Ever since reporting record first-quarter earnings earlier this year, Nvidia (NVDA) -) has become Wall Street's favorite method of gaining exposure to the artificial intelligence craze. The semiconductor maker — which sells the chips that software companies need to create AI — surged beyond a $1 trillion market cap immediately following its first-quarter earnings report, a badge of honor that it has since maintained.

Investors weren't sure if Nvidia would be able to make the magic happen twice, but the company nonetheless reported another enormous earnings beat in the second quarter, a trend that has continued into the third.

Reporting earnings after the bell Tuesday, Nvidia posted record revenue of $18.12 billion, up 34% quarter-to-quarter and up 206% from the year-ago period. Analysts expected revenue of $16.2 billion.

Related: Here's the dark horse tech giant that's going to come out ahead of Nvidia and Microsoft

The company said that its Data Center sector generated $14.5 billion of revenue for the quarter, a 279% year-over-year increase. It is continued growth in the data center that generally has the Street so excited about the monetizable opportunity around AI, through Nvidia's work.

Nvidia said that adjusted earnings for the period came in at $4.02, up around six times from the year-ago period and well above Wall Street estimates of $3.37.

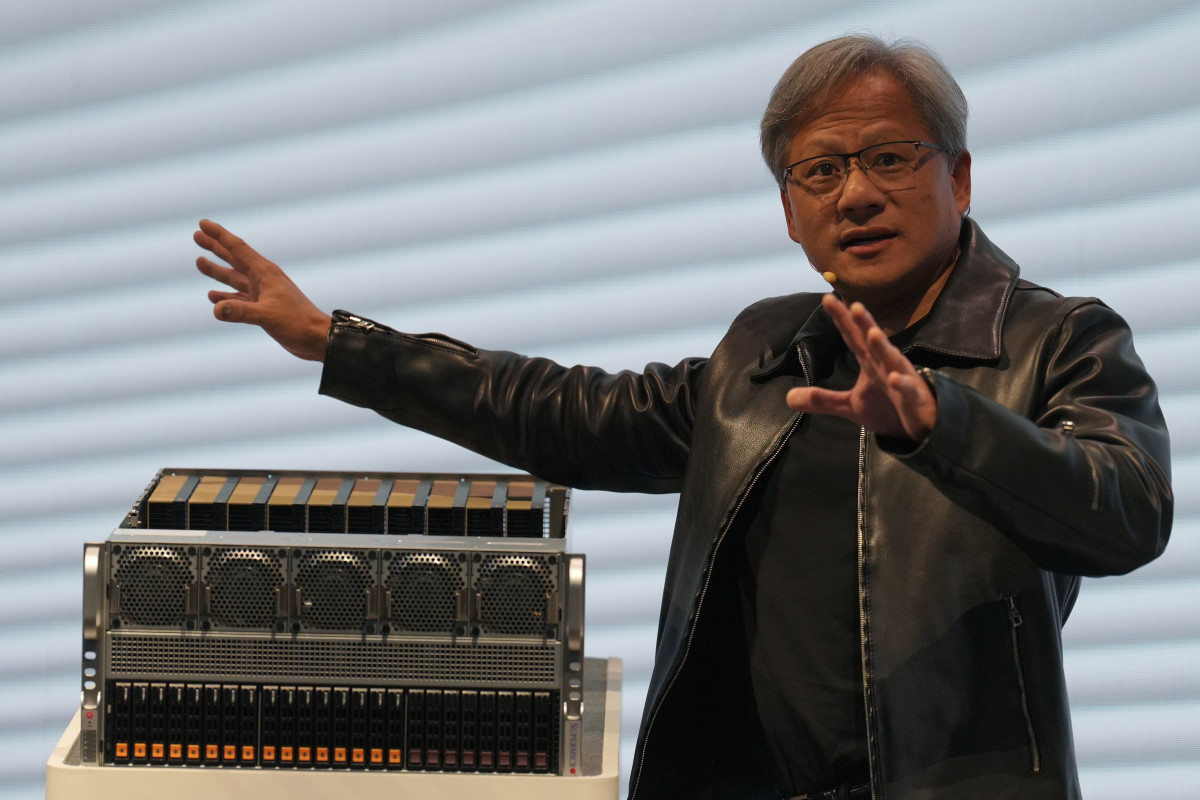

“Our strong growth reflects the broad industry platform transition from general-purpose to accelerated computing and generative AI,” Jensen Huang, founder and CEO of Nvidia, said in a statement. "The era of generative AI is taking off."

Huang said that Nvidia's GPUs, CPUs, networking, AI foundry services and AI enterprise software are all "growth engines in full throttle."

The company said that it expects to see $20 billion in revenue for the current quarter, with non-GAAP margins of 75.5%.

Despite the strong quarter, Nvidia noted an expected slowdown in China sales over the current quarter in light of new U.S. export restrictions. The company's China sales make up a roughly 20% chunk of total revenues.

"We expect that our sales to these destinations will decline significantly in the fourth quarter of fiscal 2024, though we believe the decline will be more than offset by strong growth in other regions," CFO Colette Kress said.

The stock slipped Wednesday, falling more than 3% to land at a share price of around $482. Shares of Nvidia are now up only 232% for the year.

Related: If Nvidia CEO Jensen Huang had a chance to do it all again, he wouldn't

Wall Street Reacts

Wedbush analyst Dan Ives said that the beat seems bullish for the entire technology sector.

Calling Huang the "Godfather of AI," in a post on X, Ives said that Nvidia's results were a "jaw-dropper."

"AI monetization and use cases are here and we believe AI will lead this next tech bull market into 2024," he said.

Deepwater's Gene Munster said that Huang's "case for the AI party to continue through 2025 is compelling."

Munster contended that "no one can touch Nvidia's GPUs or CUDA toolkit," adding that these components are necessary for building out AI infrastructure.

"I believe the level of investment from both big and small companies related to AI in the next five years will exceed the hype and benefit Nvidia's business," he said.

Munster predicted Tuesday night that Nvidia's stock would eventually turn green Wednesday, something that has yet to occur.

Munster, pointing out the "impressive" quarterly results, said: "All is well in AI."

Even Elon Musk, the CEO of Tesla (TSLA) -) and the leader of xAI, in addition to several other companies, seemed impressed by the earnings results.

"Wow," he said, responding to a post on X that noted Nvidia's quarterly revenue growth, from $7.2 billion to $18.1 billion — up 150% — over the course of the past six months.

Contact Ian with tips via email, ian.krietzberg@thearenagroup.net, or Signal 732-804-1223.

Related: Artificial Intelligence is a sustainability nightmare - but it doesn't have to be

Get investment guidance from trusted portfolio managers without the management fees. Sign up for Action Alerts PLUS now.