389.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Boston Beer Co. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Boston Beer Co compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Boston Beer Co's stock. This examination reveals shifts in analysts' expectations over time.

For valuable insights into Boston Beer Co's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Boston Beer Co analyst ratings.

Discovering Boston Beer Co: A Closer Look

Boston Beer is a top player in high-end malt beverages and adjacent categories in the us, with strong positions in craft beer, flavored malt beverages, hard cider, and hard seltzer. The bulk of volume and revenue is concentrated in four brands: Samuel Adams, Angry Orchard, Twisted Tea, and Truly. Beverages are produced using a hybrid model leveraging both in-house capacities and third-party breweries through contract arrangements. While the firm is required to use distributors to reach end markets, including retailers and on-premises operators, it also employs 500 internal sales representatives to educate the market about its products. The firm generates over 95% of sales in the us.

Boston Beer Co: Delving into Financials

Market Capitalization Analysis: Positioned below industry benchmarks, the company's market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: Boston Beer Co's revenue growth over a period of 3 months has been noteworthy. As of 30 September, 2024, the company achieved a revenue growth rate of approximately 0.64%. This indicates a substantial increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Consumer Staples sector.

Net Margin: The company's net margin is below industry benchmarks, signaling potential difficulties in achieving strong profitability. With a net margin of 5.54%, the company may need to address challenges in effective cost control.

Return on Equity (ROE): Boston Beer Co's ROE stands out, surpassing industry averages. With an impressive ROE of 3.26%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Boston Beer Co's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 2.38%, the company showcases efficient use of assets and strong financial health.

Debt Management: Boston Beer Co's debt-to-equity ratio is below the industry average. With a ratio of 0.04, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

The Basics of Analyst Ratings

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.