Equinix, Inc. (EQIX), headquartered in Redwood City, California, operates as a real estate investment trust. With a market cap of $83.2 billion, the company invests in interconnected data centers. Equinix focuses on developing network and cloud-neutral data center platform for cloud and information technology, enterprises, network, and mobile services providers, as well as for financial companies. The world's digital infrastructure company is expected to announce its fiscal third-quarter earnings for 2024 after the market closes on Wednesday, Oct. 30.

Ahead of the event, analysts expect EQIX to report a profit of $7.70 per share on a diluted basis, down 6% from $8.19 per share in the year-ago quarter. The company beat the consensus estimate in each of the last four quarters.

For the full year, analysts expect EQIX to report FFO of $31.01, down 3.4% from $32.11 in fiscal 2023. However, its FFO is expected to rise 7.8% year over year to $33.44 in fiscal 2025.

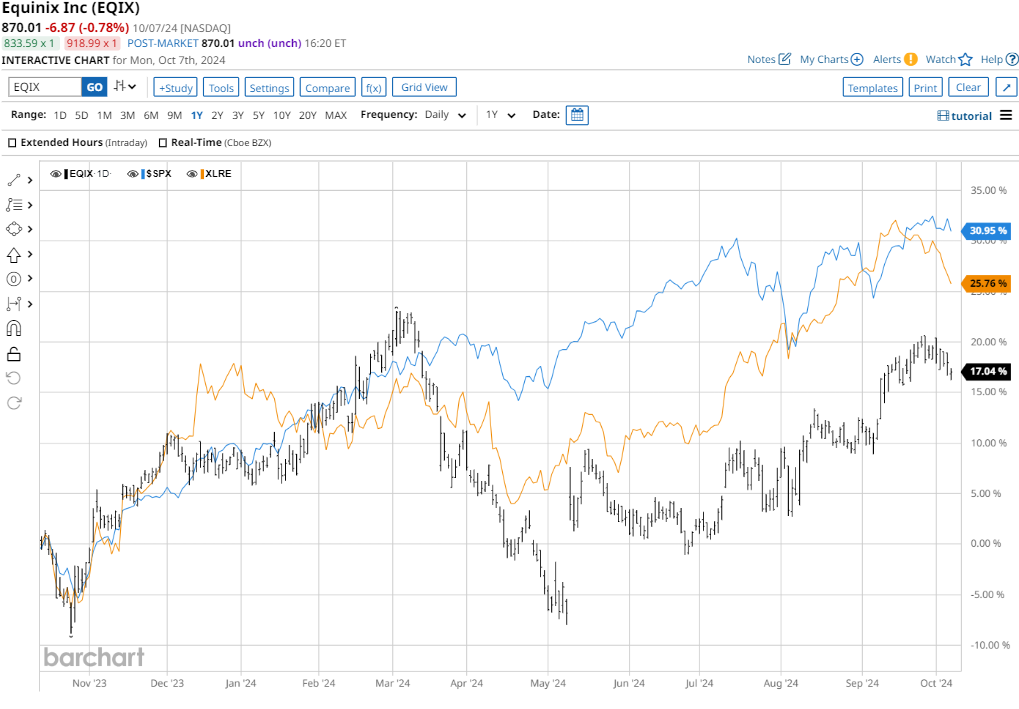

EQIX stock has underperformed the S&P 500’s ($SPX) 32.2% gains over the past 52 weeks, with shares up 20.2% during this period. Similarly, it underperformed the Real Estate Select Sector SPDR Fund’s (XLRE) 28.7% gains over the same time frame.

On Aug. 7, EQIX shares closed down marginally after reporting its Q2 results. Its FFO of $9.22 topped Wall Street estimates of $8.82. Its net income per share increased 43% year over year to $3.16. The company’s revenue was $2.2 billion, meeting Wall Street forecasts. EQIX expects full-year FFO to be between $34.67 and $35.30, and revenue to be between $8.7 billion and $8.8 billion.

Analysts’ consensus opinion on EQIX stock is bullish, with a “Strong Buy” rating overall. Out of 26 analysts covering the stock, 20 advise a “Strong Buy” rating, one suggests a “Moderate Buy” rating, and five give a “Hold.” EQIX’s average analyst price target is $922.96, indicating a potential upside of 6.1% from the current levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.