Car charging company Pod Point has sounded the alarm over electric car demand, saying new rules could make uptake even more uncertain.

The company’s shares tumbled on the London Stock Exchange after it said it was taken by surprise by low demand for its products.

The company, whose largest shareholder is France’s EDF Energy, said it missed its £60m sales target for last year by £7m, sending its shares down by a third in value.

Melanie Lane, Chief Executive Officer of Pod Point, said: “As expected, 2024 has proven to be a transitional year in terms of our financial performance. We made good progress on our costs, but the weaker-than-expected private EV market has negatively impacted revenues.”

Car makers have been lobbying the government to weaken strict rules which punish them for not hitting strict sales targets for electric cars which go up each year.

It emerged in November that the government aims to water down rules which demand car makers switch to making battery-powered cars after pressure from the industry.

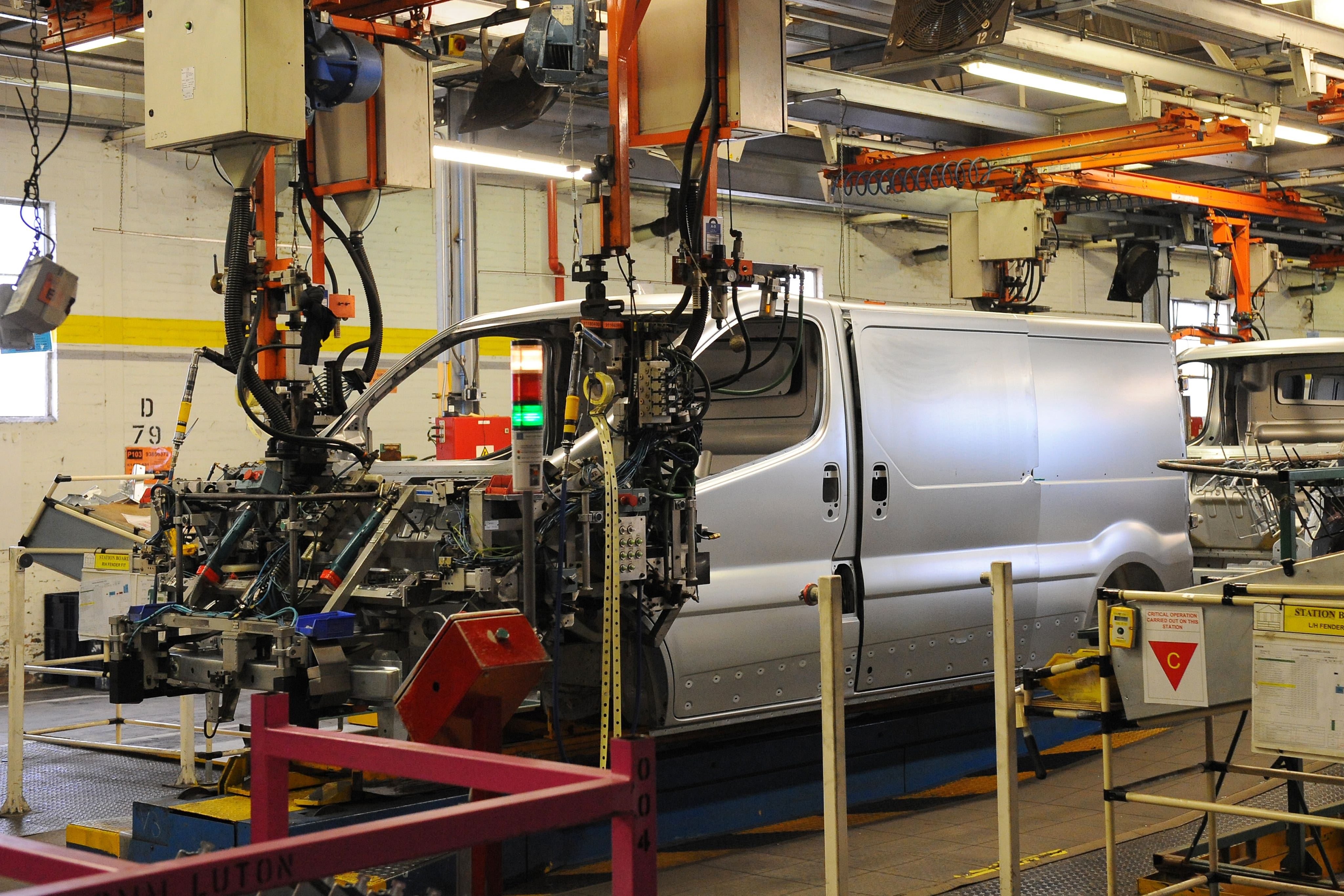

But the move came too late to save Vauxhall’s van plant in Luton, where 1,100 jobs are at risk.

Ministers have agreed to review rules which say at least 28 per cent of cars made in British factories must be battery-powered. Breaking the rules means either buying credits from competitors who are beating these targets or paying a fine of £15,000 per car.

Car makers have been battling high energy costs after Russia’s invasion of Ukraine, and they have had to pass on costs to customers. They did this very successfully in the wake of the pandemic when factory closures meant a shortage of cars.

But now, as factories have been churning out more vehicles, they are met with customers feeling the pinch of higher energy bills and mortgage payments. Efforts to sell more electric cars have also stalled.

EVs cost more to make because of the expensive materials needed to produce their large batteries.

Pod Point, which makes chargers for the home and also businesses, said this year was also likely to be tough.

While the gap is narrowing, electric cars are more expensive than petrol and diesel models of comparable spec.

Buyers who drive many miles and can charge at home will recoup the difference over the life of the car and also stand to make a saving.

But for those without off-street parking who live in flats, terraced houses or other homes without a charger fed by a domestic tariff, the cost of charging is much higher.

Public fast chargers can cost a multiple per kilowatt hour of domestic pricing.

Part of this is because VAT on domestic electricity is 5 per cent and on public chargers it is 20 per cent – the industry is lobbying the government to close this gap.

And part of it is the premium the owners of the chargers want for rolling them out across the country, which requires significant investment.