European technology startups nearly doubled the amount of debt they took on last year, exposing them to the turmoil now roiling the financial system following the collapse of Silicon Valley Bank.

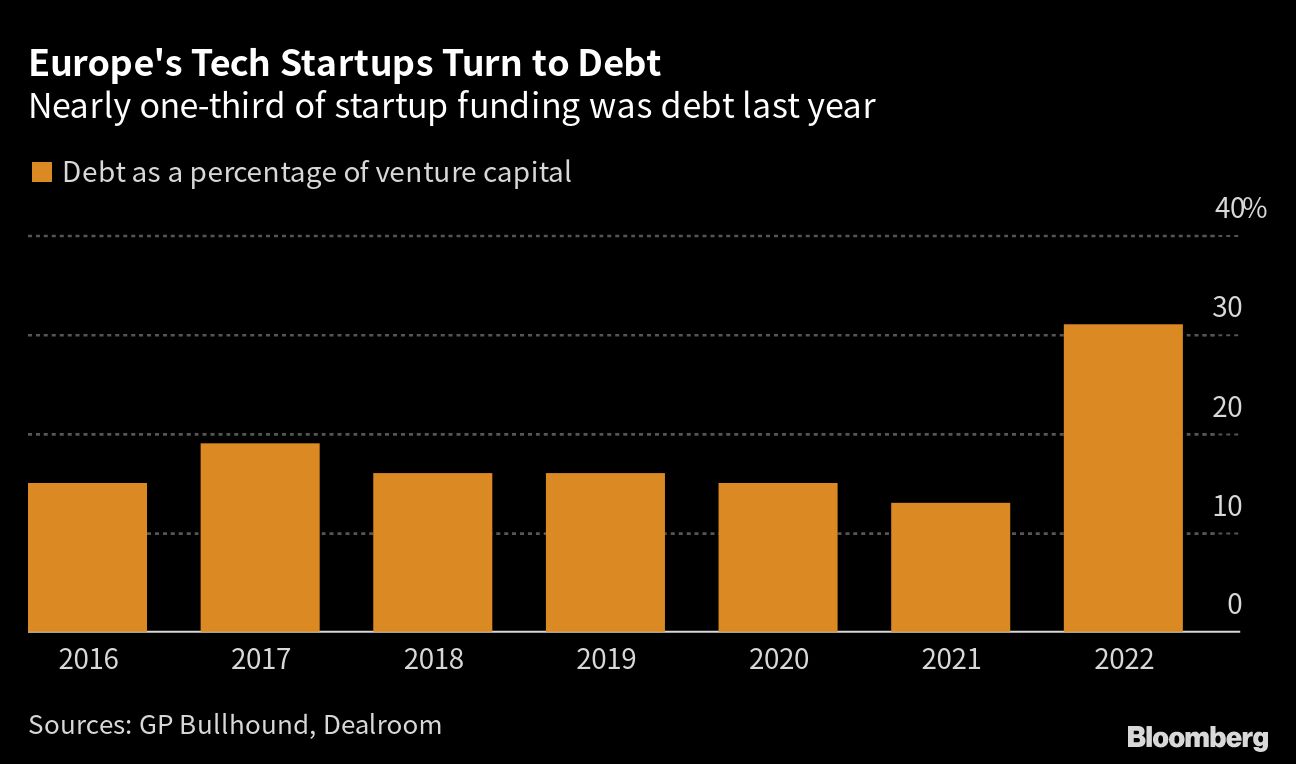

Private tech companies in Europe took out €30.5 billion ($32.7 billion) in debt last year, up from €15.9 billion in 2021, after the global tech slump made raising new equity more difficult, according to a report from investment bank GP Bullhound LLP published Tuesday. That was nearly one-third of the funding they raised in the period, the report said.

Fast-growing tech companies turned more to loans from investment firms, banks and states as public listings and huge funding rounds dried up in 2022. However, fallout from this month’s collapse of SVB, which was a major provider of venture debt—funding, could complicate this strategy.

GP Bullhound is “cautiously positive” the trend of late-stage tech companies borrowing will continue even after SVB’s downfall, according to the report.

“Lenders are now looking at the unit economics, as they should have in the past,” Olya Klueppel, a GP Bullhound partner and the report’s lead author, said in an interview.

Klueppel said it was too early to estimate the impact of Credit Suisse Group AG’s government-backed takeover by UBS Group AG on startup funding.

Last year, fintech companies in the region, including the UK, remained the biggest recipients of debt, although clean tech loans grew quickly. Four of ten Europe’s largest debt raises in 2022 went to companies working in energy, including a €2 billion bridge loan for electric battery-maker Britishvolt Ltd., according to the report.

While Britishvolt went bankrupt at the start of 2023, Klueppel said she expects investor appetite for clean tech to continue.

©2023 Bloomberg L.P.