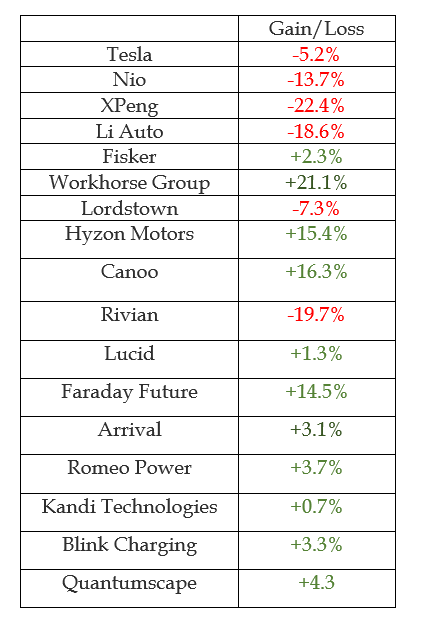

The EV space turned in a mixed performance in the week ending March 11, with some second-rung EV manufacturers and charging stocks rebounding from their losses. Shares of Tesla, Inc. (NASDAQ:TSLA), however, reversed course and ended the week in the red. The worst performers were the Chinese stocks, as investors fled from them amid fears of delisting in the U.S.

Here are the key events that happened in the EV space during the week:

Tesla Hikes Prices, Voted Best Luxury Brand: Grappling with rising material cost, which was exacerbated by the Ukraine war, Tesla was left with no option but to announce another round of price hikes for its more affordable Model 3 and Model Y vehicles, both in China and the U.S.

Information available on Tesla's website shows that the Model Y and Model 3 Long Range versions are now dearer by $1,000 each. The company also hiked the prices of some Model Y SUVs and Model 3 sedans sold in China.

Data released by the China Passenger Car Association showed that Tesla weathered the market-wide softness in China better than others. The U.S. company's domestic sales increased month-over-month in February, as opposed to the declines seen by its Chinese rivals.

Tesla, meanwhile, was voted as the "Best Overall Luxury Brand" for the third straight year in the U.S., Kelley Blue Book announced. The accolade was based on the findings from the California-based vehicle research and automotive research company's consumer perception survey.

Nio Lists In Hong Kong: On a week that saw an intensification of selling pressure, Nio, Inc. (NYSE:NIO) had something to cheer about. The company's shares successfully debuted on the Hong Kong stock exchange. An event that was delayed for about a year finally materialized on Thursday, when Nio's stock was listed on the exchange by way of introduction.

The development is positive for the company amid the looming delisting fears that are haunting U.S.-listed Chinese stocks. That said, the company didn't have the best start in Hong Kong. After listing at 160 Hong Kong dollars (HKD), or $20.44, on Thursday, the stock pulled back to settle the debut session at 158.90 HKD. It came under further selling on Friday and closed the week at 146.40 HKD.

Related Link: Why This Tesla Analyst Thinks Giga Berlin Is A 'Major Competitive Advantage' For The EV Maker

China Stocks Plunge On Delisting Fears: U.S.-listed Chinese EV stocks experienced across-the-board sell-offs during the week after the SEC released a list of 5 Chinese stocks facing the risk of delisting due to non-compliance with an audit inspection-related law. Nio, XPeng, Inc. (NYSE:XPEV), Li Auto, Inc. (NASDAQ:LI) and BYD Company Limited (OTC:BYDDF) all clocked weekly losses of over 10%.

XPeng, meanwhile, had a positive development to boot. The company said it has begun taking reservations for its P5 budget sedan in four European countries.

Rivian Slumps Following Earnings: Rivian Automotive, Inc. (NASDAQ:RIVN) towed in line with Lucid Group, Inc. (NASDAQ:LCID) and lowered its production forecast for 2022. The company now expects to produce 25,000 vehicles as opposed to the capacity of 50,000 units, blaming the shortfall on supply constraints.

The company also reported top- and bottom-line misses for the quarter. Analysts reacted with a string of downward price target adjustments.

Lucid Launches ‘Tech Talks’: Lucid launched a 10-part YouTube series to explain its technologies, with the first episode featuring CEO Peter Rawlinson. Rawlinson discussed the company's battery packs. The video has garnered over 44,000 views and 2,900 likes.

Blink Charging's Mixed Q4: Blink Charging Co. (NASDAQ:BLNK) reported a fourth-quarter loss that was wider than expectations. Revenues, however, beat the consensus. Reacting to the quarterly scorecard, Needham analyst Vikram Bagri said he sees upside to his forward estimates for the company, given a "noticeable increase in charger utilization and expected realization of govt grants."

EV Stock Performances for The Week:

Related Link: Why Tesla And This Automaker Are 'Shelter In Inflationary Storm'