With a market cap of $23.7 billion, Equity Residential (EQR) is a leading publicly traded multi-family REIT focused on high-quality residential properties in major U.S. cities. Its portfolio includes 311 properties with 84,249 units, a strong presence in established markets, and expansion into Denver, Atlanta, and Dallas/Ft. Worth, and Austin. EQR is expected to release its fiscal Q1 2025 earnings results on Tuesday, Apr. 22.

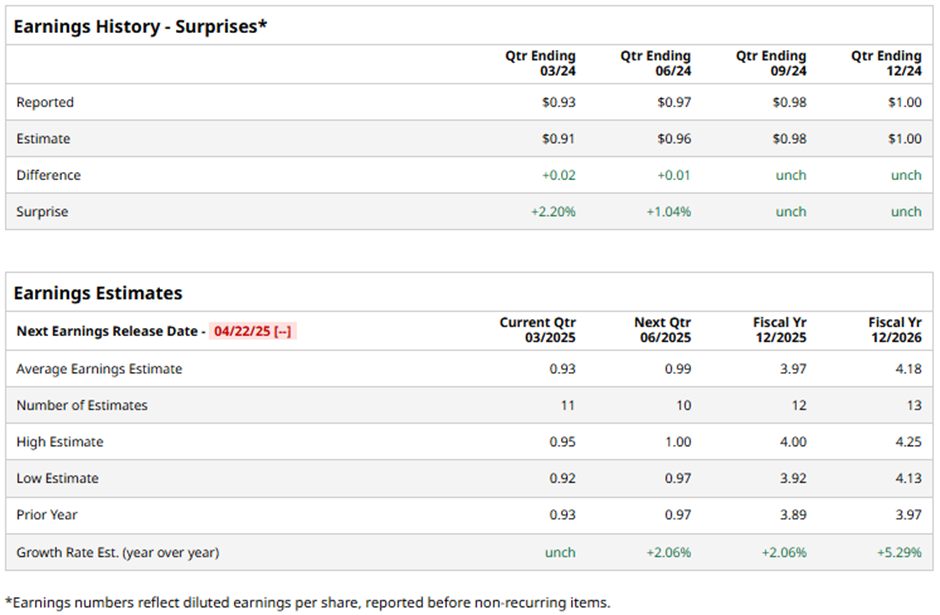

Ahead of this event, analysts project the Chicago, Illinois-based company to report a normalized FFO of $0.93 per share, which is in line with the results from the same quarter last year. It has met or surpassed Wall Street's bottom-line estimates in the last four quarterly reports. In Q4 2024, Equity Residential met the consensus NFFO estimate.

For fiscal 2025, analysts forecast EQR to report an NFFO of $3.97 per share, up 2.1% from $3.89 in fiscal 2024.

Equity Residential has declined marginally over the past 52 weeks, underperforming the broader S&P 500 Index's ($SPX) slight gain. The stock has almost aligned with the Real Estate Select Sector SPDR Fund's (XLRE) marginal dip over the same time frame.

Shares of EQR recovered marginally after its Q4 2024 earnings release on Feb. 3 as normalized FFO per share of $1 matched the consensus estimate and rental income of $766.8 million beat expectations. Same-store revenue grew 2.4% year-over-year, and physical occupancy remained strong at 96.1%, slightly above estimates. The company also posted a full-year 2024 normalized FFO of $3.89, alongside 3.7% rental income growth. Optimism was further fueled by 2025 guidance projecting normalized FFO per share of $3.90 - $4 and same-store revenue growth.

Analysts' consensus view on Equity Residential stock is cautiously optimistic, with a "Moderate Buy" rating overall. Among 26 analysts covering the stock, 10 suggest a "Strong Buy," one gives a "Moderate Buy," and 15 recommend a "Hold." As of writing, EQR is trading below the average analyst price target of $77.77.