Investment houses—whether brokers, mutual fund companies, exchange-traded funds, or hedge funds—are mostly in business to attract money from customers, invest it (wisely, one hopes), and, when the year is over, renew the relationship with the customer for another year.

So, after two huge years for stocks, these money managers have, for the most part, made their bets for 2025. No great surprise: Most are bulls.

They like the Trumpian idea of lower tax rates, relaxed regulation of day-to-day operations and a relaxed antitrust environment so that mergers and acquisitions can get done, enriching shareholders and, of course, their own bottom lines. And they believe artificial intelligence will be a powerful driver of profit growth.

They see the economic environment as relatively benign. Inflation has eased from its peak in 2022. Interest rates are lower. Oil prices are well off their 2022 highs, although they started to tick higher in mid-December. In fact, as of Jan. 17, West Texas Intermediate, the benchmark U.S. crude, was up 15% from its December 6 low of $67.20 a barrel.

Related: TikTok, Trump, earnings will dominate markets this week

While many firms and their investment managers see stocks rising in 2025, how big or small those gains (or losses) can vary widely.

Analysts announce S&P 500 price targets for 2025

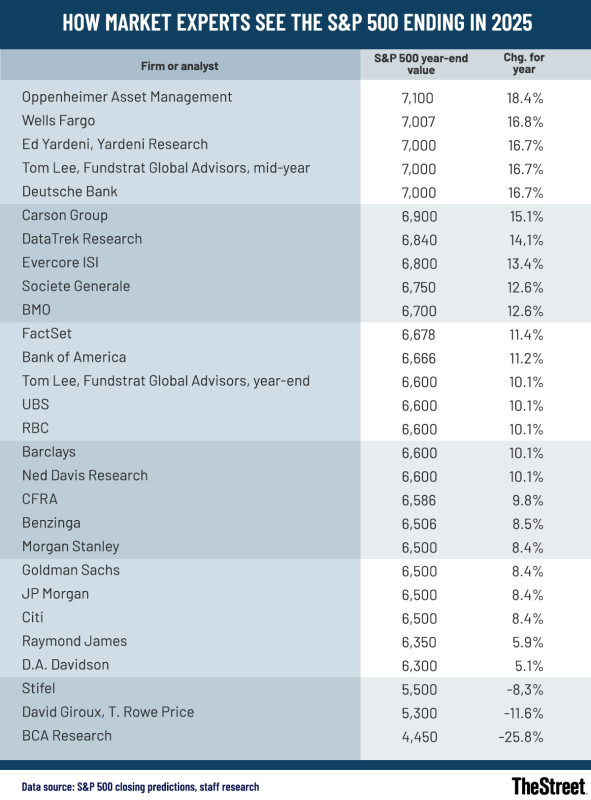

Looking at 27 projections for the S&P 500 Index, the most widely watched index among investment professionals, the sweet spot for the year-end level for the index is about 6,600.

That would translate into a 10% annual gain from the 2024 close of 5,881.63.

The index in 2024 was led by huge gains for Palantir Technologies (PLTR) , Vistra Energy (VST) and Nvidia (NVDA) .

Pleasant and nice projections. And maybe a little safe.

The top estimate in this admittedly unscientific survey is about 7,100 from Oppenheimer Investment Management.

An S&P close at 7,100 translates into a gain of 18.4%, which is pretty rich. The average annual gain for the index from 1998 through 2024 was 8.3%.

Next up: Ed Yardeni at Yardeni Research and Tom Lee of Fundstrat Global, both at 7,000. Lee's target is actually his mid-year. He sees the S&P 500 falling back to 6,600 by year-end, an 8.3% gain.

The lowest estimate comes from BCA Research, the Canadian firm that publishes the Bank Credit Analyst, which shows a 26% decline. Peter Berezin see a recession i 2025.

Let us linger on the S&P 500's 8.3% average annual return briefly.

