Global revenue for the entertainment and media industry is expected to grow at just a compounded annual rate of just 3.9% to $3.4 trillion from 2024 to 2028, and that growth won’t come easily, according to a new report from PwC.

That compares to the 5% growth the industry saw in 2023.

Disruption is the theme of the PwC outlook, with some segments growing faster than others and some segments declining.

Also Read: IAB: Digital Video Ad Spend Will Jump 16% in 2024

“Linear value chains are disaggregating as we move into a world dominated by digital ecosystems,“ the report said. “The content boom driven by rapid streaming growth has come to a halt. Generative AI is promising to deliver efficiency and productivity gains while powering new ways of doing business across and between multiple industries.”

All of that leads to uncertainty. According to PwC’s annual survey of top executives, 57% of entertainment and media company CEOs said their current business path would no longer be viable in 10 years, compared with 45% of all CEOs a year ago.

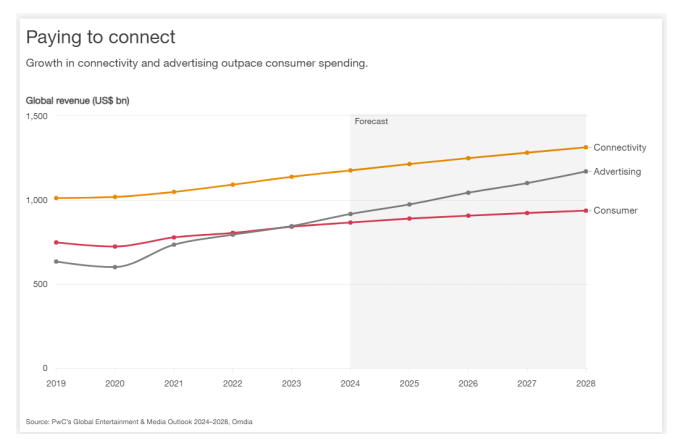

Of the industry’s three main revenue sources — direct consumer spending on content, spending on connections such as broadband and advertising — advertising is poised to grow the fastest during the next five years, according to PwC.

Advertising, which surpassed consumer spending in 2023 in terms of total revenue, is projected to top $1 trillion in 2026 and will grow at a 6.7% compound annual growth rate (CAGR) through 2028 — when ad spending will be nearly double the 2020 total.

Consumer spending is expected to be basically flat, edging up to $67.7 billion in 2028 from $65.2 billion in 2023.

Advertising will account for 55% of the industry’s growth during the current five-year span.

“For strategic reasons, all participants in the E&M industry need to become more proficient at selling ads — and more effective at making them generate value for all participants in the ecosystem,” the PwC report said.

This has already been seen with streaming services like Netflix, Disney Plus and Amazon Prime Video pivoting from ad-free to ad-supported.

Most of that advertising growth will be digital.

“Despite headwinds including limited ad budgets, discussion of regulation, and continuing geopolitical and economic uncertainties, internet advertising grew 10.1% in 2023, adding $52.5 billion in new revenues,” PwC said.

PwC expects internet advertising to rise at a 9.5% CAGR through 2028. At that point, it would account for 77.1% of total ad spending.

Internet advertising is rising especially fast in mature e-commerce markets like the U.S., PwC noted. In the U.S., PwC projects that internet advertising will rise at a 21.6% CAGR to $31.7 billion in 2028.

Connected TV is projected to double, from $20.5 billion in 2023 to $41.2 billion in 2028.

“As more consumer attention migrates away from traditional television to user-generated, short-form content, advertisers may need to follow this migration with approaches that go beyond the 30-second or 15-second spot,” the PwC report says. “These may include relying more on influencers, offering experiential promotions, and tapping into new technologies that enable creative messaging.”

PwC sees gaming as a potential area for growth for entertainment and media companies.

Global video games revenue, including esports, was up 4.6% to $227.6 billion in 2023. While a small component of industry revenues now, it is expected to be one of the fastest growing sectors, topping $300 billion by 2028, according to PwC.

Advertising is becoming a more substantial revenue stream in the gaming business, the report added..

Artificial intelligence, particularly generative AI, is going to drive reinvention in the entertainment and media industry, the PwC report says.

Its survey found that nearly half of U.S. CEOs expecting generative AI to boost profits this year, with 61% expecting it to improve the quality of their products and services.

“Thus far, much of the discussion surrounding AI in E&M has focused on reducing and controlling costs—rather than driving new revenue streams,” PwC noted.

“As we look ahead, in a dynamic that the forecast doesn’t quite capture yet, industry participants will have to focus on how this powerful technology can lead to greater value creation,” PwC said.”GenAI offers users a powerful flywheel for experimenting, iterating, and scaling new solutions and processes.”

The report added that in advertising, generative AI can be used to develop creative for different contexts and quickly iterate in response to consumer attention and outcomes.

“If GenAI can be harnessed to offer new experiences, and create new revenue streams, the growth potential is even greater,” PwC concludes.