What can the Riksbank do to really shake things up for EUR/SEK? It could raise interest rates by less than 50 bps on Thursday, which would likely see EUR/SEK rise dramatically, but that seems unlikely. All 16 economists recently polled by Reuters expect the Swedish central bank to raise interest rates by 50 bps and interest rate markets are fully pricing in just such a move. After the surprise 25 bps hike in April, the Riksbank is under pressure to do more in order to tame inflation. Sweden’s headline inflation rate rose to 7.2% y/y in May - its highest level in three decades. That’s well above the Riksbank current inflation forecast of 5.5% and its 2% inflation target.

Given a 50 bps hike is so well expected, traders may be faced with a classic buy the rumor and sell the fact scenario when it comes to EUR/SEK on Thursday, unless the Riksbank does something more. The big question for EUR/SEK is what that more will be? As the Riksbank already signalled in April that it would start tapering asset purchases in the second half of this year, any downward pressure on EUR/SEK from Thursday's decision will come down to the central bank’s published interest rate path and forward guidance.

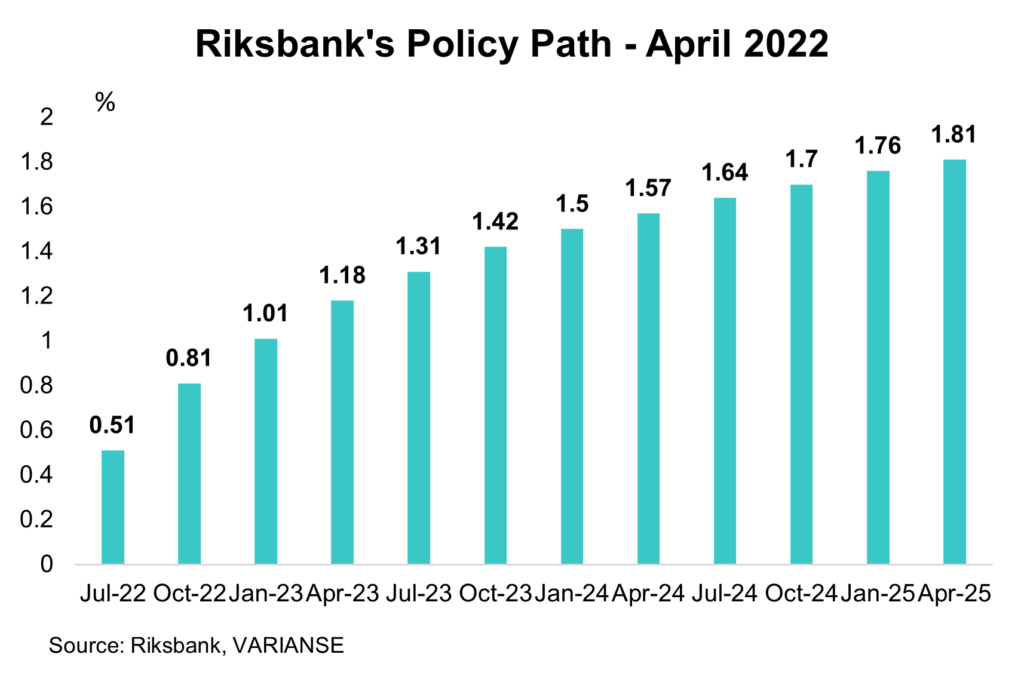

Back in April, the Riksbank indicated a further 75 bps of hikes this year with the key policy rate topping out at 1.0% and at 1.8% in 2025. If the Riksbank talks tough on inflation on Thursday, and solidifies the potential for 50 bps hikes further down the line, that could prove negative for EUR/SEK. A stronger Swedish krona would certainly help the Riksbank cool inflation. That said, there is every risk that the Riksbank decided not to box itself into a corner in terms of interest rate hikes beyond June. If so, that could prove positive for EUR/SEK.

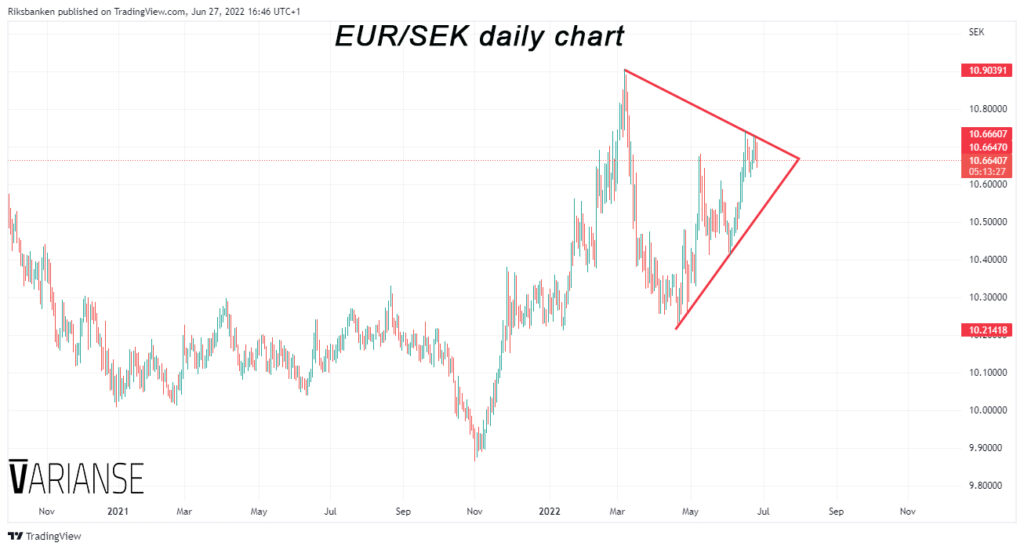

Whatever the Riksbank decides on Thursday, it should prove noteworthy for EUR/SEK. After rising sharply at the start of the year, in part due to geopolitical concerns related to war in Ukraine, the Swedish krona quickly reversed its losses ahead of Apri’s surprise Riksbank decision. More recently, it has retraced those gains, in part reflecting an increasingly more hawkish ECB. That price action has created a pretty obvious triangle formation.