During the last three months, 12 analysts shared their evaluations of Microchip Technology (NASDAQ:MCHP), revealing diverse outlooks from bullish to bearish.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 5 | 5 | 2 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 4 | 4 | 1 | 0 | 0 |

| 2M Ago | 0 | 1 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 1 | 0 | 0 |

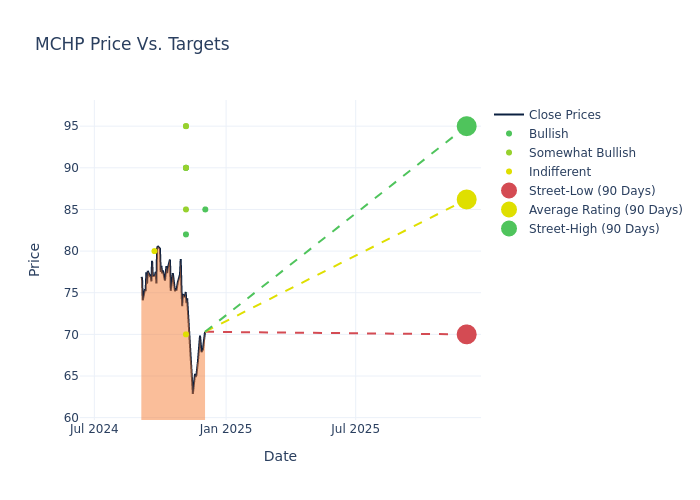

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $86.83, a high estimate of $95.00, and a low estimate of $70.00. Highlighting a 8.04% decrease, the current average has fallen from the previous average price target of $94.42.

Deciphering Analyst Ratings: An In-Depth Analysis

The standing of Microchip Technology among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Quinn Bolton | Needham | Maintains | Buy | $85.00 | $85.00 |

| Christopher Danely | Citigroup | Lowers | Buy | $82.00 | $92.00 |

| Blayne Curtis | Jefferies | Lowers | Buy | $90.00 | $100.00 |

| Joshua Buchalter | TD Cowen | Lowers | Hold | $70.00 | $80.00 |

| Mark Lipacis | Evercore ISI Group | Lowers | Outperform | $95.00 | $101.00 |

| Christopher Rolland | Susquehanna | Lowers | Positive | $90.00 | $95.00 |

| Weston Twigg | Keybanc | Lowers | Overweight | $95.00 | $100.00 |

| Harsh Kumar | Piper Sandler | Lowers | Overweight | $85.00 | $100.00 |

| Hans Mosesmann | Rosenblatt | Maintains | Buy | $90.00 | $90.00 |

| Quinn Bolton | Needham | Lowers | Buy | $85.00 | $96.00 |

| Christopher Rolland | Susquehanna | Lowers | Positive | $95.00 | $105.00 |

| William Stein | Truist Securities | Lowers | Hold | $80.00 | $89.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Microchip Technology. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Microchip Technology compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Microchip Technology's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

To gain a panoramic view of Microchip Technology's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Microchip Technology analyst ratings.

Discovering Microchip Technology: A Closer Look

Microchip Technology became an independent company in 1989 when it was spun off from General Instrument. More than half of revenue comes from MCUs, which are used in a wide array of electronic devices from remote controls to garage door openers to power windows in autos. The company's strength lies in lower-end 8-bit MCUs that are suitable for a wider range of less technologically advanced devices, but the firm has expanded its presence in higher-end MCUs and analog chips as well.

Microchip Technology: Financial Performance Dissected

Market Capitalization Analysis: Falling below industry benchmarks, the company's market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Negative Revenue Trend: Examining Microchip Technology's financials over 3 months reveals challenges. As of 30 September, 2024, the company experienced a decline of approximately -48.37% in revenue growth, reflecting a decrease in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Information Technology sector.

Net Margin: The company's net margin is below industry benchmarks, signaling potential difficulties in achieving strong profitability. With a net margin of 6.74%, the company may need to address challenges in effective cost control.

Return on Equity (ROE): Microchip Technology's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of 1.24%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): Microchip Technology's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of 0.5%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: Microchip Technology's debt-to-equity ratio stands notably higher than the industry average, reaching 1.03. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

Analyst Ratings: Simplified

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.