If it sounds low, remember that the index (and the entire stock market) suffered big losses in 2000, 2001, 2002, 2008, and 2022 that would more than offset sizable gains in between.

More stocks’ performance in 2024

- The 5 best performing stocks on the Dow Jones Industrial Average in 2024

- The 5 worst-performing stocks on the Dow Jones Industrial Average in 2024

- The 5 best performing stocks on the Nasdaq 100 in 2024

- The 5 worst performing stocks on the Nasdaq 100 in 2024

- The 5 best performing stocks on the S&P 500 in 2024

- The 5 worst performing stocks on the S&P 500 in 2024

Big risks threaten S&P 500 projections in 2025

The risks to analysts S&P 500 outlooks for this year boil down to three main issues:

- Bond yields, especially the 10-year yield, have risen despite three Federal Reserve interest-rate cuts in the last four months of 2024. The yield was 4.61% on Friday, It hit as high as 4.817% on Jan. 14 — pushing mortgage rates nearly to 7%, high enough to dampen homebuying interest. The bond market is huge and global, and many factors affect rates. But U.S. money managers cite the probability of much higher fiscal deficits from the new Trump Administration as well as continuing deficits among industrial nations.

- The U.S. dollar has been rising. The U.S. Dollar Index rising as much as 9% since September. That makes U.S. exports more expensive to non-U.S. buyers, cuts into profits of U.S. multi-national companies, and should cut prices of European goods into the United States.

- The potential effects of deep government spending cuts and new tariffs on foreign-made products including those from China, Mexico, Canada and Europe. Trump said late Monday that 25% tariffs would be imposed on Canada and Mexico on Feb. 1.

Bulls do not consider these risks especially threatening.

First, they argue, the Fed will cut interest rates perhaps twice by 2025, and bond yields should fall.

In addition, they believe that Trump's move to cut taxes and reduce regulation will more than offset those problems for two reasons.

- Stock returns should rise, especially if tax rates are cut.

- Lower taxes and less regulation (especially on antitrust issues) should generate more interest in mergers, acquisitions and initial public offerings.

These thoughts manifest themselves in the idea that animal spirits are driving markets just now.

Related: Fed interest rate cut bets in 2025 tied to Trump policy wild cards

These concerns are evident in TheStreet's list of S&P 500 projections below. The bulls, who think Trump's business policies will offset anything else, are at the top of the list.

Skeptics are further down the list.

It is rare that anyone nails a year-end target from the outset. And it is possible that a shock to the economy will totally destabilize the financial system. Few analysts had actually forecast a major recession coming in 2008 as the global financial system nearly imploded.

The odds of not being right are so great that New York Times columnist Jeff Sommer wrote in December, "I salute them for having the supreme self-confidence to stick with it."

But he correctly noted at least being positive on markets is not wrong-headed. The S&P 500 has shown only seven year-over-year declines since 1999.

Now, a related bit of trivia: Since the end of 2008, when the financial crisis was in full swing, the S&P 500 is up 563.9%, or an average of 12.6% a year. The 17 years include six separate years of annual gains of 23% or more.

So, with all that context, here's the list of projections. There are a few notes and caveats at the end.

How market experts see the S&P 500 ending in 2025

TheStreet

Notes:

- As noted, Fundstrat Global Advisors' Tom Lee has two S&P 500 projections, mid-year and year-end.

- Carson Group predicted the S&P 500 would rise 12% to 15% in 2025. The chart assumes a 15% return. At 12%, the index would close at 6,717.

- D.A. Davidson projected a fair value year-end value of 6,300 but noted the index's close could range from 5,200 to 6,800.

- David Giroux is Head of Investment Strategy and Chief Investment Officer at T. Rowe Price (TROW) .

- Benzinga is a financial media site.

- BCA Research is the Montreal-based owner of The Bank Credit Analyst.

Related: Veteran fund manager issues dire S&P 500 warning for 2025