The euro and the U.S. dollar traded at parity on Tuesday morning, meaning $1 is equal to 1 euro.

It’s the first time the pair have traded at parity since 2002, making it another example of how wild various markets have been so far in 2022.

The euro has lost roughly 11% of its value against the dollar this year and about 15% over the past 12 months. From its high in 2008, it’s fallen 37.6% vs. the dollar.

Stocks, bonds, commodities, cryptocurrencies and fiat currencies have fluctuated widely this year and, really, since the covid-19 pandemic started more than two years ago.

The dollar's strength comes as Europe tries to avoid a recession and faces a more dire energy crisis than the U.S. does.

Further, the Federal Reserve has been more aggressive with its monetary policy than the European Central Bank, as it aggressively raises interest rates and reduces its balance sheet.

Aside from a potential discount for Americans traveling abroad in Europe, what happens from here now that parity has been achieved?

What Happens After Euro-Dollar Parity?

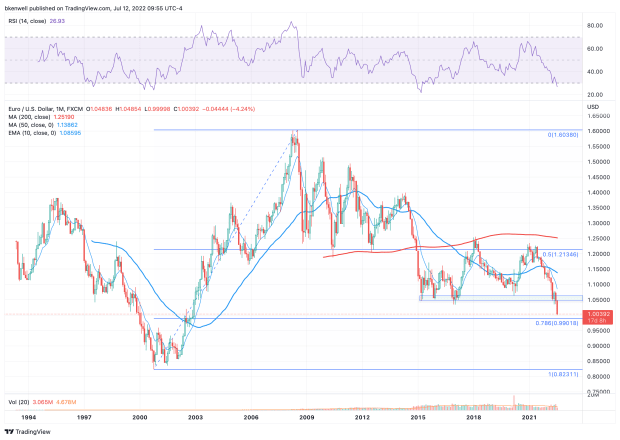

Chart courtesy of TradingView.com

The euro has declined against the dollar in 11 of the past 14 months, with one of those monthly gains just a 0.09% tick upward. It’s been a rough ride.

The 1.05 to 1.06 area had been very strong support since 2015. That level stopped a near free-fall in the euro in early 2015, following a near-24% skid as the euro declined in nine straight months.

That level has now failed as support, as the euro-dollar hit 1 this morning. From here, the 78.6% retracement — the last meaningful retracement level on the chart that spans the euro’s entire trading range — is down at 0.99.

Investors must acknowledge that the trend is down. The question becomes: Does the euro find support near current levels?

It certainly could, although it faces a lot of negative catalysts at the moment, including: the war in Ukraine, the energy crisis, the Fed’s continued effort to raise rates and the ECB’s ability to lift the euro being “quite limited.”

On the downside, I’m watching 0.99, but below that, 0.95 is of interest. That’s the 161.8% downside extension of the current range.

Below that and sub-0.9 will likely be a talking point — although things would have to really deteriorate in Europe for that to happen.

On the upside, investors must watch the 1.05 to 1.06 area as possible resistance, followed by the declining 10-month moving average. The first zone is former support that may now turn to resistance, while the 10-month moving average has been active resistance.

Above both can put 1.1-plus in play.