KEY POINTS

- Ether ETFs took in nearly $107 million on the first day of trading, and saw over $1 billion in trading volume

- ETH ETFs inflows may result in higher pricing sensitivity: Alluvial CEO Mara Schmiedt

- Possible ETF-induced demand shock could be 'tipping point' for Ethereum and other crypto, she said

Spot Ethereum ($ETH) exchange-traded funds (ETFs) are now live and saw significant trading volume surpassing $1 billion on their first day. The hype around the ETFs continues to build up, but an expert said the industry may see a short-lived severe shortage in supply since nearly half of existing tokens are currently locked up.

'Solid' Day 1 for $ETH ETFs

With nearly $107 million in inflows on the first day of trading, Ether ETFs sure had a "very solid first day," according to senior Bloomberg ETF analyst James Seyffart.

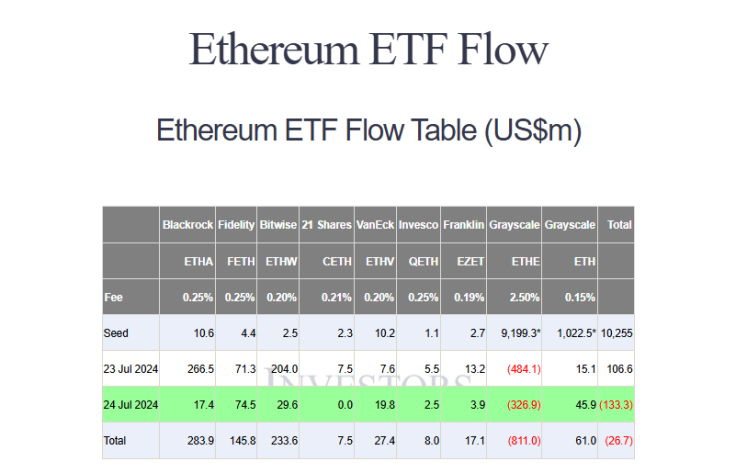

BlackRock's $ETHA was the leader in inflows, hauling in $266.5 million, followed by Bitwise Invest's $ETHW, which saw inflows of $204 million. Fidelity's $FETH came in third, with $71.3 million.

On the second day, the ETFs saw negative flows of $133.3 million, with Grayscale's $ETHE to blame as it bled $326.9 million Wednesday. Fidelity's $FETH led the inflows, logging $74.5 million in positive flows, as per data from Farside Investors.

'Demand shock' possible: expert

Inflows around Ethereum ETFs are expected to possibly result in higher pricing sensitivity and impacts relative to Bitcoin, even possibly catapulting the numbers to well over $20 billion in the initial months of the funds, Mara Schmiedt, Ethereum expert and the CEO of enterprise-grade staking products and services firm Alluvial, told International Business Times.

"With roughly 38% of the current $ETH supply locked in staking, bridges, and DeFi (decentralized finance), and another 10% sitting on retail exchanges, ETF-driven $ETH inflows could have a significant upward price impact. The combination of $ETH's supply constraints and possible ETF-induced demand shock could be the tipping point for Ethereum and other cryptocurrencies into the next market cycle," she said.

Ethereum ETF flows to hit 30% of Bitcoin's market size?

Seyffart has said figures on the first day of trading "won't be indicative of much," and observers should instead focus on the period between the second week of the ETFs' trading through their first month live, as this is when actual demand and market impact for the funds can be estimated.

On the other hand, the differences between the launches of Bitcoin ETFs and Ether ETFs can provide at least a broad view of what to expect from the $ETH ETFs, Schmiedt noted.

"There are some parallels and key differences between the $BTC and $ETH spot ETF launches, particularly in terms of market sizing, supply dynamics, price sensitivity, and native yield properties. While $BTC spot ETF inflows hit a higher-than-expected $60 billion assets under management (AuM) target in the U.S. this year, we can anticipate $ETH ETF inflows to reach approximately 30% of $BTC's total market size, or $20 billion+ at current prices," she said.

Ether retreats

Meanwhile, Ether, the native token of the Ethereum blockchain, plunged to $3,100 early Thursday, possibly affected by outflows on Grayscale's Ethereum ETF. Data from CoinGecko shows that the digital asset is down by over 7% in the last 24 hours.

Despite the price downtrend, Schmiedt said some investors may still find the $ETH ETFs valuable. "An interesting and important difference between $BTC and $ETH is that staking on Ethereum introduces a native rate of return, currently around 3.3%, that may prove compelling to investors seeking fixed income-like alternatives to equities, enabling portfolio diversification and inflation hedging," she said.