Big tech is out of favor amid current market conditions, but one analyst said it's only a matter of time before investors regained an appetite for growth.

What Happened: Loup Funds' Gene Munster anticipated weakness in tech stocks in the short term, but he thinks money will flow back into the group as investors ultimately salivate at the growth opportunities in big tech following multiple compression.

"Investors are human and humans like things that are growing," Munster said Tuesday on Benzinga's "PreMarket Prep."

The Loup analyst expected a rotation back into mega-cap tech in 2023, but he noted that he doesn't foresee all of the names benefiting equally.

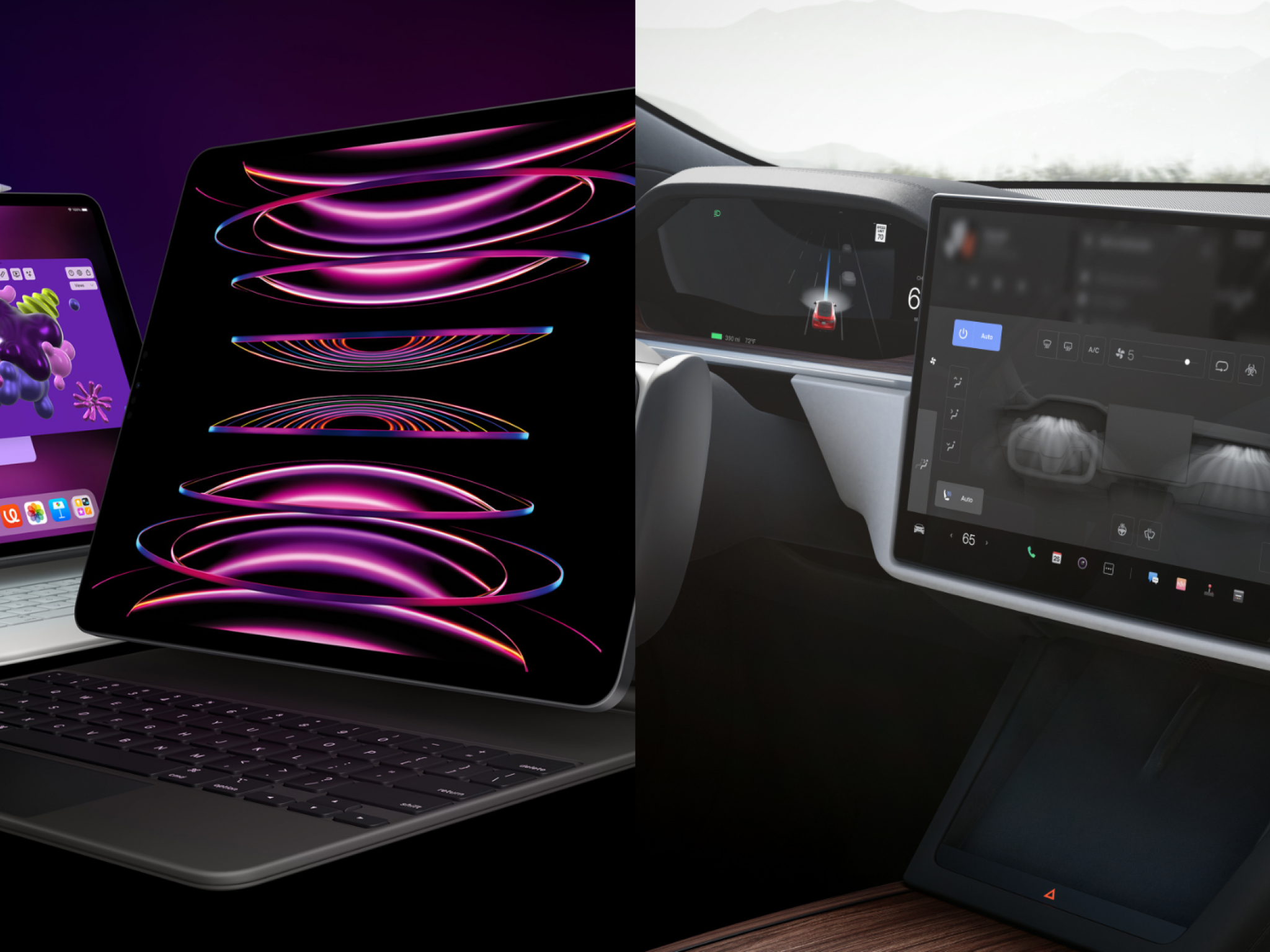

"There are a couple companies — Apple and Tesla — that kind of stand out amongst the six or seven biggest tech companies," Munster said.

Tesla Inc (NASDAQ:TSLA) is facing some short-term headwinds as CEO Elon Musk spends more of his time focused on Twitter Inc (NYSE:TWTR) following his $44 billion takeover of the social media company.

Although the Twitter acquisition had a negative impact on Tesla's multiple, it didn't actually change anything about Tesla's business, Munster said.

"I think it's getting, near term, more attractive. I've been a long-term believer in this. None of that long-term optimism has changed," Munster said

Munster remained confident in Tesla's lead over the competition. He told Benzinga it was a stretch to think legacy automakers can close the gap "in the next few years."

"I just still believe that it's a lot harder to build an electric car than it would seem," Munster said.

Apple Inc (NASDAQ:AAPL) is another standout among the mega-cap tech stocks as the company continued to sell additional products to existing customers, Munster said.

Only 15% of iPhone users owned an Apple Watch, he said: "That number could be 50% over time."

Apple also had pricing power with its subscription businesses, which helped to beef up its bottom line, he said.

Related Link: How Will Apple Price Increases Impact Earnings? 'Most Users Won't Think Twice'

Over the next three to six months, Munster anticipated continued multiple compression, but the company has optionality and is expected to enter new markets including AR/VR, healthcare and the automotive space, he said.

"It's pretty rare to have optionality value that's that big. Tesla also has big optionality value around FSD and Optimus so they have some similarities in that sense," Munster said.

"I think when you put it together, I still believe Apple should be a much bigger company. I think it probably goes lower in the near term, the next three to six months, but I think it's still poised very well for the next five years as it's digging into these new markets and building off of a good core business."

See the full interview with Munster here:

AAPL, TSLA Price Action: At publication time Tuesday afternoon, Apple was down 0.19% at $138.66 and Tesla was down 3.34% at $190.49, according to Benzinga Pro.

Photo: Courtesy of Apple, Tesla.