The week ending April 1 proved to be a mixed one, although the major EV manufacturers closed firmly in the green. Tesla, Inc. (NASDAQ:TSLA) shares rose above the $1,100 level before pulling back and yet closed with handsome gains amid company-specific developments.

As the industry navigates through geopolitical and macroeconomic risks, a lot of discussion is revolving around vertical integration and localizing the supply chain. Morgan Stanley analyst Adam Jonas said in a note this week that he believes Tesla may be better positioned than peers on this front.

In a noteworthy development, President Joe Biden invoked the Defense Production Act to lay emphasis on producing materials domestically.

Here are the key events that happened in the EV space during the week:

Tesla Stock Split, Shanghai Plant Shutdown And More: Tesla made waves this week with the disclosure of its intention to split its shares. The company last implemented a stock split in August 2020 in a 5-to-1 ratio. Tesla shares had a nice run-up in the aftermath of the announcement.

After shutting down the Giga Shanghai plant from Monday through Thursday, Tesla reportedly said in an internal communication that the closure will be extended into the weekend. The shutdown was in line with the lockdown restrictions put in place by the local administration.

Meanwhile, CEO Elon Musk took a jibe at the United Auto Workers when it was revealed that an ex-official of the union pled guilty to swindling $2.2 million in workers' funds. In a tweet, Musk said, "the UAW stole millions from workers, whereas Tesla has made many workers millionaires via stock grants." It should be noted that Musk has thus far refused calls to allow for the unionizing of Tesla employees.

Fisker Says Ocean SUV Snags Strong Orders: Fisker, Inc. (NYSE:FSR) said in a release that it has received over 40,000 initial reservations for its Ocean SUV. Most of the orders were for the Ocean One launch edition and Ocean Extreme models, both priced at $68,999 in the U.S. The company also noted that it will begin manufacturing 5,000 limited edition Fisker Ocean vehicles, beginning in November.

Related Link: Why More EV Price Hikes Could Be Coming In Q2

Ford, GM, Volkswagen Face Production Disruptions: Volkswagen AG (OTC:VWAGY) said production at its Shanghai plant will continue to remain suspended, from April 1-5, due to COVID-19 disruptions. U.S. auto giants General Motors Corporation (NYSE:GM) and Ford Motor Company (NYSE:F) also separately said they are idling production at their Michigan plants due to component shortages.

Nio Starts Deliveries Of ET Sedan: Nio, Inc. (NYSE:NIO) kept its tryst with the timeline for beginning deliveries of its flagship ET7 sedan. Representatives from the manufacturing and quality departments handed over the first batch of ET7s to customers at Hefei, the company's China headquarters, on Monday.

Separately, the company said it delivered 9,985 vehicles in March, up strongly from February's 6,131 units. Shares of the EV maker reacted with a relief rally. Among peers, XPeng, Inc. (NYSE:XPEV) and Li Auto, Inc. (NASDAQ:LI) sold 15,414 units and 11,304 units, respectively for the month.

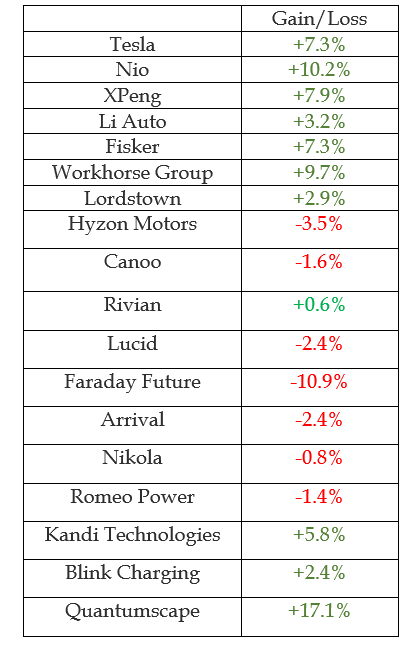

EV Stock Performances for The Week:

Related Link: Tesla Mulls Stock Split: Why This Analyst Says It's A Smart Strategic Move